21 Workers’ Compensation Insurance Facts to Know Before Buying Coverage

Workers’ compensation insurance is a necessity for almost every business, but it can be complex. Before you buy, know what kind of coverage you need, how to get it, and how to keep your costs low by keeping employees safe.

Table of Contents

1. What is workers’ compensation insurance?

Workers’ compensation insurance is protection for people who get hurt or become ill during the course of their employment. It can be the result of an accident — like hurting their back in a fall or being burned by a hazardous chemical. It can also be the result of repeated exposure to something harmful during work, like losing hearing due to persistent loud noises or rotator cuff damage from performing the same arm motion over and over.

Workers’ compensation insurance offers five basic benefits:

- Medical care for the injured worker.

- Temporary disability benefits to make up for lost wages while the injured employee is recovering.

- Permanent disability benefits if an employee can’t return to work.

- Supplemental job displacement benefits, which pay for skill enhancement or retraining if the injured worker can’t return to the job they had before the injury.

- Death benefits paid to a spouse, children or dependents if the worker dies as a result of job-related injury or illness.

2. What is the history of workers’ compensation?

The concept of providing monetary compensation for injured workers dates back to approximately 2050 BC in the city-state of Ur because of a mandate by King Ur-Nammu. Hammurabi’s Code, written in roughly 1750 B.C., provided a similar set of rewards for injuries.

In more modern days, Spanish pirates in the 1700s followed the “pirate code,” which offered compensation for injuries. Losing an eye yielded a certain amount of treasure. Losing an arm yielded more. They even offered injured workers easier jobs — creating the world’s first light duty, return-to-work programs.

German Chancellor Otto Von Bismarck passed the “Workers’ Accident Insurance” bill in 1884, essentially creating the first modern workers’ compensation program in Europe. The idea soon spread to the United States and gained traction after the publication of Upton Sinclair’s 1906 novel The Jungle, which detailed the dreadful working conditions inside Chicago slaughterhouses. In 1908, at the urging of President Theodore Roosevelt, Congress passed the Federal Employer’s Liability act.

Roosevelt argued to Congress that “under the present law an injured workman … has no remedy, and the entire burden of the accident falls on the helpless man, his wife, and his young children. This is an outrage. It is a matter of humiliation to the Nation that there should not be on our statute books provision to meet and partially to atone for cruel misfortune when it comes upon a man through no fault of his own … .”

By 1911, Wisconsin passed the nation’s first state workers’ compensation law. Nine other states passed regulations during the same year. Before the decade concluded, 36 others would follow suit.

3. Do I have to buy workers’ compensation insurance?

Workers’ comp is required in every state except Texas. The workers’ compensation insurance requirement is dependent on the number of people a company employs. More than half of all states require employers to carry coverage if they have one or more employees. Yes, even a small business needs workers’ comp.

States like Georgia, Arkansas, and Michigan require workers’ compensation insurance for three or more employees; while states like Missouri, Tennessee, and Alabama require it for five or more. In Texas, workers’ compensation insurance is not required unless a company is contracting with a government entity.

The penalties if you do not obtain workers’ comp insurance can be stiff. It can lead to allegations of criminal noncompliance in states like California, Massachusetts, Michigan, Pennsylvania and Illinois. It can also lead to fines that vary depending on the number of employees, the reason for noncompliance, and the amount of time a business was noncompliant. In Pennsylvania, for example, employers can face civil or criminal charges. Individuals responsible for lapses in coverage could face up to seven years in prison, and $15,000 in fines.

4. What’s the cost of workers’ compensation insurance?

Costs vary widely from state to state. Workers’ comp costs between $0.75 in Texas to $2.74 in Alaska per $100 in employee wages, according to the National Academy of Social Insurance.

Cost is also dependent on the type of work an employee does. The riskier the work, the more workers’ compensation insurance will cost. A clerical worker will certainly have a lower risk profile than a construction worker. In 2018, the Bureau of Labor Statistics reported workers’ compensation for sales and office professionals cost $0.22 per hour or 0.9 percent of overall compensation — while coverage for natural resources, construction and maintenance jobs cost $1.16 per hour, or 3.2 percent of overall compensation. The cost is often based on the classification by the National Council on Compensation Insurance (NCCI), an independent council that identified 700 “class codes” representing the risks of different job types.

5. Who does workers’ compensation insurance cover?

A workers comp policy covers employees who’ve become injured or ill on the job, or while doing employment-related activities. Which employees are eligible depends on each state. Many states require workers’ compensation insurance for W2 employees. Some require it for independent contractors like freelancers, volunteers, and consultants.

