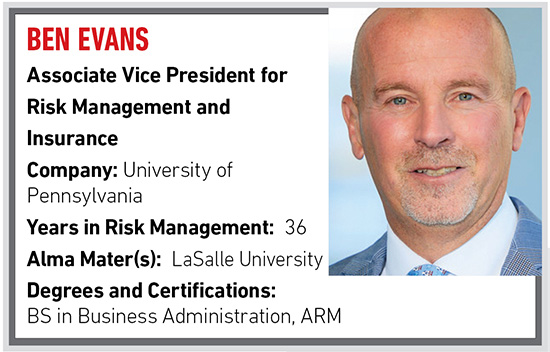

University of Pennsylvania’s Ben Evans on the Changes and Challenges He’s Witnessed in the Risk Management Sphere

R&I: What was your first job?

My first post-college job was as a risk analyst in the Risk Management and Insurance office at Thomas Jefferson University.

R&I: How did you come to your current position?

I began my employment at the University of Pennsylvania on November 1, 2008. For the ten years prior to that I was an employee of Temple University, serving in a couple different roles during my tenure.

My predecessor at Penn, whom I knew for many years, retired in the summer of 2008. I was contacted by a firm to apply, but at the time I was comfortable at Temple and was hesitant to consider the Penn position.

Finally, it was a friend and colleague of mine, who was employed at Penn who suggested I apply. I remember her saying, “You’ll be great for the position and great for Penn.” A few months went by, I applied, went through the interview process, and the rest is history.

R&I: What’s been the biggest change in risk management and the insurance industry since you’ve been in it?

A unified approach to partnership between risk managers/insurance professionals, brokers, and underwriters.

R&I: What’s the biggest challenge you’ve faced in your career?

I remember it like it was yesterday. A responsibility that I had a prior position was assuring that physicians were properly reported to a state entity for insurance purposes. Well, one of those reports fell through the cracks and because of that, the physician’s medical license was in jeopardy. The physician received notice of such and was very angry. I ultimately reconciled the issue. I had a part in the process, an essential part. I jeopardized the livelihood of a physician, and not on my watch would that happen again.

R&I: Who has been your mentor(s) and why?

My father. My father taught me about the value of hard work and commitment. He taught me to find what you love doing and do it better than anyone else. Many years ago, I found what I love doing, and everyday I wake up with the goal of doing it better than the day before.

R&I: What is the risk management community doing right?

There are many things that are being done right. Two that stand out for me are:

- Communicating with each other and sharing ideas. Risk Managers are not about keeping secrets and taking all the credit. If we do our jobs well, it is better for all of us, our institutions, and our industry.

- Socializing why risk management is important to success and why risk managers deserve a “seat at the table”.

R&I: What could the risk management community be doing a better job of?

Thinking outside the box through innovation and creativity. Don’t be afraid to challenge the status quo.

R&I: How would you say technology has impacted the risk management profession?

For me, risk management remains about “visibility”. Whether that is a college campus, a health care facility, a manufacturing warehouse, etc.

The effects of technology on risk management, in my opinion, have not fully played out. It is a roadmap that is being assembled with blocks of continuous improvement that lead to “work smarter and more efficient” culture. Technology will assist with advanced planning and preparation, so it isn’t always putting out fires, but rather preventing the fires in the first place.

R&I: What’s your favorite book or movie?

My favorite movie is “One Flew Over the Cuckoo’s Nest.”

R&I: What is the riskiest activity you’ve ever engaged in?

I swam with the great white sharks off the coast of South Africa.