Sponsored Content by Fiserv

Is Your Process for Certifying Financial Statements Putting You at Risk?

For insurance organizations with millions of transactions, closing the books is no easy feat. Quarterly, half-year and annual 10-K reports — along with other forms required by regulatory agencies — keep the accounting team taxed year-round.

Insurers’ financial statements, filed for every line of business, face external scrutiny from regulatory agencies in every state where they operate. Internally, there are shareholders, boards of directors and in-house audit and compliance teams analyzing the numbers.

There is great pressure to avoid mistakes, and no one feels that pressure quite like the CFO who signs off on the books. By attesting to their veracity, he or she assumes a great deal of personal liability. If the numbers don’t match up, the company can face fines for non-compliance and tarnish its image in the market.

“The pressure to get financial reporting right comes from all sides,” said Renata Sheyner, Senior Product Manager for Financial Control Solutions at Fiserv. “And while companies may only publicly disclose financial information a few times a year, they are continually reconciling transactions to prepare those reports.”

Manual reconciliation compounds compliance risks because insurers house huge stores of disparate data. Data can come from internal departments or third-parties, in the form of text files, spreadsheets or PDFs, it can involve multiple currencies, and it can refer to a payment, policyholder information, or claims history. Different sources and different structures of data make manual reconciliation cumbersome and error-prone.

Additionally, manual intervention can lead to manipulation of data and a lack of audit trail, making it impossible to identify discrepancies in data.

“It’s the combination of the volume and complexity of the data that creates risk,” Sheyner said.

Finance and accounting teams are being pushed to reduce costs and hasten the close cycle without sacrificing accuracy. But accelerating the process can also drive up the risk of error — unless an organization has the right tools in place.

A fully automated and integrated end-to-end reconciliation and certification solution can ease the pain of financial preparation while facilitating speed, accuracy and efficiency.

Reconciliation + Certification: The Power of Integration

Reconciliation and certification are normally two separate processes. Integrating them as a single process is a crucial move that can significantly improve accuracy and confidence in the data being attested/certified.

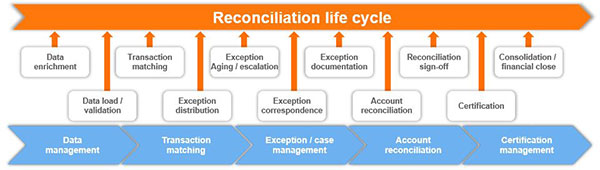

Gathering and prepping all the data, matching data to transactions, managing exceptions and providing proof calculations and summary reports constitutes the bulk of the work in the reconciliation process. Certification provides the final seal of approval.

Some vendors offer an automated solution for certification, addressing only the public signature aspect of the financial close process. With a certification-only solution, reconciliation is still done manually. Final numbers are entered into the certification system for review and final approval.

But certification is just the last step in a 10-step process. Without the back-end infrastructure to connect certification to reconciliation, it remains vulnerable to error. Once financial leaders sign off, there isn’t an easy way to backtrack and gain visibility into the data they approved. Insurance companies that manage millions of transactions per day need an automated system that tracks, matches and archives all the data, and connects that data processing directly to certification.

“Certification is just verifying that the columns match, but there’s no data to show cash flows over time and no view into what comprises your assets and liabilities. There’s no way to know what exceptions emerged or how they were rectified,” Sheyner said. “If your data is not integrated on the back end, how can the CFO know that what he or she is certifying is correct?”

Centralizing data in one place and integrating automated reconciliation and certification processes allows the data to be traced to its source throughout the entire financial close lifecycle — from data ingestion through matching, exception management, reconciliation, certification and signoff. It becomes trackable and transparent.

Additional Risk Mitigation Benefits

Integrating these processes can also mitigate risks inherent in the financial close process.

Automated reconciliation, for example, can reduce the operational risk from fraud and write-offs by identifying exceptions that require investigation, such as payments or policy information that need review.

“When you’re dealing with tens of millions of transactions in a day, it’s critical to focus resources on the exceptions that need attention,” Sheyner said. “The pieces of data that are clean and match evenly are not where you need to spend your time.”

Connecting the exception management process to certification allows auditors to access all the data that lead to the final numbers. It provides transparency with traceable and trackable data, and shows exactly how an organization adheres to internal compliance controls. This reduces regulatory risk of hefty fines and reputational damage in the marketplace.

“Reputational risks associated with restatement can be far-reaching,” Sheyner said.

Providing a view into the data matching and exception management steps of reconciliation also reduces the personal liability assumed by finance executives when they sign their names on the bottom line. “Now the executives can see for themselves that the data is accurate, comprehensive and complete,” Sheyner said.

The End-to-End Answer

Finance teams have been evolving to act as strategic partners in their organizations, helping to drive business results. They should be working with tools that can do some of the number-crunching for them, allowing them to focus on the tasks that provide the most value for the bottom line, like exception investigations and other strategic projects such as mergers and acquisitions and transformation initiatives.

In addition to freeing up time for those high-value tasks, end-to-end automation and integration can also save costs by reducing labor hours and saving resources like paper and ink.

But the biggest difference between a certification-only product and an integrated end-to-end reconciliation and certification solution is that integration provides transparency and risk control.

“Merging those two processes makes them simpler, more transparent and traceable, so the same data system is being used throughout the entire reconciliation and certification lifecycle,” Sheyner said. “Frontier™ Reconciliation from Fiserv is an end-to-end solution, starting with detailed data and tracking it all the way through to final certification.”

With an integrated solution like Frontier™ Reconciliation, insurers have the tools they need to address the high-stakes and cumbersome financial filing process while reaping the benefits of boosted efficiency and lower costs.

“Integrating all back-end processes and centralizing all data in one location provides true risk management,” Sheyner said.

To learn more, visit http://www.fiserv.com/FrontierForInsurance.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Fiserv. The editorial staff of Risk & Insurance had no role in its preparation.