“Correctly classifying your workers can help reduce aggravation at the time of a premium audit. Your agent can help and if they have questions our underwriters are always available to help resolve issues. The ‘guiding light’ for classifications is the Scopes manual, which outlines the proper classifications for all employees,” said Matt Zender, Senior Vice President, Workers’ Comp Product Manager, AmTrust Financial Services.

Learn more about your obligation to provide workers’ comp insurance to independent contractors, or “gig workers.”

This legal decision highlights the risks of misclassifying workers.

It does not cover employees who have been injured outside the scope of work, self-inflicted injuries, injuries or illnesses from drugs or alcohol intoxication, injuries caused by fights or horseplay, or injuries sustained after an individual’s employment has been terminated.

6. What workers’ compensation laws apply to me?

The most basic law is whether or not you are required to carry workers’ compensation insurance. Every state other than Texas requires businesses to carry workers’ compensation insurance if they employ a certain number of people.

Other states have tried to “opt out” of the workers’ comp requirement in the past, with little success. Read more about Oklahoma’s legislative battle:

Other laws are also dependent on each specific state. In Illinois for example, employers are obligated to inform the workers’ compensation insurance carrier if an employee is out for three days due to injury. They must also continue to pay the employee even if a claim has not yet been filed; provide a written statement to the employee explaining any additional information they may require for a claim; provide written explanation if benefits are denied; and file an Employer’s First Report of Injury with the state workers’ compensation commission.

Other states are different. In Georgia, an employee must be out of work for seven or more days before the employer is required to notify the Board of Workers’ Compensation. The amount of workers’ comp benefits can be determined by either a panel of physicians or a workers’ compensation managed care organization certified by the state workers’ comp board. The employer may choose which entity determines benefits.

7. How do state laws differ for workers’ compensation?

Some states, like California, are “no-fault,” meaning injured employees don’t need to prove that their injury was the fault of someone else to receive benefits. In “fault” states, it’s necessary to demonstrate who was to blame for an accident, making the claim resolution process longer and more arduous.

The National Federation of Independent Businesses offers a comprehensive state-by-state breakdown of the laws and requirements for workers’ compensation.

8. How does workers’ compensation insurance compare for different industries?

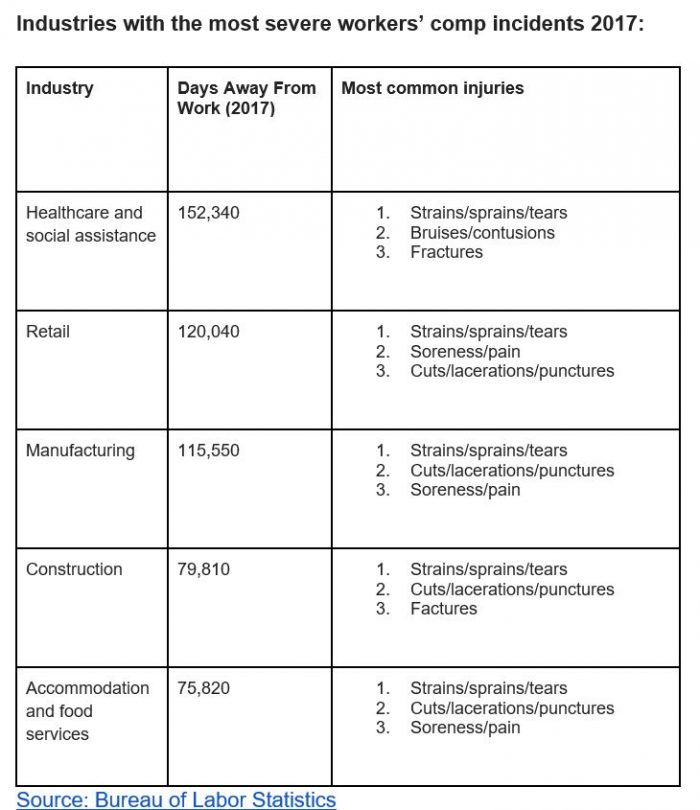

Every industry faces unique exposures and structures workers’ compensation insurance differently. Let’s examine construction, food services, healthcare, manufacturing and retail.

