Bermuda’s Captive Industry Continues to Draw Capital, Despite Looming G7 Regulatory Enforcement

Bermuda’s captive insurance industry is at a tipping point.

Since the first captive was formed there in 1962, the insurance boom of the 1970s and ‘80s, and the subsequent wave in the 2000s following the 9/11 terrorist attacks and Hurricanes Katrina, Rita and Wilma, the island has been at the forefront of the market.

Yet, recent proposed regulation threatens to change all that.

In June, the Group of Seven (G7) countries put forward a plan to shake up the global tax system, later approved by the Group of 20’s (G20) finance ministers and the Organization for Economic Co-operation and Development’s (OECD) Inclusive Framework members the following month.

At the heart of this proposal is a commitment to a minimum corporate tax rate of 15% imposed on multinationals with more than $890 million in revenue, in line with one of President Biden’s key priorities to stop firms moving their profits to low tax domiciles.

The goal is for the plan to come into effect in 2023.

Among the businesses most likely to be affected are multinationals domiciled or with captives in global financial centers such as Bermuda.

The proposal may have a damaging effect on the island’s captive industry and economy at large, with taxes earned being redirected to the authorities in those countries where the firms’ products are sold, rather than remaining on the island.

Julie Boucher, islands practice leader, Marsh Captives Solutions

Speaking at the Bermuda Captive Conference in June following the G7’s announcement, Will McCallum, managing director and Bermuda tax practice leader at KPMG, said: “These rules are very, very complicated and they will bite in a lot of different ways. If we look at the large reinsurance groups that have a presence in Bermuda and elsewhere, a lot have an effective tax rate at group level that is less than 15%.”

Maintaining Top Spot

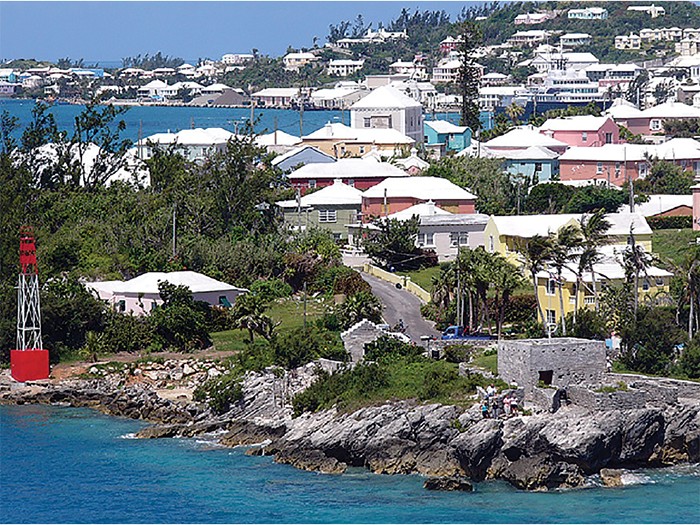

As the world’s leading captive domicile, Bermuda already has much going for it. It has a strong and established re/insurance market with most brokers and carriers based within a square mile of the capital.

The island also boasts a robust legislative and regulatory framework with European Union Solvency II and U.S. National Association of Insurance Commissioners equivalence and quick speed to market. It also has close proximity to the U.S. and Europe and a rich talent pool, as well as being at the cutting-edge of innovation.

By the close of 2020, Bermuda had 680 registered captives, down marginally from 715 the previous year, primarily due to amalgamations and dormant captive deregistrations. Despite the COVID-19 crisis, 12 new captives were formed last year, most of which came from North America, down almost half from 22 registrations in 2019.

Given the current hard market, Sherman Taylor, director at Ocorian, said it presents start-ups and captives with the opportunity to bring new capital in, and Bermuda is well-placed to take advantage of this influx.

The island has already attracted significant fresh capital investment in the first half of 2021 and is looking to build on that moving forward, he said.

“There are also new opportunities where coverage gaps exist for new and emerging risk,” said Taylor. “Such risks include pandemic, cyber and business interruption risks.”

He continued, “Bermuda’s insurance market can step in and provide solutions to fill these coverage gaps, and schemes have already been introduced to attract start-up insurance companies with innovative business plans. These schemes relax capital and regulatory requirements for a specific period of time during the development stages of the company, allowing it time to incubate and grow.”

Tax Not a Priority

Marsh Captive Solutions’ islands practice leader Julie Boucher said that contrary to popular perception, tax was not a motivating factor for many companies when establishing captives or choosing a domicile. For these firms, she said the effect of the G7’s proposed tax reform may, in fact, be less.

“Whether or not regulatory and/or tax threats arise or continue, Bermuda has an opportunity to remain a global captive center of excellence,” Boucher said. “By continuing to be a captive-friendly jurisdiction and supporting both the captives located here and their owners’ risk management needs, Bermuda can demonstrate its global position in the captive market.”

She added: “Given Bermuda’s position in the global captive market, it is likely to learn about new markets and revenue opportunities early on in the idea phase. Further, it is well-positioned to take its ideas to the captive community for consideration and development.”

Innovation Edge

Roland Andy Burrows, CEO of the Bermuda Business Development Agency, said Bermuda would continue to remain a global leader because of the quality of its captives writing business, with gross written premiums holding firm at approximately $40 billion year-on-year.

Andy Jeckells, co-CEO and chief commercial officer, I-RE Miami

Another competitive advantage, he said, was that the island provides access to large re/insurance and alternative capital markets, as well as having a strong track record in innovation.

“Innovation is in our DNA — Fred Reiss created the captive concept here 60 years ago; this spirit of innovation continues today with our continued development of insurtech opportunities,” said Burrows.

“In addition, Bermuda is committed to transparency and regulatory excellence: Our integrated financial services regulator, the Bermuda Monetary Authority, offers quality, risk-based captive supervision.”

Andy Jeckells, co-CEO and chief commercial officer of I-RE Miami, which formed a segregated account captive domiciled in Bermuda to write a broad range of property and casualty (P&C) lines, said that if the minimum $890 million revenue threshold for the taxation proposed by the G7 was lowered without limit it could have dire consequences for high-performing mid-market firms with captives.

For now, though, he believes that Bermuda remains an attractive proposition as a captive center of excellence.

“Bermuda is a dynamic insurance marketplace with a forward-thinking regulator that has many synergies with the Lloyd’s of London market, as well as a good supply of capacity,” said Jeckells.

“It is at the forefront of driving innovation in the captive space, both for the commercial P&C risks I–RE underwrites, as well as for emerging risk areas such as cryptocurrency, cannabis and insurance-linked securities.”

Reinventing Itself

To stay ahead of the curve, Bermuda’s captive industry needs to keep reinventing itself, as it has done with previous market-changing events, in order to attract emerging and hard-to-insure risks such as cryptocurrency and cannabis.

The key is innovation and nimble regulation.

The effects of the new tax reform remain to be seen. But by playing to its strengths and embracing change Bermuda can keep itself on the cutting-edge of captive insurance.

“With the G7, G20 and OECD advocating for the new global tax reform, and countries representing approximately 90% of the world’s GDP supporting the initiative, efforts by individual jurisdictions to resist are unlikely to succeed,” said Taylor.

“As an early signatory, Bermuda has made its intentions clear and continues to make the island an attractive place to do business.” &