Claims

Preparing for Hail

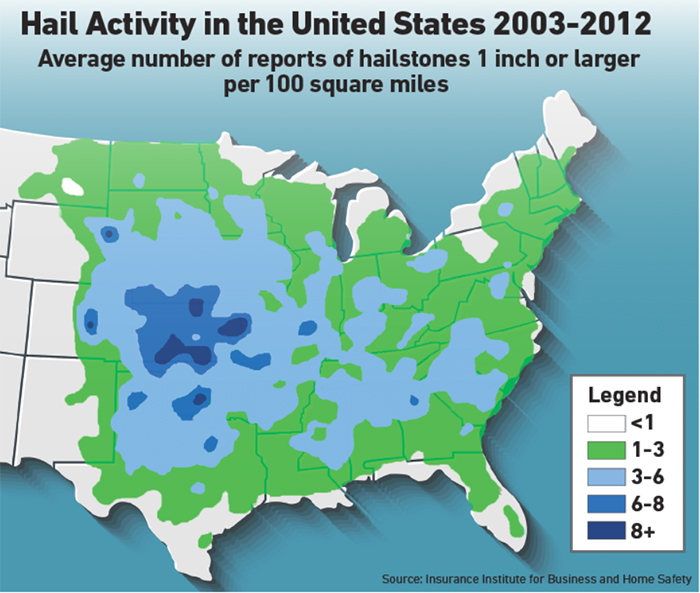

Hailstorms are expanding their geographic footprint in every direction.

In Texas, storms are striking as far south as San Antonio. While the city normally experiences one to five hailstorms per year — a moderate risk zone for hail — this year it had more than 30, according to data tracked by Liberty Mutual’s risk engineering arm.

“Hail activity has also been expanding more into the North and Northeast,” said Arindam Samanta, director, product management and innovation at Verisk Insurance Solutions.

“We’ve noticed it becoming more of a problem in parts of Ohio, Illinois and Minnesota, outside of traditional hail-prone areas.”

As these areas become more developed, more properties are built in hail’s path, increasing claim frequency and severity.

Areas on the west and south sides of Oklahoma City, for example, have largely transformed from wheat fields to sprawling suburban communities in the last 10 years.

Arindam Samanta, director, product management and innovation, Verisk Insurance Solutions

“We know that the weather patterns responsible for the formation of hail are fairly consistent over certain geographic areas — the Great Plains states, the Rocky Mountain West, parts of the Midwest — but over time the expansion and aerial coverage of cities and suburbs throughout these regions have increased, so the number of properties in the path of these damaging hailstorms will increase,” said Curtis McDonald, product manager, weather verification services, CoreLogic.

The type of storm has changed too. Smaller stones with diameters of less than 2 inches combined with higher velocity winds wreak different types of damage than larger, denser stones.

Hail typically smashes up roofs, siding, skylights and roof-mounted equipment like refrigeration units. In 2016, though, wrecked air conditioner coils have constituted roughly 30 percent of hail damages.

The smaller hailstones have an easier time getting into the coils — which are fragile and susceptible to damage — but are not heavy enough to significantly damage roofing materials and sturdier equipment.

The costs associated with hail damage have also risen due to the expensive repair and replacement of air conditioning units that are either too old or too new. For out-of-date equipment, there may no longer be parts available, while newer units must adhere to eco-friendly guidelines that elevate their price.

Many newer A/C units are also custom-built, especially for large commercial properties, so the replacement process is not only costly, but time-consuming.

Commercial property insurers can build a defense strategy by arming themselves with data, and there are plenty of ways to gather it.

“For 200-ton to 500-ton air conditioning units, it could take three to four months to get a new unit built and installed. And sometimes roof modifications are necessary during that process,” said Ralph Tiede, vice president, commercial insurance, and manager, property risk engineering, at Liberty Mutual.

“The business interruption impact can be significant, and that’s one piece of the puzzle that risk managers may not think about,” Tiede said.

If a storm strikes in the middle of a hot Texas summer, then the property may need to shut down completely while it waits for the new unit.

Data-Driven Defense

Commercial property insurers can build a defense strategy by arming themselves with data, and there are plenty of ways to gather it.

The Insurance Institute for Business and Home Safety (IIBHS), a research organization funded by insurance companies, conducts storm simulations inside its massive laboratory in Chester County, S.C., firing lab-created hailstones from cannons into full-size buildings to study effects on roofing, siding and outdoor equipment.