- Construction: Injuries from handling heavy equipment, illnesses from exposure to hazardous chemicals, falls at job sites — the construction industry is filled with risks. Companies may be held liable even for injury to a subcontractor. Workers’ compensation insurance covers wages and medical expenses for injured workers — as well as court costs. Risk managers in the construction industry should be sure that workers are wearing personal protective equipment (like hard hats), are trained in the latest safety protocols, and identify hazardous materials long before a job begins.

- Food Services: Falls on wet floors, back injuries from repetitive motions, cuts from sharp knives, and burns from hot food are all common injuries in food service. It’s a fast-paced world where employees hurry to get food prepped, cooked and onto patron’s plates — and that time crunch can lead to accidents and injuries. If people travel for work (like a catering company) automotive accidents could be covered under workers’ compensation. To mitigate risk, ensure that staff wear proper attire, go through safety training, and wear proper safety equipment. Check out AmTrust Financial’s 2018 Restaurant Risk Report to learn more about how food services companies can mitigate risk and prepare for injuries.

- Healthcare: Repetitive movements, strains from lifting heavy patients, exposures to sicknesses, dealing with physically aggressive patients — they can all lead to injuries or illnesses for healthcare workers. Like other industries, workers’ compensation insurance for healthcare workers will cover lost wages and medical expenses for workers affected. Risk management tips include safety training, safe handling of hazardous chemicals, and proper lifting techniques and equipment.

- Manufacturing: There are no shortage of risks in manufacturing. Whether equipment malfunctions, employees suffer a sprain or strain from heavy lifting, or repetitive motion wears down muscles and joints — manufacturing can be particularly tough on the body. Good risk management includes ongoing safety training, state-of-the-art equipment, and proper safety gear.

- Retail: Employees in the retail industry can hurt themselves while stocking shelves, slip on a wet floor or get carpal tunnel syndrome from working a cash register day after day. While the injuries may not sound as severe as other industries, they still lead to more than 120,000 days away from work each year (see below.) Risk managers should ensure that workers wear closed-toed shoes, properly stretch before lifting heavy merchandise, and invest in ergonomic office supplies.

Industries with the most severe workers’ comp incidents 2017:

Find out how to build an integrated safety culture at your company.

9. How do I pick the right workers’ compensation insurance for my business?

- Have a broker or agent lead you through the process. An experienced agent, like an AmTrust Financial-appointed agent, can walk you through the buying process, and help you understand the various laws, class codes and underwriting involved with workers’ compensation insurance. The right agent can help relay your risk management strategy to insurers to help you get the best quote — and guide you through the claims process if something goes wrong.

Check out the best workers’ comp brokers of 2019.

- Make sure the policy is specific for your industry. Every industry has its own safety risks. Running a manufacturing plant is far different than employing people at a call center. Make sure the workers’ comp policy you choose is tailored to those risks. If you’re employing people inside an office, a general policy will probably suffice. If you’re employing people who work with heavy equipment, or in dangerous conditions, you’ll likely want more coverage.

- The price should match the risk. Make sure the price of your workers’ compensation insurance matches the risk profile of your business. Employing a group of salespeople should be far less expensive than a group of home builders. The National Council on Compensation Insurance (NCCI) identified approximately 700 job types broken out into “class codes” which are used to help determine coverage cost.

- Know the state requirements. Some states require that businesses purchase workers’ compensation insurance if they employ just one employee, other states require coverage after five employees. Some regions will require workers’ compensation insurance if working with government entities — some will not. Getting educated on your state’s workers’ comp requirements is a good place to start. “For traditional workers’ comp coverage, the amount of coverage you secure is not the issue. Coverage is statutory, meaning that the carrier will cover the loss, no matter the size. There are other items that are important to consider that may be addressed via endorsements, such as Foreign Voluntary Workers’ Comp. These items can be assessed by meeting with your agent and explaining any peculiarities about your firm,” Zender said.

10. How does workers’ compensation differ from group health?

Workers’ compensation insurance is state-regulated coverage for workers who get injured or ill on the job. Group health insurance is coverage for employees for preventative care and medical expenses for injuries or illnesses not stemming from workplace activities. In fact, most health insurance providers exclude coverage for ailments covered by workers’ compensation insurance.

11. Does my LLC need workers’ compensation insurance?

Workers comp is only required if you have employees. If your Limited Liability Company (LLC) does not have employees, it doesn’t need to carry workers’ compensation insurance. If an LLC with no employees obtains a workers’ compensation insurance policy, the members of the LLC are automatically included in that policy.

Generally, an LLC is required to follow the state minimums outlined in section three.

