Regulatory Risk

A Rule Too Far?

OSHA’s revised recording and reporting rule has kicked up a dust storm of objections from employers and professional organizations across multiple sectors.

The new rule impacts the public disclosure of injury reporting, the timeliness required to report injuries, the ability of employers to determine whether the worker was impaired by drugs or alcohol at the time of injury, and criteria used in safety incentive programs.

The rule, titled “Improve Tracking Workplace Injuries and Illnesses,” revised in May for the first time since 2001, requires that employers electronically submit the data that they are already required to record on their onsite OSHA injury and illness forms.

The change drew heat when OSHA announced its intent to make a portion of the data public on its website.

“Our new rule will ‘nudge’ employers to prevent work injuries to show investors, job seekers, customers and the public they operate safe and well-managed facilities,” Assistant Secretary of Labor for Occupational Safety and Health Dr. David Michaels said in a statement.

Randy Johnson, senior vice president of labor, immigration and employee benefits, U.S. Chamber of Commerce

Critics likened the tactic to public shaming, and expressed concerns about the data painting a skewed picture of employer safety efforts.

Public disclosure of such data “fails to show the complete narrative of a company’s safety record or its efforts to promote a safe work environment,” said Associated Builders and Contractors’ Vice President of Health, Safety, Environment and Workforce Development Greg Sizemore in March.

A statement from the U.S. Chamber of Commerce was far more damning.

“This will only create a new filing requirement that will lead to sensitive employer data being published without context or explanation,” said U.S. Chamber of Commerce Senior Vice President of Labor, Immigration and Employee Benefits Randy Johnson.

“The agency’s excessive reporting requirements will lead to employers being falsely branded as unsafe … . Additionally, OSHA’s obsession with shaming employers has not led to better results in workplace safety and this regulation will not change that trend.”

Johnson added that publicly disclosed injury and illness data would likely be misused by labor unions and would also lead to an increase in frivolous lawsuits. Not mincing words, Johnson called the revised rule “poorly conceived, unworkable and unauthorized.”

Responding to concerns that public disclosure would motivate employers to underreport illnesses and injuries, OSHA included provisions to the final rule intended to counter employer practices that might discourage or prevent employees from reporting illness or injures.

Those provisions, however, turned out to be even more controversial than public disclosure.

Anti-Retaliation Measures

Section 1904.35 of the final rule states that a company’s injury and illness reporting procedures must be “reasonable,” meaning easy to follow, and that any procedure that would deter or discourage reporting is not reasonable.

This provision takes aim squarely at employers with complicated, confusing or “unduly burdensome” procedures for reporting injuries or illnesses. It also wags a finger at rigid prompt reporting policies that penalize workers for not reporting a condition immediately, or within a very tight window such as by the end of shift or within 24 hours.

Overly rigid reporting policies, reasoned OSHA, automatically preclude the reporting of conditions that develop over time, such as musculoskeletal disorders or other problems that might have delayed onset of symptoms. In other situations, a worker might not be able to report within a proscribed period of time because he or she is incapacitated or otherwise briefly unable to report an illness or injury.

A large number of employers have a routine mandatory drug testing policy for all injured workers. Such policies could now come under OSHA scrutiny.

If a policy specifies “immediate” reporting of injuries or illnesses, “you don’t necessarily have to take that word out, but you might want to add a little wiggle room that says ‘immediately or as soon as it’s feasible or possible to do so,’ ” said Pat Miller, a member of Sherman & Howard LLC, during a November webinar hosted by Lockton.

The other two new provisions of section 1904 pertain to retaliation against employees for reporting injuries and illnesses. Of particular alarm for employers is the prohibition against routine post-injury drug testing without a legitimate “objectively reasonable basis” for doing so.

Part of the agency’s rationale is that common methods of testing can determine whether a person used drugs in the recent past, but cannot distinguish whether a person was actually under the influence at the time of the incident. For that reason, some workers may avoid reporting injuries for fear of testing positive due to drug use that occurred days or weeks prior to the incident.

A large number of employers have a routine mandatory drug testing policy for all injured workers. Such policies could now come under OSHA scrutiny.

“It’s inconceivable to those of us who study how to improve safety performance that OSHA would want to limit drug and alcohol testing as part of the investigation after an accident or near-miss incident,” said ABC’s Sizemore. “Root cause analysis is key to developing procedures that prevent future incidents, so we need to know whether drugs or alcohol were a factor.”

OSHA specified that employers should only mandate post-injury drug tests if it is likely that the injury was caused by drug use. For many companies, that will put the burden on front-line supervisors to decide whether there is probable cause to test a worker for drug use after an injury.

But the rule doesn’t take into account whether those supervisors are qualified to make those determinations, said Bob Trinkleback, SVP and casualty risk control leader at JLT Specialty USA. The Department of Transportation, he said, requires that all supervisors receive drug and alcohol training that addresses reasonable suspicion, but a similar requirement doesn’t exist for general industry.

“I don’t think OSHA has thought through [reasonable suspicion] as well as they should,” said Trinkleback.

Response from employers runs the gamut.

