What Can We Expect from Cryptocurrency Regulation in 2023?

Even for the tumultuous world of cryptocurrencies, 2022 was a year of great turmoil.

Amid increasing interaction between the crypto economy and the rest of the global financial system, the crash of crypto asset prices and liquidity and collapses like crypto hedge fund 3AC and centralized cryptocurrency exchange FTX have led many to wonder if 2023 will be marked by a move toward increased regulation of digital assets.

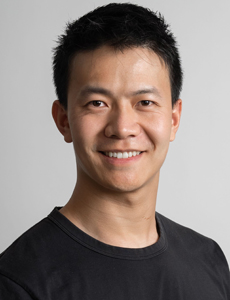

“The collapse of FTX has essentially made the regulation come sooner, especially in the U.S., and that’s the main driver for the regulations for crypto and on crypto worldwide,” said Yemu Xu, co-founder of the crypto startups ARPA and Bella Protocol, and founding partner at ZX Squared Capital, a hedge fund focusing solely on digital assets.

“What we expected to happen in the next three to five years, prior to the collapse of FTX, will come probably in the next one to two years, especially on exchanges.”

Jacob Decker, SVP and director financial institutions at Woodruff Sawyer, also sees a trend toward greater regulation.

“I do think it’s going to accelerate,” said Decker. “It will be a while before we can say the trend of more regulatory enforcement is going to flatten out or recede. I think we’re just at the part of the innovation cycle here where that’s going to continue to ramp up.”

But he anticipates more modest change.

“There are too many nuances and too much complexity that exist across different use cases for this technology,” Decker said. “I don’t see the level of innovation leveraging the underlying technologies here as lending itself to some sort of magic silver bullet.”

Where Regulation May Step In

New regulations may focus on a number of different aspects of the cryptocurrency industry, including cryptocurrency exchanges.

“They provided fiat on- an off-ramp tool or infrastructure,” said Xu. “That is the gateway to control the inflow of money into the crypto world, and that’s what the government cares about. And then the outflow of the money, meaning converting crypto to fiat and then to cash out. That is what the government is concerned about too.”

Xu expects much of this regulation to target Know Your Customer (KYC), Anti Money Laundering (AML) and taxation.

“As long as there’s financial activities, there’s transfer, there’s trading, and there’s depositing and withdrawing,” said Xu.

“So that means illegal activities, money laundering, can easily happen if there’s no regulations and procedures in place. So, the U.S. government will start to regulate the exchanges, especially centralized exchanges, and most likely decentralized exchanges, too, as centralized entities or centralized financial entities. That means that there will be a strict AML and KYC process in place.”

Protecting customer assets will also be a priority.

“You have to make sure a central exchange is solid, that there is enough capital to make sure it’s operating properly and that there is segregation of customer funds,” said CK Zheng, cofounder and CIO at ZX Squared Capital.

“So, a customer who is using the centralized exchange, their funds are there and cannot be tapped to do something totally different.”

Yet another regulatory focus may be mining.

“A lot of states are welcoming mining because it’s a huge tax generator for the state government,” said Xu.

“But a lot of states are opposing it because the current proof of work scheme for Bitcoin mining is very energy consuming and sometimes not environmentally friendly if you’re using unclean energy. So, there might be some regulations coming on that front.”

Counterparty risk will likely be another focus.

“When one firm defaults, it impacts the next firm, and when the next firm defaults, it impacts the following firm, so there’s clearly a lack of the counterparty risk management that would segregate this type of domino effect,” said Zheng. “There’s a lot of similarity to the traditional finance market. You have to have regulation to make sure that the traditional financial firms are solid and apply these principles to the crypto space.”

Adding in Crypto Complexity

But while there are definite similarities and overlap, cryptocurrencies are vastly different from conventional financial products in ways, most notably their technological complexity.

And that can slow the tide of regulation.

“I don’t think that our legislators are yet at a point where they understand it deeply enough or where they’ve broken down the hundreds of relevant issues that need to be clarified down into something that will be done in a big sweeping law,” said Decker.

Stablecoins in the Mix

Other regulations will focus on stablecoins, digital assets whose value is pegged to other commodities or currencies like the U.S. dollar.

“Stablecoin is one of the fundamental concepts in the crypto space and relatively straightforward, because you need a collateral of a dollar against a dollar of USDT or USDC or whatever the stablecoin is,” said Zheng. “And I think that’s relatively simple to [regulate] in a way that conceptually everybody agrees it should be done.”

Decker agrees: “I wouldn’t be surprised if there are more narrow rule updates or potential legislation to deal with who can and can’t be a sponsor or issuer of a stablecoin,” he said.

“There’s plenty of legislation that’s been proposed. It’s a little bit easier to wrap your head around and think about.”

Other Factors to Consider

It remains to be seen whether new regulations will entail expansions of existing financial industry or digital asset industry regulations or entirely new ones.

Decker anticipates an iterative evolution of existing regulations.

“My only prediction related to regulation is that over time there will be tweaks to existing laws that are appropriate and deal with the appropriate nuance that comes with a digital asset as opposed to the traditional form. But they will be more incremental clarifications of existing rules,” he said.

Xu is not so sure: “It can be a mixture of everything,” he said. “For example, to include the crypto activities into the existing legal framework, which is a set of frameworks that was essentially set up decades ago to regulate the financial giants in the traditional sense. Or they could have a brand new set of regulations that’s called blockchain- or crypto-focused regulation framework that’s regulating such activities in a more systematic and holistic manner. It can be both.”

Decker also sees enforcement playing an increasingly central role.

“The current trend of increasing enforcement actions, I expect to continue with potentially more severe penalties. In the near term, it’s not really a change, but rather an acceleration of the existing trend. Certain areas such as AML, KYC or sanction violations are good examples,” Decker said.

“While this type of enforcement is not limited to digital assets firms, many operators in crypto either don’t have mature compliance programs or have unique technological challenges related to conducting AML/KYC/sanctions compliance that put them in the crosshairs.”

Increased enforcement will also mean a growing body of case law that can serve as a de facto regulatory framework, especially regarding what is and isn’t a security — an important and thorny question in the world of digital assets.

Industry groups may also play a growing role in creating standards and best practices.

“There are industry groups that are doing that around stablecoins, industry groups that are doing that around custody. And there are overlapping issues,” Decker said.

“The leaders in the digital asset space already participate heavily in what I would call self-regulatory organization-type activity. They realize that the credibility of the whole industry is at stake, so continued advocacy for smart regulation is critical to their long-term success. We want to create standards and a level of transparency that allows for the legitimate community within this space to operate and continue to grow.”

Not everyone will be happy about a more robust regulatory environment.

“Short term, a lot of entrepreneurs don’t want to deal with regulations because it’s costly in terms of time and capital and energy,” said Xu.

“They will naturally flow to the jurisdiction where there is less regulation or there is less strict regulations in place.”

But many others will embrace it.

“The positive side will be that a lot of investors will use the US-regulated entities, like Coinbase,” said Zheng. “It’s regulated in the U.S., and if there’s solid regulation people may trust them a lot more than an offshore exchange. I think that will be a net benefit to the U.S.”

And some results of regulation will be welcomed by everyone.

“I think the regulation definitely will boost investors’ confidence, especially after the chaos from FTX and other failures of 2022,” said Zheng. “I think that’s definitely something everybody will be looking for.”&