The organization also conducts field testing using impact probes to analyze hailstone size and density, and radar to track weather patterns.

“The IIBHS supplies member companies [including Liberty Mutual] with the most up-to-date information. That’s critical, because otherwise we’d be left making risk mitigation recommendations to clients based on building codes that are years old and don’t reflect what’s happening today,” Tiede said.

Other analytics organizations provide similar real-time insights.

Verisk Analytics uses weather modeling and ground observations to complement its real-time weather monitoring data feed.

Ralph Tiede, vice president, commercial insurance, and manager, property risk engineering, Liberty Mutual

“We use an extensive ground-based network, including dual-pol radars, which collect huge amounts of data on fast-moving storms every two to five minutes,” Samanta said. This helps to complete the picture of a property’s exposure and keep an accurate record of hail events.

Storm history, collated with industry-wide hail claims data, informs Verisk’s Hail Damage Score, which ranks a location on a scale from one to 10. Higher numbers indicate higher likelihood of exposure to past damaging hail events and the presence of pre-existing hail damage.

Such data can help insurers discern what to look for when conducting property inspections for potential new clients, and may lead them to decide that a location is too risky to underwrite.

Analytics firm CoreLogic also produces retrospective data using a proprietary forensic database that houses three years’ worth of storm data.

Analytics firm CoreLogic also produces retrospective data using a proprietary forensic database that houses three years’ worth of storm data.

“At CoreLogic, we score properties based on the actual number of hail events that previously impacted it,” McDonald said. “It’s a tool underwriters can use when evaluating a new property or geographic area.”

But with hailstorms fanning into new regions and the resulting damage changing in nature, data based on past events may not suffice. Forward-looking probability metrics complete the risk picture.

“We’ll also run a 10,000-year simulation and look at the probability of hail 1 inch in diameter or greater impacting a specific property in the future,” McDonald said.

Other data points to consider are more property-specific: the types of building materials for roofing and siding, the number of roof-mounted equipment units and skylights, the age of the equipment, the current value of the building, and any mortgage or potential liens.

“High quality data is key in forming a basis for a view of risk in areas where it is still emerging,” Samanta of Verisk said.

Risk Mitigation

Hailstorm and property-specific data can aid insurers in multiple capacities, from initial assessments of a potential new client to risk mitigation recommendations to expeditious claims processing.

“We have specific guidelines for our engineers when they go out to do an assessment of a new building in an area prone to hailstorms and wind,” Tiede of Liberty Mutual said. “We will want them to look at specific things like the roof condition, roof-mounted equipment, and any maintenance programs in place.”

The engineers then report back to account managers, who use the information to customize pricing and deductible structures, and to develop specific risk mitigation recommendations.

“We built a proprietary hail tool where we’ll enter in all the property-specific data collected for us by our engineers, and it will show us the loss potential for that specific location.

“We pass that along to the account managers, who help clients develop and prioritize specific steps they can take to reduce their exposure,” Tiede said.

Recommendations can include installing factory-approved hail guards over air conditioning and heating units, replacing an old roof with stronger material, conducting regular roof maintenance and installing protection for skylights.

At about $250 each, “manufacturer-installed hail guards are a surprisingly inexpensive fix” that won’t compromise the unit’s efficiency, Tiede said.

Liberty Mutual’s tool also has the benefit of identifying customers who are doing their homework and have already taken steps to protect themselves.

“If we have a customer who is proactively taking these steps that could reduce loss expectancy, this might make them more attractive, which would likely be reflected in that risk’s pricing,” said Brent Chambers, underwriting consultant, national insurance property, Liberty Mutual.

“It’s a tool we can use to sharpen our quote.”

“Customers who are loss-conscious deserve some type of credit. If we can, we like to give them something back to demonstrate that we’re partners in this together,” Tiede said.

Insurers can also use weather monitoring systems to send out alerts to clients sitting in a storm’s path, advising them of immediate steps they can take to limit damage and providing them with a claims contact if a loss occurs.

“If they suffer serious damage, they may not be able to get inside the building or get access to their files where they keep their insurance information,” said Chambers.

“We send them the claims intake phone number to call so they have it right in front of them if they need it.”

When insureds are warned and prepared, claims can be filed and resolved more quickly.

“Hailstorms aren’t going to stop, and in fact we’re going to see more and more of them,” Tiede said. “2016 saw a lot of hail damage — about 5,400 storms this year, and it’s a risk the whole industry is waking up to.” &