Mark Sullivan, senior casualty risk control consultant, Aon

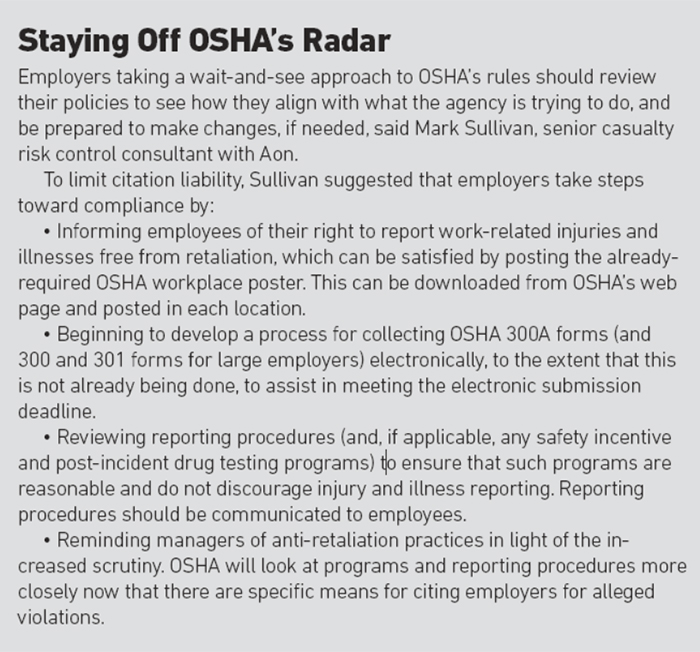

“We have some [clients] that are changing policies and some that are taking a wait and see approach … . There are very mixed feelings as to how they’re going to respond to it,” said Mark Sullivan, senior casualty risk control consultant with Aon.

A few employers seem determined to defy OSHA on this point, consequences be damned. On the opposite end of the spectrum, Trinkleback said some of his clients intend to cease post-incident drug testing altogether.

But those wanting to avoid those two extremes still have options, he said.

“You have to have a process,” said Trinkleback. That might mean requiring two trained supervisors to agree that testing is warranted in a particular case. “If they both agree, then those two should get on a call with legal, risk management and safety and talk about the facts and document everything.”

At least then, whether the worker’s test comes back negative or positive, the company can counter any retaliation claim by showing that it followed established protocols. Having a process and following it consistently is the best way to stay on safe ground with OSHA while continuing to utilize post-incident drug testing.

In a memorandum dated Oct. 19, OSHA clarified that the revised rule does not apply to drug testing for reasons unrelated to injuries or illnesses, or testing conducted post-injury in compliance with a state workers’ compensation law, or other state or federal law.

Will Your Raffle Get You Cited?

Another common practice that now may run afoul of OSHA’s rule is the ubiquitous safety incentive program. Not all incentive programs are problematic. However, companies with incentive programs tied solely to OSHA recordable injuries, lost-time injuries, or any type of reportable illness or injury, could find themselves in the hot seat.

The agency has expressed concern that workers might not be reporting injuries for fear of losing a desired incentive reward, or fear of compromising a department or work group’s eligibility to receive a coveted group award. That kind of pressure can be a powerful deterrent.

“OSHA just doesn’t want the peer pressure that says, ‘Oh, you’re the one who reported the OSHA recordable and we lost the trip to Hawaii?’ ” said Trinkleback.

Programs that reward employees or departments for following safety procedures, reporting unsafe working conditions, or completing safety training would all pass muster with OSHA. However, holding a raffle for all employees who have worked six months without an injury would be considered a violation.

“Out of a misguided zeal to improve accuracy of reporting on workplace injuries … OSHA has lost sight of the importance of reducing the number and severity of injuries themselves.” — Randy Johnson, SVP of labor, immigration and employee benefits, U.S. Chamber of Commerce

“[OSHA wants programs] that incentivize people for doing the right things,” said Aon’s Sullivan. “Are they participating in training, are they identifying hazards, correcting those hazards, participating in safety committees, attending required training.”

Tying incentives to those leading indicators will keep companies off of OSHA’s radar. Employers can also look for ways to combine the two, said Trinkleback.

“If you can blend in some leading indicators that are meaningful, that will impact your trailing indicators, you’ve got the best of both worlds,” he said.

Legal Challenge

OSHA said that the anti-retaliation provisions are intended to ensure that all workers receive proper care and compensation for legitimate workplace injuries. The secondary goal is to ensure maximum accuracy in illness and injury reporting “to enable ‘big data’ researchers to apply their skills to making workplaces safer.”

But many feel that OSHA has missed the mark.

“Out of a misguided zeal to improve accuracy of reporting on workplace injuries … OSHA has lost sight of the importance of reducing the number and severity of injuries themselves,” said the Chamber’s Johnson.

Still more have accused OSHA of overstepping its authority, circumventing the standard-making process by using the lengthy preamble to the rule to lay out the parameters of the rule itself.

“Part of the problem,” said Sullivan, “is that this was passed as a rule rather than a standard, and all of the enforcement guidance sits in the preamble to the actual law. That’s very unlike OSHA’s normal approach when they publish a standard … and it’s got employers very concerned.”

“It’s kind of a backdoor way of getting their interpretations in without actually having to put the language in a final rule,” said Miller, during the Lockton webinar.

In July, the National Association of Manufacturers, Great American Insurance Co. and several other organizations challenged the rule in the U.S. District Court for the Northern District of Texas. Consequently, the effective date of the anti-retaliation provisions was pushed from Aug. 10 to Nov. 1, and then to Dec. 1.

While the legal dance goes on, employers are left with troubling questions about what steps to take. And of course, the 2016 election results could change everthing.

“Congress may eliminate this new rule,” said Trinkleback. “It’s happened before — it happened with the ergonomics standard.”

After labor organizations fought for two decades for an ergonomics standard, OSHA finalized an ergonomics rule in November 2000. President George W. Bush repealed it in March 2001, two months after taking office. &