Reinsurance

Basking in the Sun Once More

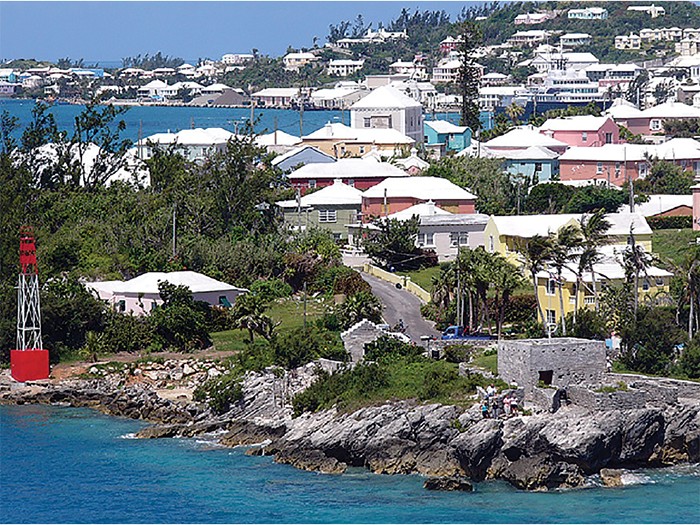

Bermuda is one of the world’s biggest and most successful offshore reinsurance markets, largely as a result of its tax advantages, strong regulatory system and its proximity to the U.S. and Europe.

But in recent years, many of the island’s reinsurers redomiciled to Europe, amid concerns over Bermuda’s international reputation, regulatory uncertainty and political instability.

The outflux started in 2010, when Flagstone Re redomiciled to Luxembourg and Allied World moved its holding company to Switzerland. The latest, Canopius, followed suit at the end of last year.

Companies are now returning to the island, though, after the announcement in March that the European Union granted it Solvency II equivalence.

Bermuda, along with Switzerland, is the only country that garnered Solvency II equivalence and was designated a “qualified jurisdiction” by the National Association of Insurance Commissioners (NAIC), allowing free cross-border trade with the U.S.

Further evidence of the island’s resurgence is borne out by the fact that 64 new reinsurance companies incorporated in Bermuda last year, according to the Bermuda Monetary Authority (BMA).

Meanwhile, seven of the island’s biggest reinsurers merged or were acquired over the last four years, with more deals expected, according to the Association of Bermuda Insurers and Reinsurers (ABIR).

Bermuda is also firmly established as one of the leading offshore domiciles for captive insurance, as well as an alternative capital market.

“Bermuda was always a leading reinsurance domicile,” said Brad Kading, president and executive director of ABIR. “These two bilateral agreements [Solvency II and NAIC qualified jurisdiction status] further cemented its position as a reputable domicile for reinsurance.”

Movers and Shakers

XL Catlin’s proposed move from Ireland back to Bermuda made the biggest headlines this year and will be accomplished in the third quarter, subject to shareholder approval. Bermuda was a stronghold for both companies before their merger. XL moved its main operations there 30 years ago, and Catlin incorporated its holding company in Bermuda in 1999.

XL Catlin’s CEO Mike McGavick said the fit with Bermuda is a natural one, given that a significant part of the company’s business and its largest operating subsidiary are already there. He cited Solvency II equivalence as the main reason behind the move, adding that it would benefit clients, partners and shareholders alike.

“These two bilateral agreements [Solvency II and NAIC qualified jurisdiction status] further cemented its position as a reputable domicile for reinsurance.” — Brad Kading, president and executive director, Association of Bermuda Insurers and Reinsurers

“With the recent determination of full Solvency II equivalence in Bermuda, it has been concluded that the BMA is best situated to serve as XL’s group-wide supervisor and to approve XL’s internal capital model,” McGavick said.

Qatar Re also announced at the end of last year that it would relocate its main operations from Dubai to Bermuda after its merger with parent Qatar Insurance Co.’s Bermuda-domiciled reinsurer Antares Reinsurance.

CEO Gunther Saacke cited Bermuda’s “decades of proven reliability” and said that the move would enable the company to consolidate its capital and move closer to its brokers and clients in the U.S.

Ross Webber, CEO of the Bermuda Business Development Agency (BDA), said the decision by all of these companies to redomicile to Bermuda sent a “very positive message.”

“No doubt Solvency II equivalence played a big part in all this, but Bermuda’s improving economic outlook and growth in business confidence is also a factor,” he said.

“Our company register is growing across all sectors at present, while consolidation only strengthened the physical presence of companies such as XL Catlin here on the island.

“As a result of all this, we are already seeing companies looking to set up new operations, to merge or to expand their operations here in Bermuda.”

Taking Flight

Webber said that the main reason behind companies leaving Bermuda in the first place was a move from U.S. and European regulators to bring companies back onshore.

Being offshore “was perceived as somehow being unpatriotic and somewhere you shouldn’t be,” he said.

“Some left simply because the CEO and leadership wanted to physically move themselves back onshore, along with the corporate structure that goes along with it.”

David Brown, a retired insurance industry veteran and former CEO of Flagstone Re, which redomiciled from Bermuda six years ago, said there was no single trigger for the exodus.

“I think that people were almost hedging their bets — not knowing if Bermuda was going to get Solvency II equivalence — by moving to jurisdictions in the EU that were considered more likely to succeed,” he said.

“Another factor at the time was the political risk associated with an unsustainable public debt growth, as well as a negative political climate against international business and expat employees generally.”

But he added that since the government started to tackle the debt problem and make the island more welcoming to international business, companies now are taking another look at the island.

Solvency II Equivalence

Gaining Solvency II equivalence means that Bermuda is now better positioned to meet the regulatory standards being redrawn by the International Association of Insurance Supervisors, said Kading, as well as to provide more capacity for markets like Asia and Oceania.

Being offshore “was perceived as somehow being unpatriotic and somewhere you shouldn’t be,” — Ross Webber, CEO, Bermuda Business Development Agency

“All this means is that the Bermuda Monetary Authority is now recognized as a global group supervisor for targeted insurance groups and reinsurance can be conducted on a cross-border basis without market barriers,” he said.

“For Bermuda insurers, this means an efficient rather than redundant layer of group supervision and for reinsurers, it means cross-border trade without individual jurisdictional restrictions.”

Susan Molineux, senior financial analyst at A.M. Best, who was based on the island for more than a decade, said that achieving Solvency II equivalence was a “big win” for Bermuda.

“Bermuda expended a lot of effort to really explain to Europe what they do and how they do it, and it paid off in the long run,” she said.

The Future

Despite the positives, Bermuda still has a way to go to convince everyone that it is on the rise.

Saddled with a $2 billion debt after seven years of deep recession, the government is under pressure to rein in costs and to find new revenue sources, mainly through tax collection.

A.M. Best said last year that it maintained a negative outlook for the island’s reinsurance industry. In response to this, the BDA is setting up industry focus groups. It is promoting Bermuda as a domicile in conjunction with ABIR members to attract new business from emerging markets such as Latin America and China.

After years of departures and uncertainty, Bermuda is seemingly restoring its position as a leading reinsurance market. &