12. Where do I buy workers’ compensation insurance?

A workers’ comp policy can be purchased directly through a carrier or through a state fund. Buying workers’ compensation insurance online from a carrier is likely the fastest option but it may not be easy to understand all the options. Typically, buying through a broker or agent can help clarify any confusion and help you land the right coverage. (See the next section for more.)

Insurance can also be purchased through a workers’ compensation state insurance fund — a government-funded organization that provides coverage in a specific state. The state-funded option is often a last resort source of coverage for small businesses. They include:

-

-

- Competitive state insurance funds, where private workers’ compensation insurers as well as the state offer coverage to your business. In this scenario, state and private insurers compete for your business.

- Monopolistic state insurance funds, where the state only allows businesses to buy coverage from a state-funded program. It does not allow you to purchase through a private insurer. Only a handful of states require that coverage be purchased strictly through state programs.

-

13. Should I obtain workers’ compensation insurance direct or through a broker or agent?

Unless you’re an insurance expert, it’s typically best to purchase coverage through a broker or agent. They can assess the specific risks your business faces, learn how you promote safety in your organization, and showcase your risk management efforts to potential carriers. They also live and breathe workers’ compensation, and will know which laws you need to adhere to, and which coverage options make the most sense for your business.

According to Brad Wilkins, Loss Control Manager, AmTrust Financial Services, some of the key characteristics carriers look for in a safety and risk management program include:

- A safety structure that is consistent with the size, complexity and type of hazards in the business operation.

- Established safety procedures are reviewed and updated as the operations, tasks, equipment evolve.

- Leadership and employee involvement in the safety effort, regular safety training and safe work procedures, documented hazard identification and post-injury management procedures.

“Are safety rules such as the use of personal protective equipment enforced on the job? Or do the rules exist in name only? In other words, does the safety program and commitment level permeate the organization as a living, breathing part of daily work or does it exist only in a dust-covered manual on a shelf that nobody reads. Is there a specific person who is responsible and accountable to top management for safety implementation?” Wilkins said. These are the questions carriers will ask, and which your workers’ comp broker or agent should be able to anticipate and answer.

14. What’s the difference between a broker and an agent?

Agents and brokers act as intermediaries between you and an insurance carrier — and both can help you secure appropriate coverage at a reasonable price.

An insurance agent works with specific insurance carriers. Captive agents only represent one carrier while independent agents represent multiple carriers. An agent may have the ability to bind coverage, meaning they can initiate coverage on your behalf. They also may be closer to the specific insurance coverages and have the ability to offer exclusive policies not available to all brokers.

An insurance broker basically works for the insurance buyer and can place coverage with any carrier. A broker solicits insurance coverage quotes on behalf of the buyer and helps secure proper coverages and prices. Since they’re not bound by any specific insurer, they are truly independent. Many specialize in specific lines of business and are well-versed in that field.

15. How do I determine my workers’ compensation rates?

Workers’ compensation quotes should be dependent on the amount of risk associated with your company’s tasks. The more risk, the more expensive your coverage will likely be. Those risks can be mitigated through comprehensive risk management practices that increase safety and drive down the amount of injuries or illnesses.

Rates are determined by premium rates from each employee classification code, annual payroll, and the experience modification factor. Here’s a basic example: If your construction staff is charged a rate of $2.50, you must pay $2.50 in premiums for every $100 your employees earn in payroll.

The next step is to divide each class code’s annual payroll by 100. Let’s say your construction staff earns $45,000 (divided by 100, that’s 450). Now multiply the new number (450) by the class code’s premium ($2.50 in this example). That gives us a grand total of $1,125 per year in premium costs for each construction worker. Add them together for all class codes and you have your total annual workers’ compensation insurance cost.

That cost is also subject to an experience modifier, which offers either a discount or surcharge based on claims experience over a three-year period. An applicant with little to no claims history could get an experience modifier of .90 — meaning they will be charged 90 percent of the cost as determined above. “In essence, the fewer accidents a company has, the more they save on their premiums,” Wilkins said.

In our previous example, premium costs of $1,125 would fall to $1,012.50 ($1,125 x .90). If you’ve had some claims, that number could increase. For example if the experience modifier was 1.1, the coverage would be 10 percent higher. In our previous example, that would mean coverage would cost $1,237 ($1,125 x 1.1).

Adding the annual premiums for all class codes will give you the estimated cost of annual workers’ comp insurance for your entire staff.

