Brokers

Decades Spent Serving Clients

At the age of 100, Woodrow Cross has no plans to retire.

The founder and chairman an of Cross Insurance – the Bangor, Maine-based independent insurance provider that employs 800 people at 40 locations in five states – still goes to work a few days per week to schmooze with his staff, service his insurance clients and grow the business.

He won’t retire, Cross said, because running his insurance dynasty is more fun than anything else.

“I like the challenge,” he said. “I like growing the business. I like the people.”

A Sociable Man

Cross has made a few concessions to age, such as moving to an assisted living facility, employing a driver and using a wheelchair. His hearing isn’t what it used to be. When he walks, or rolls, into his office, he makes the rounds of hellos and well wishes from the staff, which include his son Royce, president and CEO; grandson Jonathan, executive vice president; and grandson Woodrow, commercial lines account executive. His late son Brent served as executive vice president.

The Cross family, from left, Jonathan Cross (grandson); Royce Cross (son); the late Brent Cross (son); Woodrow Cross; and grandson Woodrow Cross. Photo taken in 2014.

“It’s exhilarating,” he said to see his family thriving and contributing. It makes his heart swell with pride and joy.

He is a sociable man. When Cross was proprietor of a country store in the tiny hamlet of Bradford, Maine, during the Depression, the store’s wood stove served as the town’s meeting spot.

There was no television and few radios, said his son Royce. No alcohol because of Prohibition, although a few men occasionally bought large quantities of vanilla extract, putatively to bake a cake.

“The entertainment was visiting with each other in the store,” Royce Cross said, “and Woodrow was at the center.”

His personality continues to bring in business. At a recent event recognizing his business and civic accomplishments, Woodrow Cross and another honoree made their acquaintance – in whispers – at the rear of the stage as a speaker delivered his speech at the podium.

“They really hit it off,” Royce Cross said.

The new acquaintance, it turned out, was part of a large national organization, and he was so impressed that he moved the company’s sizable insurance accounts to Cross Insurance.

“Sales is what I love,” Woodrow Cross said. “I haven’t lost the excitement. I hope I’m improving.”

Servicing Clients

Cross also takes pleasure in doing right by his clients, Royce said. For example, when a client’s property burned one Christmas Eve after the office had closed early for the holiday, Cross took Royce to the property to work on the claim, delaying their own festivities.

“That was a good Christmas. When you help someone, that’s rewarding,” Royce said.

“We were brought up to help,” he said.

Without resorting to intimidation, despotism or tyranny, Cross is a perfectionist when it comes to service, Royce said. “He taught us, ‘There’s a limited amount you can do for your clients on pricing, so come back on service.’ ”

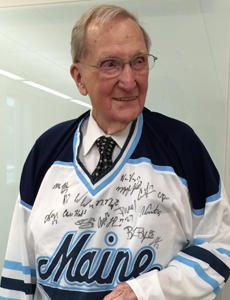

Woodrow Cross in a University of Maine Hockey jersey.

When banks and real estate agencies need binders for closing, Cross taught his sons to “move quickly. Close the deal before they can go to the competition,” Royce said.

Woodrow Cross built the largest independent insurance provider in the Northeast, acquired more than 100 agencies, has buildings in Bangor and Portland bearing his name, was awarded an honorary doctorate and is generally considered a bastion of Bangor’s economy.

But it’s also important to him that he remembers his first business of selling seed door to door at age 6, and his teenage entrepreneurial venture of raising baby chickens and selling them at a profit.

“He doesn’t see himself as a big important guy, and he doesn’t permit grandiosity in his children,” Royce said. “I speak to him every day of my life, and I can’t recall a conversation when we talked about ourselves as pretty special. He wouldn’t like it.”

The combination of ambition for future accomplishments and modesty about past ones is the mainspring behind the company’s growth.

The company that Cross started in 1954 at his kitchen table now sells and services personal and commercial insurance lines, employee benefits, surety bonds, comprehensive risk management advice and counsel, and specialized products focused on higher education and high net worth needs.

Cross’ extroversion, ambition, love of family and community, resourcefulness and honesty is a perfect fit for his profession, said Royce, who joined the company in the 1970s.

Indeed, Woodrow Cross said, no pleasure associated with retirement would deliver the shot of joy, pride and adrenaline that he gets from his work.

Does he have any regrets for trips not taken or golf not played?

“No regrets,” Cross said. “No bucket list.” &