Transportation

6 Critical and Emerging Risks in Transportation

Advancing technology, cyber exposures and market fluctuation created by international trade disputes are some of the newer risks facing transportation. The worsening driver shortage, regulatory compliance and the sad state of America’s infrastructure also present persistent challenges. Here are the six most pertinent transportation risks today:

1. Cyber Attacks on Physical Assets

“The biggest threat facing today’s transportation executives is cyber vulnerability,” according to a Willis Towers Watson report, “Transportation Risk Index 2016: Navigating risk in the transportation sector.”

Increased use of fleet telematics systems that track the location, status and condition of physical assets creates more access points for hackers. While breaching a private network does expose private customer data, the greatest threat to transportation companies is the potential for cyber criminals to cause physical damage to the vehicle itself or its precious cargo.

Cyber attackers could, for example, take over the digital dashboard of a truck carrying fresh produce that displays the trailer’s temperature to show an appropriate reading, even while shutting down the cooling mechanisms. The result: Thousands of dollars’ worth of spoiled food, which the driver may not discover until stopping to make his delivery.

The biggest threat facing today’s transportation executives is cyber vulnerability. — “Transportation Risk Index 2016: Navigating risk in the transportation sector,” Willis Towers Watson

The rail industry also heavily utilizes electronic sensors, network technology and automation. Positive train control, track signals, communications systems and power delivery all rely on these technologies.

High-volume and commodities rail carriers may be particularly susceptible to cyber attacks by political actors because of the greater potential for supply chain disruption.

2. Advancing Technology

Cyber transportation risks are likely to be elevated by the emergence of new technology, like semi- and fully-automated vehicles and greater use of sensors connected to the Internet of Things. Aside from cyber exposure, these technologies do hold potential to ameliorate the driver shortage and enhance safety, but companies that disregard or fail to stay up to speed with these changes could fall behind competitors and lose out on critical opportunities.

According to a Marsh report on cyber risks in transportation: “As operational technology evolves, critical infrastructure operators will need to ensure that new architecture should not be deployed until it can be controlled and protected. As companies develop and modernize, they will be at risk of cyber attack. Exercises such as upgrading existing legacy systems may result in sacrificing security.”

3. Continuing Driver Shortage

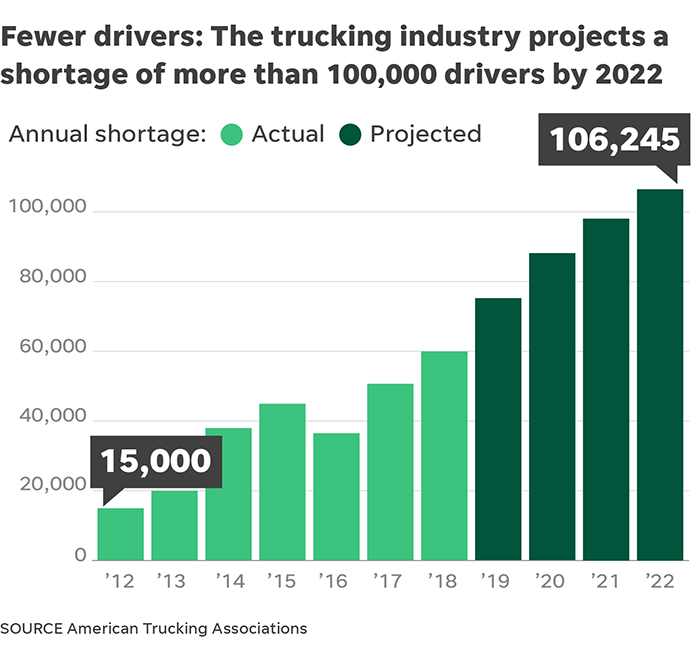

According to the American Trucking Associations, the industry projects a shortage of more than 100,000 drivers by 2022. The persistent shortage is driven by the retirement of older workers, difficulty filing vacant positions with new recruits, and increased delivery demand created by the rise of e-commerce.

The average age of the American trucker is 56 years old. Despite rising wages and signing bonuses for new drivers, trucking owners and operators have struggled to sell the trucking lifestyle — long, lonely, sedentary hours on the road — to younger people. And an older workforce usually comes with higher prevalence of health issues and higher utilization of employee benefits, which drives up those costs for employers as well.

The driver shortage also means more pressure on veteran drivers to put in extra runs and more hours on the road per day in order to make deliveries on time, leading to fatigue and an increased likelihood of an accident.