16. What are the most common types of employee injuries?

The five most common types of workplace injuries are:

- Overexertion. Lifting heavy objects and repetitive motions can lead to strains and sprains. Keeping heavy objects close to the body, bending at the hips, keeping good posture, and maintaining overall good condition can help to prevent these injuries.

- Slips, Trips and Falls. Certain floor surface types, changes in level or friction and foreign objects in the way can precipitate a slip and fall. Keeping pathways clear and putting up slippery surface warning signs where appropriate can prevent accidents.

- Transportation Incidents. For employees on the road, wearing seatbelts, evaluating weather conditions, implementing routine maintenance, and monitoring work hours will keep themselves and others on the road safe.

- Burns. Some industries have considerable exposure to burn risks including restaurants, construction, auto mechanics and certain types of manufacturing. Wearing and using protective equipment and maintaining tools can reduce the hazards.

- Lacerations. Employees can be cut or punctured by tools, machines, instruments, as well as environmental objects like plants or animals. Maintaining equipment and enforcing safety procedures can reduce the risk.

17. How can I avoid workers’ compensation claims or losses?

Every company should have a comprehensive risk management program — especially if they work in high-injury sectors. There are a number of initiatives you can take:

- Conduct post-offer, pre-employment physicals: Make sure that people can perform the job tasks before actually putting them to work. That’s what Monmouth County, New Jersey does for its most physically challenging jobs. Potential new hires must perform a series of tests to make sure they’re capable of fulfilling the job tasks before they actually get hired. The post-offer, pre-employment program helped lower claims by 44 percent and losses by 76 percent from 2009 to 2017.

- Consult the experts. There is plenty of literature about the best ways to mitigate injury risks. AmTrust Financial has a particularly robust set of loss control resources aimed at sectors like workplace safety, commercial property, and transportation.

- Train constantly. Don’t just train new employees. Make sure everybody is going through ongoing training sessions so they’re up-to-date and well-versed in the latest safety protocols. Train them on site-specific hazards, emergency response situations, safe handling of hazardous chemicals and materials, and identifying potential new hazards.

- Assess your workplace for safety risks. Examine your workplace to identify potential hazards and how they might affect employee safety. After the assessment, follow up to make sure the hazard has either been eliminated or that sufficient training is provided to help workers avoid injury. “There are countless resources available to assist employers in the development of their safety policies and procedures: the loss control staff and loss control website of their workers’ comp carrier, Federal OSHA, their state’s occupational safety and health division or program, industry trade groups, and their insurance agent can also recommend solutions,” Wilkins said. “In all cases, a safety manual/program needs to be specific to each individual operation. Companies can use sample resources found on AmTrust’s website to assist in creating a safety manual/program.”

- Identify injury trends. Do the same accidents keep happening? Do new employees seem to be getting hurt most often? What are the costliest injuries at your workplace? Identifying trends can help you mitigate problems on a broader scale.

- Develop a safety-and-wellness program. Encourage stretching and movement before heavy lifting. Offer training on the most ergonomic ways to perform daily job tasks. Run a competition to see who can take the most daily steps. Initiatives like these can lead to a healthier workplace and less potential injuries.

- Invest in the right tools. Proper protective gear is crucial. Everything from eye protection to gloves to gas masks to full body suits can help prevent injuries and illnesses. Don’t just assume employees know how to use the tools, train them on how to properly put them on, remove them, and maintain them.

These three technologies can help you modernize your safety program and prevent injuries.

18. What injuries are covered?

Workers’ compensation insurance covers only injuries that occur at work or in the process of employment. This is known as “AOE/COE” — arising out of employment and occurring during the course of employment. This includes everything from a chef cutting herself with a knife to a construction worker breaking his leg after falling off a ladder. The injuries or illnesses can also be the result of cumulative trauma — like back injuries from lifting heavy materials or joint pain from repetitive motion.

Pre-existing conditions are a bit of a grey area. Sometimes a new injury can exacerbate an existing injury — and that would trigger coverage, although benefits may be reduced. If you hurt your knee on the job, but medical examinations find that you have arthritis in that knee, you’ll still get benefits because the new injury exacerbated the old one — but the benefits may be limited.

19. How can I fight workers’ compensation fraud?

Workers’ compensation fraud is unfortunately common. Many workers feign injuries to receive benefits while staying out of work. In fact, the National Insurance Crime Bureau reports that workers’ compensation fraud costs insurers as much as $7.2 billion annually.

Here are some things you can do to fight fraud:

- Look for warning signs. Was the injury reported on Monday morning? Did it happen immediately following a job termination? Were there zero witnesses? Does the claimant have a history of suspicious claims? Was the injury reported late? Are they refusing X-rays or other diagnostic tests? These can all be warning signs of fraud.

