R&I Profile

Achieving Balance: Mixing Kidnap & Ransom with a Yogi Lifestyle

In the high-stress scenario of kidnap or ransom, the first image that comes to mind isn’t necessarily a yoga mat — at least, not for most.

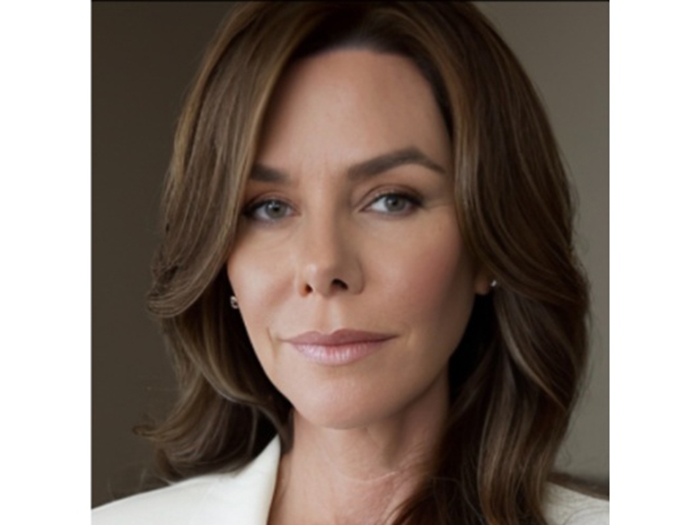

But Denise Balan, senior VP and head of U.S. kidnap & ransom, XL Catlin, who practices yoga every day, would swear by it.

“I looked at these opposing aspects of my life,” she said. “Yoga is about focus, balance, clarity of intent. In a moment of stress, how do you respond? The more clarity and calmness you maintain, the better positioned you are to provide assistance in moments of crisis.

“Nobody wants to be speaking to a frenetic person when either dealing with a dangerous situation or planning for prevention of a situation,” she added.

“There’s a poem by [Rudyard] Kipling on that,” added Balan’s colleague Ben Tucker. “What it boils down to is: If you can remain calm, you can manage through a crisis a lot better.”

Tucker, who works side by side with Balan as head of U.S. terrorism and political violence, XL Catlin, has seen how yoga influences his colleague.

“The way Denise interacts with stakeholders in this process — she is very professional and calm in the approach she takes.”

Yin and Yang

Sometimes seemingly opposite or contrary forces may actually be complementary and interconnected. In Balan’s life, yoga and K&R have become her yin and yang.

She entered the insurance world after earning a juris doctor degree and practicing law for a few years. The switch came, she said, when Balan realized she wasn’t enjoying her time as a commercial litigator.

In her new role, she was able to use her legal background to manage litigation at AIG, where her transition from law to insurance took place. She started her insurance career in the environmental sector.

In a chance meeting in 2007, Balan met with crisis management underwriters who told her about kidnap and ransom products.

She was hooked.

Because of her background in yoga, Balan liked the crisis management side of the job. Being able to bring the calmness and clearness of intent she practiced during yoga into assisting clients in planning for crisis management piqued her interest.

She then joined XL Catlin in July 2013, where she built the K&R team.

As she became more immersed in her field, Balan began to notice something: The principles she learned in yoga were the same principles ex-military and ex-law enforcement practiced when called to a K&R-related crisis.

She said, “They have a warrior mentality — focus, purpose, strength and logic — and I would say yoga is quite similar in discipline.”

“K&R responders have a warrior mentality — focus, purpose, strength and logic — and I would say yoga is quite similar in discipline.” — Denise Balan, senior VP and head of U.S. kidnap & ransom, XL Catlin

Many understand yoga to be, in itself, one type of meditation, but yoga actually encompasses a group of physical, mental and spiritual practices. Each is a discipline. Some forms of yoga focus on movement and breathing, others focus on posture and technique. Some yoga is meant to relax the mind and create a sense of calmness; other yoga types make participants sweat.

After having her second child and working full-time, Balan wanted to find something physical and relaxing for herself; a friend suggested yoga. During her first lesson, Balan said she was enamored with it.

“I felt like I’d done it all my life.”

She dove into the philosophy of yoga, adopting the practice into her daily routine. Every morning, whether Balan is in her Long Island home or on a business trip, she pulls out her yoga mat to practice.

“I always travel with my mat,” she said. “Daily practice is the simplest form of connection to routine to maintain my balance — physically and mentally.”

She said the strangest place she has ever practiced was in Lisbon. She was on a very narrow balcony with a bird feeder swarming with sparrows overhead.

After years of studying and practicing, Balan is considered a yogi — someone who is highly proficient in yoga. She attends annual retreats with her yoga group, where she is able to rejuvenate, ready to tackle any K&R event when she returns.

In 2016, Balan visited Tuscany, Italy, where she learned the practice of yoga nidra, a very deep form of meditation. It’s described as the “going-to-sleep stage” — a type of yoga that brings participants to a state of consciousness between waking and sleeping.

“It awakens a different part of your brain,” Balan commented. “Orally describing it doesn’t quite do it justice. One has to practice Nidra to fully understand the effect it has on your being.”

Keeping a level head during a crisis is key in their line of business, Tucker said. He can attest to the benefit of having a yogi on board.

“I’ve seen her run table-top exercises where there is this group of people in a room and they run an exercise, a simulation of a kidnap incident. Denise is very committed to what we’re doing,” said Tucker.

“She brings that energy. She doesn’t get flustered by much.”

Building a K&R Program

When Balan joined XL Catlin, she was tasked with creating the K&R team.

She spent time researching and analyzing what clients would want in their K&R coverage. What stuck out most to Balan was the fact that, in these situations, the decision to purchase kidnap and ransom cover is rarely made because of desire for reimbursement of money.

“I asked why people buy this type of coverage. The answer was for the security responders,” she said.

“These are the people who sit with the family. They’re similar to psychologists or priests,” Balan further explained. “Corporations can afford to pay ransom. They buy [K&R] because it gives them access to these trained and dedicated professionals who not only provide negotiation advice, but actually sit with a victim’s family, engaging deep levels of emotional investment.”

“I’ve learned to appreciate all moments in life — one at a time. The ability to think clearly and calmly guides my work, my practice and my personal life.” — Denise Balan, senior VP and head of U.S. kidnap & ransom, XL Catlin

Balan described these responders as people having total clarity of purpose, setting their intentions to resolve a crisis — a practice at the very heart of yoga. She knew XL Catlin’s new kidnap program would put stock in their responders.

“I’ve worked closely with the responders to better understand what they can do for our clientele. These are the people who run into danger — warrior hearts married to dedication to our clients’ best interests.”

But K&R is more than fast-paced crisis and quick thinking; Balan also spent a good deal of time writing the K&R form and getting the company’s resources in order. This was a huge task to tackle when creating the program from the ground up.

“A lot of my day-to-day is speaking with brokers and finding ways to enhance our product,” she said.

After a few months, she was able to hire the company’s first K&R underwriter. From there, the program has grown. It’s left her feeling professionally rewarded.

“People don’t often get that opportunity to build something up from scratch,” she said. “It’s been an amazing experience — rewarding and fun.”

“She brings groups of people together,” said Tucker. “She’s created a positive environment.”

Balan’s yogi nature extends beyond the office walls, too. Her pride and joy, she said, are her kids. And while it may seem like two large parts of her life are opposite in nature, Balan’s achieved balance through her passions.

“[Yoga] has given me the ability to see beyond only one aspect of any situation” she said. “I’ve learned to appreciate all moments in life — one at a time. The ability to think clearly and calmly guides my work, my practice and my personal life.” &