Utilization Review

You Ain’t From Around These Parts

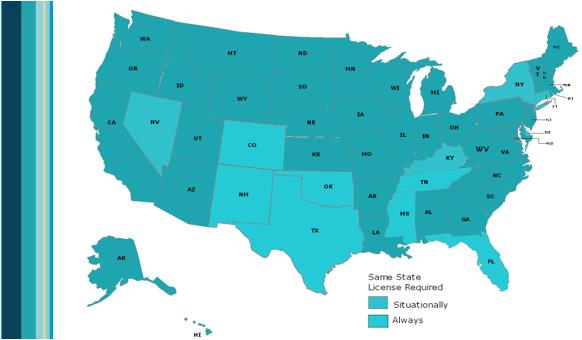

Peer review is used in a lot of different ways to identify physician involvement in claim management. For the purpose of this article, peer review is referred to the necessary process inside of utilization review (UR) that ensures medical necessity denials are made by physicians or other key health care practitioners. But do these peer providers need to be licensed in the jurisdiction of the WC claim?Today, only a few states require physicians to be licensed by their own state medical board in order to perform UR peer reviews. However, each year, additional states discuss same-state license requirements and/or file legislation to mandate same state licensed peer reviewers.

With more states now considering same-state licensure requirements, it appears that many participants believe that this requirement helps ensure high quality peer reviews. But shouldn’t the focus be on ensuring quality peer review and does same state licensure foster this?

A peer reviewer’s most important responsibility is objectivity. Objectivity requires a physician to understand the effect of treatment determinations on claims outcomes. Peer reviewers must provide high quality determinations that are supported and justified in accordance with applicable state requirements.

Is same state license mandate necessary? Does it create a better peer review process?

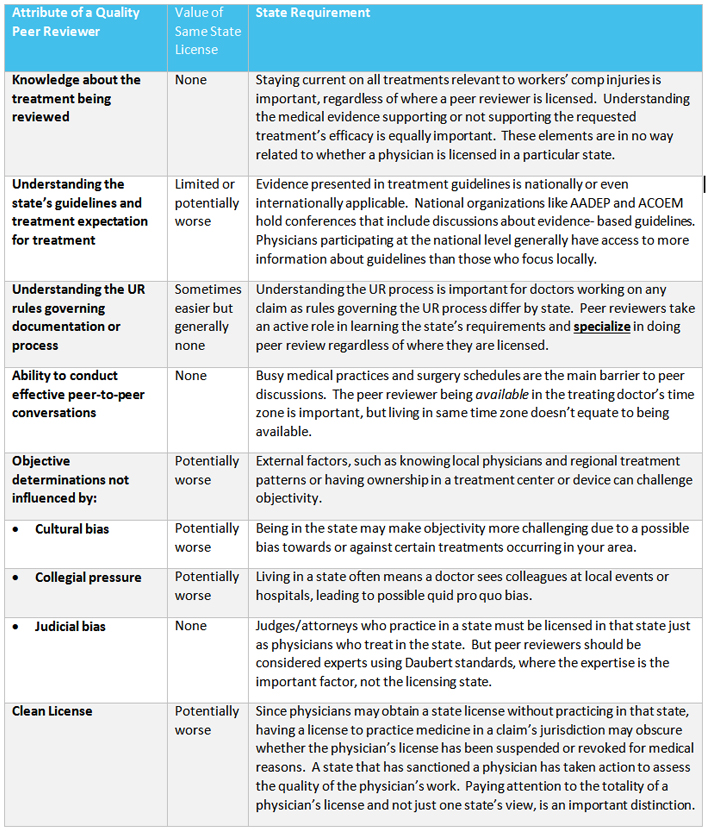

To determine whether a peer reviewer has the right attributes to make quality decisions, consider these key points, and assess whether a same-state license would enhance the quality of UR medical necessity decisions.

When you ain’t from around these parts, does it make a difference? Simple answer is NO.

There is no support for the premise that physicians licensed in a state perform better peer reviews for that state. Requiring same-state licensure adds cost and bureaucracy, with no known value to peer review quality. What do we really want from a peer review physician? The key is a doctor who understands evidence-based guidelines and how to improve an injured employee’s quality of life and ability to return to work. What matters is that the peer reviewer serves the injured worker by knowing the applicable state guidelines and processes and being exceptionally qualified medically to review the proposed treatment.

Read more to review the facts or myths about the top 10 most commonly heard reasons for peer reviewers to have same state licenses.

Read more to review the facts or myths about the top 10 most commonly heard reasons for peer reviewers to have same state licenses.