- Check their Facebook page. Is an injured worker out on leave but posting photos of themselves lifting heavy objects, running marathons, or skydiving? If so, you’ve likely caught them committing fraud.

- Implement motion-capture technology. Similar to the technology used in filmmaking or video game creation, motion-capture technology can watch a person move and help determine if they’re actually injured or feigning an injury to gain workers’ compensation benefits.

- Issue a zero-tolerance policy around workers’ compensation fraud. Train your employees about the dangers of workers’ compensation fraud and explain that it could lead to serious repercussions.

- Encourage people to share suspicions. Provide an anonymous tip line or email address. Give rewards for whistleblowers. Creating a culture where people can speak out will help detect fraudulent behavior.

- Hire private investigators. When it’s serious enough, hiring private investigators can prove fruitful. They just might come back with video of the “injured” worker running, jumping, golfing, or playing sports.

20. How will advances in technology impact workers’ compensation insurance?

Imagine workers’ comp underwriters quickly analyzing thousands of pages of medical bills and health records to predict injury risks. Imagine deep computer analysis showing shipping companies safer routes to sail, factory workers safer processes for working on a line, or hospital workers better ways to lift patients and heavy equipment.

It’s all a product of artificial intelligence — machine learning that can analyze mountains of data in seconds. It’ll help better predict workplace injuries, transform risk prevention, lead to more accurate underwriting and make claims processing far faster.

“In the last few years, underwriters in workers’ compensation have become increasingly aware of how their data can help guide them in assessing and pricing their business. Predictive analytics and data science are now well established and exciting avenues within the line of business. At AmTrust we have heavily invested in these areas as well. However, we will never replace traditional underwriting. Instead we use these exciting findings as tools to help shape the underwriting process,” Zender said.

With AI, injured workers can communicate with chatbots rather than filling out forms in writing. That will not only lead to workers offering more information about their injury or illness but also help in fraud detection as the chatbots will be designed to pick up verbal cues that may indicate fraud — like long pauses.

Take a look at how AI and machine learning will impact the insurance industry over the next decade, and what that means for you.

McKinsey & Company’s Insurance 2030 report explains in far more detail how AI will process big data and mimic the perception, reasoning, learning, and problem solving of the human mind. It could take workers’ compensation insurance — and the entire industry — from a detect-and-repair mindset to a predict-and-prevent philosophy.

21. What are some common workers’ compensation terms?

There is plenty of jargon associated with workers’ compensation insurance. Here’s a basic glossary of terms:

- Accepted claim/admitted claim: A workers’ compensation claim in which the injury or illness is covered by workers’ compensation insurance.

- Alternative work/light duty: A new job offered to an injured employee that gets them back to work but not in the same role they performed while getting injured. The role must last at least 12 months and pay at least 85 percent of the previous pay.

- Americans with Disabilities Act (ADA): A federal law prohibiting discrimination against people with disabilities in several areas, including employment. It requires reasonable accommodations for employees with disabilities or who become disabled due to a work injury or illness.

- Claims administrator/adjuster: The individual at an insurance company who handles an injured workers claim.

- Commutation: A lump sum payment of part or all of an injured worker’s permanent disability award.

- Ergonomics: The study of how a workplace and the equipment used there can best be designed for comfort, efficiency, safety, and productivity. Proper ergonomics can prevent injuries.

- Fault state/no-fault state: In a “fault state,” workers’ compensation benefits are dependent on who is to blame for the accident. In “no-fault” states, benefits are given to any worker injured on the job.

- Fraud: Knowingly faking or feigning an injury or illness to gain workers’ compensation benefits.

- Impairment rating: The percentage estimate of how much an injury has affected the use of an injured worker’s body. It can include physical impairments or mental impairments — and be permanent or temporary, severe or mild.

- Independent medical examination: A medical exam performed by a physician not chosen by the company or the injured worker. This step is typically taken after a dispute arises over the extent of an injury.

- Permanent disability: Payments to an injured employee when an on-the-job injury permanently limits the kinds of work they can do and/or their ability to earn a living.

- Temporary partial disability: Payments to an injured employee who can still work, but not at the same rate or level that they did before the injury or illness. These payments are available for a limited time, ending when a worker makes a full recovery.

- Temporary total disability: Payments to an injured employee who is unable to work at all for a temporary period of time. The benefits stop when the employee is able to resume working.