Sponsored Content by AIG

9 Reasons You Should Consider Piloting Wearables Now to Help Improve Worker Safety

In the future, industrial-grade wearables may become as prevalent on job sites as hard hats, neon vests, or other personal protective equipment. At one point we thought of seatbelts and airbags as “technological safety advancements.” Now, we expect them.

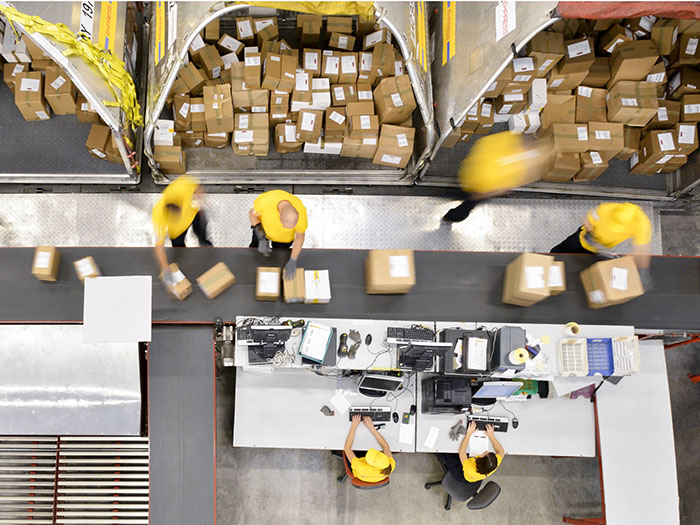

Wearables come in many forms and perform many functions, but nearly all have demonstrated benefits for enhanced worker safety. “Today, there exists technology to track location, that allows communication with supervisors, and that measures biometric data like heart rate or environmental factors like temperature and air quality,” said Nick Conlon, Innovation & Sharing Economy Associate at AIG. “But, we’re focused on a subset of ergonomic sensors that track body movement, because that’s where it appears the greatest opportunity is to help prevent soft tissue injuries.”

After reviewing more than 65 industrial grade wearable devices and capabilities, AIG developed a shortlist of promising tech that it is actively bringing to customers in the form of pilot studies. So far, AIG has completed pilots with five clients across the construction, manufacturing and agriculture sectors, collecting more than 254,000 hours of data. The body-worn sensors in play can track 25 different data points every 80 milliseconds.

“Early results are positive,” Conlon said.

For example, during one 12-week pilot, workers saw an average of a 33 percent improvement in bending postures. The data identified a key process change that could help avoid unsafe bending. Another client saw a 58 percent improvement in body movement and fewer musculoskeletal injuries. It also identified a subset of workers whose safety scores remained low and who required extra training.

With more pilots in the pipeline, further evidence supporting wearables’ safety benefits is likely to come. “Combining wearable data with our expansive claims experience helps drive insights that companies or technology vendors can’t necessarily produce on their own. It’s all about partnership.” Conlon said.

Pilot results have resulted in nine key insights companies interested in the technology may want to consider:

1. Sensors can collect an enormous amount of data without being worn continuously over long periods of time.

Nick Conlon, Innovation & Sharing Economy Associate at AIG

There is a misconception that wearables must be worn continuously in order for the data gathered to be useful. But that’s not always the case.

“There is a category of devices more diagnostic in nature that can be worn over a period as short as eight weeks,” Conlon said. Unlike wearables designed to track location or act as communication devices, diagnostic wearables aim to identify a specific problem within a finite period of time, such as work process that forces less ergonomic movements. Wearables can help isolate processes or movements that can be unsafe well before they are likely to result in an injury to workers.

2. The data collected can help identify otherwise normal workflow processes that are causing injury and should be changed.

Wearables are about more than worker behavior. They can also identify workflow processes that may be contributing to recurring injuries in the workforce.

“During a pilot, one client noticed that workers were consistently exhibiting bad bending behavior, even after wearing a device for weeks that would send an alert every time they used poor movement,” Conlon said. “When we examined their work processes, our client discovered that the problem wasn’t the workers themselves, or the process – it was actually a serial number that was printed too small. The workers had to bend over to read the small print over and over again throughout the day.”

As a result, the company made a process change and had the serial numbers printed larger, so workers could eliminate that potentially injurious movement altogether.

3. Once you know what activities are driving injuries, you can better allocate resources for more focused safety related trainings or encouragement of process changes.

In most cases, wearables that send constant reminders to workers help encourage better lifting form or more correct posture do tend to produce sustained improvements. Nevertheless, there will likely be a small subset of workers who may need more intensive coaching or training to help them address lifting form or potentially unsafe movements.

“Wearables can help identify on a more granular level where to allocate training and related resources,” Conlon said. “That way, instead of providing full retraining to your entire staff, you can focus on any additional training efforts on workers, if any, for whom it seems a higher level of emphasis may be warranted.”

4. Wearing a device can motivate workers to correct poor movements.

It’s called the Hawthorne Effect — people will pay more attention to their behavior when they know they are being monitored. Wearing a device makes workers hyperaware of harmful movements, which naturally drives an effort to improve.

“At the end of the day, behavior change is the primary goal, whether that’s accomplished through coaching or a process change, or assisted through technology to help remind people to do something different,” Conlon said.