4. Deteriorating Infrastructure

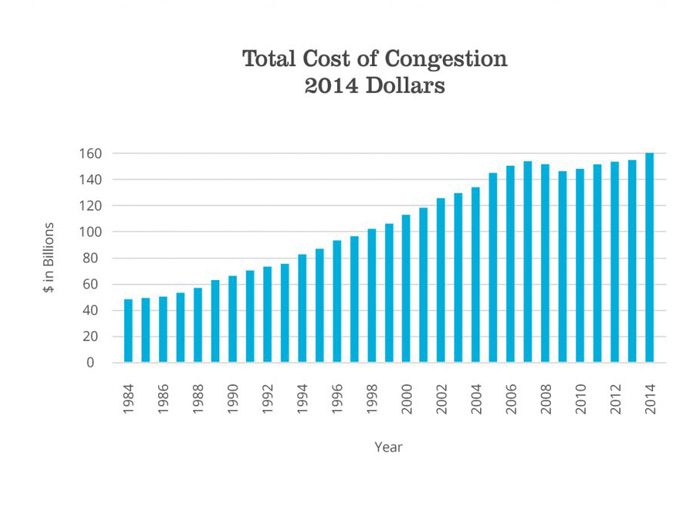

America’s outdated — and in some places, dilapidated — infrastructure will continue to pose problems for ground transportation and increase congestion on the roads and rails. Even small travel delays add up to big costs for trucking and rail owners and operators.

According to the American Society of Civil Engineers’ 2017 Infrastructure Report Card, “across 470 urban areas, there was a total of 6.9 billion vehicle-hours of delay on roads due to congestion in 2014.” These delays cost the nation 3.1 billion gallons of wasted fuel and a total cost of $160 billion. The ASCE also projects that these delays will rise 20 percent to 8.3 billion hours by 2020.

In addition to fuel costs and fewer deliveries being made on time, vehicles are also more likely to incur damage from poorly maintained roads, requiring more frequent maintenance or costly repairs.

The problem is also not likely to abate any time soon. The ASCE’s infrastructure report states “the total investment gap is now expected to be $1.1 trillion through 2025, and an additional $3.2 trillion from 2026 through 2040.”

5. Greater Regulatory Oversight

Driver fatigue is one factor behind more stringent federal regulations dictating how many hours drivers can sit behind the wheel in one day.

As of April 1, 2018, trucks must be equipped with electronic devices to track how many hours each vehicle spends on the road in a day. The new “hours of service” rule prohibits truckers from driving more than 11 hours in a 14-hour period of time. They must also take at least 10 hours of mandatory rest after an 11-hour drive.

While the regulation has been shown to combat driver fatigue and reduce crash rate, it also increases the cost of training and may further delay deliveries — further exacerbating issues created by driver shortage and adding to the list of transportation risks.

The Food Safety Modernization Act, which large trucking companies had to comply with by April of 2017, also increases the regulatory compliance burden for motor carriers and comes with the risk of significant fees.

The Food Safety Modernization Act, which large trucking companies had to comply with by April of 2017, also increases the regulatory compliance burden for motor carriers and comes with the risk of significant fees.

According to Fleet Owner Magazine, “The FDA finalized its new food safety rule in April 2016 to prevent food contamination during transportation. The rule requires those involved in transporting human and animal food — shippers, loaders, carriers and receivers – to follow best practices for sanitary transportation, such as properly refrigerating food, adequately cleaning vehicles between loads and properly protecting food during transportation.” The rule includes requirements around proper documentation of every action taken.

6. Demand Volatility

Profit margins in the transportation sector rely heavily on the price of fuel. Lower oil prices equal lower prices at the pump and more money in operators’ pockets. Unfortunately, oil prices are far from stable, and the trucking, rail and aviation industries have to contend with unpredictable swings that affect each sector disproportionately.

When fuel is cheap, more shippers turn to trucking to transport goods as trucking is generally faster than rail. Railways conversely may get more business when oil prices are higher and freight trains provide better value over gas-guzzling tractor-trailers.

In addition to oil price fluctuation, international political tension and trade wars stand to change volume of goods being shipped and disrupt global supply chains. A Fitch Ratings report said auto tariffs and tariffs on aluminum and steel could both affect the U.S. transportation industry.

“Were auto tariffs to significantly raise the cost of purchasing an automobile, they could act as a sort of tax on motorists that would increase the costs of auto transportation and in turn reduce demand,” Scott Monroe, a Fitch analyst, said in a statement. &