5. The ability to track behavior changes that may suggest fatigue lets you know when it’s time to rotate workers or make micro-adjustments to shift changes.

Working in manufacturing, construction or agriculture often demands repetitive motions.

Working in manufacturing, construction or agriculture often demands repetitive motions.

“Imagine hammering, riveting or picking crops all day. Performing those movements properly is essential to the longevity of the worker,” Conlon said. If a wearable detects that a worker’s body mechanics decline sharply after three hours of work, it can highlight a need to shift workers to different tasks at certain times to reduce fatigue.

“Depending on how the pilot is set up, and we’re very flexible to tailor a program that works best for the client and the workers, data collected from wearables can be made available to direct supervisors. Many supervisors are empowered to make changes in rotations and scheduling that help minimize the risk of injury,” Conlon said. “Fundamentally, this puts the power of risk management in the hands of an operations executive who may not think of risk as often, but is an important by-product of these pilots.”

6. Identifying poor ergonomics can indicate an injury and allow for earlier intervention.

Evidence shows that soft-tissue injuries tend to develop over time, and workers can easily dismiss a dull ache or pain as an inconsequential issue not worth reporting or treating.

“Most people are inclined to wait and see if the discomfort will get better on its own after a few days before going to a doctor,” Conlon said. “But when the pain doesn’t subside, they begin overcompensating with other body parts, and that often leads to more injury.”

These behavioral changes should raise a red flag and provide cause for intervention. Having wearables that can detect these changes helps give risk managers an opportunity to step in and assist a worker with addressing his or her injury before things potentially get worse.

7. Location tracking capability means you can get to injured workers more quickly.

Data shows that working alone or in a remote area of a site can expose a worker to greater safety risk. If a fall or some other injury occurs, it could potentially take hours for anyone to know about it.

“A wearable that detects a fall or a complete lack of motion for a period of time can send out an alert, enabling help to get to that worker more quickly,” Conlon said.

8. Data from wearables can be used to understand the behaviors of safe and injury-free workers from whom others can learn.

Wearables can help identify the workers with the safest behavior as easily as those potentially in need of extra training. Using the behaviors of these workers as a model can help risk managers devise training procedures and a set of best practices.

“Pilots can take many forms. For example, let’s not just focus on the workers getting injured. Let’s look at the ones who’ve spent years on the job without a single injury. What are they doing differently? Are there insights we can glean from them to educate other workers?” Conlon said.

9. Gamifying measurable outcomes can help motivate workers to move more safely more often.

The concrete data gathered from wearables offers an opportunity to turn safety into a tangible pursuit.

“One of our clients piloted a wearable technology that pulled several data points together to create a ‘safety score’ on a scale of 0 to 100. It’s a simplified barometer for how well you’re performing safety-wise, and it allows workers to see how they stack up against their colleagues and track their own improvement,” Conlon said. Companies may also offer incentives like gift cards or other prizes for workers with the highest scores.

“Turning it into a game or competition can help motivate workers to practice and even compete for better ergonomics,” Conlon said.

Innovation in Insurance Matters

Better ergonomics can help translate into fewer missed days of work and reduced workers’ compensation insurance costs for employers in sectors where soft tissue injuries are prevalent. AIG’s approach to innovation is guided by a mission to find solutions to its clients’ most ubiquitous problems.

As such, innovation also plays an integral role in underwriting. Emerging technologies inevitably shift risk profiles and business models, and a best-in-class insurer must not only adapt, but also stay ahead of the curve.

“We’re always looking for opportunities to partner with clients and others like startups that provide data relevant to underwriting, pricing, and risk selection,” Conlon said. “By bringing our own data and expertise to the table, we can help facilitate our clients’ efforts to test out new tech and find better ways to do business. Wearables are just one example.”

To learn more, please visit: https://www.aig.com/innovative-tech.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with AIG. The editorial staff of Risk & Insurance had no role in its preparation.

American International Group, Inc. (AIG) is a leading global insurance organization. Founded in 1919, today AIG member companies provide a wide range of property casualty insurance, life insurance, retirement products, and other financial services to customers in more than 80 countries and jurisdictions. These diverse offerings include products and services that help businesses and individuals protect their assets, manage risks and provide for retirement security. AIG common stock is listed on the New York Stock Exchange and the Tokyo Stock Exchange.

Additional information about AIG can be found at www.aig.com |YouTube: www.youtube.com/aig | Twitter: @AIGinsurance |LinkedIn: www.linkedin.com/company/aig

AIG is the marketing name for the worldwide property-casualty, life and retirement, and general insurance operations of American International Group, Inc. For additional information, please visit our website at www.aig.com. All products and services are written or provided by subsidiaries or affiliates of American International Group, Inc. Products or services may not be available in all countries, and coverage is subject to actual policy language. Non-insurance products and services may be provided by independent third parties. Certain property-casualty coverages may be provided by a surplus lines insurer. Surplus lines insurers do not generally participate in state guaranty funds, and insureds are therefore not protected by such funds.

The data and other content contained herein are provided for general informational purposes only. The advice of a professional insurance broker and/or counsel should always be obtained before purchasing any insurance product or service. The information contained herein has been compiled from sources believed to be reliable. No warranty, guarantee, or representation, either expressed or implied, is made as to the correctness or sufficiency of any representation contained herein.