Sponsored: Liberty Mutual Insurance

The Sharing Economy Is Built on Trust — And Managing These 3 Risks Can Help Sustain It

How often do you order an Uber instead of taking a taxi? When you travel, are you as likely to book a rental as a hotel? Even if you’re not a regular consumer of sharing-economy services, it’s hard to remember a time when they weren’t at least up for consideration.

On-demand sharing platforms are woven into our everyday lives and continue to disrupt traditional business models. In fact, the number of users is expected to hit 86.5 million by 2021, and global sharing economy revenues are projected to reach $335 billion by 2025.

These platforms have become so successful in part because of shifting societal attitudes that place less emphasis on ownership and because of advances in technology that enable on-demand service.

But their continued success centers on something more abstract – trust and understanding across the entire ecosystem. For example, ride-share passengers trust that their drivers are vetted by the transportation network company (TNC). Drivers and passengers trust that the TNC has insurance protections in place if a ride goes awry. And this trust ultimately comes back to the strength of the relationship between the TNC and its insurance company.

“Insurers enable trust in this equation by backing it up with adequate protection, and foster sustainability and scale by partnering to build a culture of risk management” said David Blessing, Sharing Economy & New Mobility Senior Vice President and Chief Underwriting Officer, Liberty Mutual.

Here are three risks that sharing economy stakeholders should appropriately manage:

1. New Forms of Vehicle Usage Can Create a Lack of Coverage Clarity

David Blessing, Sharing Economy & New Mobility Senior Vice President and Chief Underwriting Officer, Liberty Mutual

The lines between consumer and commercial insurance get blurry when individuals put their personal assets and skills to work in the sharing economy. For example, ride-sharing hinges on drivers’ willingness to use their personal vehicles to “sell” rides to passengers, at which point the vehicles’ purpose becomes commercial. Where that shift occurs matters a great deal from a liability and insurance perspective. Take a ride-sharing driver who is logged into the platform, but not yet engaged in a ride request when they get into an accident. Is the accident covered by the driver’s personal insurance, the platform’s commercial insurance, or both? The answer may determine who is responsible for covering the cost of any damages or injuries resulting from the accident.

“Many personal insurance auto policies will exclude commercial use of vehicles. Some of them exclude ridesharing, delivery, or car-sharing explicitly,” Blessing said. “Others will allow an individual to purchase a policy or endorsement that will cover the driver for certain periods of the ride share process.”

Sharing platforms tend to publish their terms of service along with what limits and certificates of insurance they provide, but many users may not read or fully digest them. “Part of the advantage of these services is their speed and convenience, so we’re all inclined to click ‘Agree’ to the terms and conditions and move on. But that’s where the trust can create unintended vulnerability.”

It’s not only important for the driver, or renter, to understand what their personal policy covers, but also for the platforms to be clear about the insurance protection available to both their vehicle suppliers and the ultimate users of the service. There should also be clarity around any specific circumstances in which coverage may be void. How does the company define its own responsibilities versus those of contractors and customers?

2. Evolving Regulations Answer Some Questions and Raise Others

Legislators in most states have helped to clarify TNCs’ obligations by setting minimum levels of coverage. Many states require TNCs to ensure that at least $1 million in limits is available to insure their drivers for auto liability while they are actively engaged in a ride.

Car-sharing laws, on the other hand, are less consistent, and many states have not yet adopted a common statute. The ever-evolving nature of the sharing industry raises questions about how current laws apply to different types of platforms.

For example, a 2005 federal law called the Graves Amendment addresses vicarious liability for leasing and rental car companies, asserting that owners engaged in leasing and rental are not automatically liable for the negligence of the drivers of their vehicles. But what if individuals rent out their vehicles via a sharing platform? When the same car is used for both personal and commercial purposes, do the same rules and underlying assumptions apply?

“It’s important to understand the laws where you operate and any precedent set by the courts – and have insurance limits in place that are commensurate with any additional risk you take on by facilitating business transactions between individuals,” Blessing said. “A good insurance partner can help you navigate and adapt to the changing regulatory landscape.”

3. Insurance Expertise Is Critical to Sustainable Growth

For peer-to-peer platforms that don’t own assets, insurance may constitute one of their biggest business expenses.

“Beyond the cost of supply – for example, rideshare drivers using their own vehicles or peer-to-peer car sharing hosts putting their own vehicles up for rent – insurance really becomes a significant portion of the platform’s P&L,” Blessing said.

Many companies in the sharing economy are not yet profitable and are continuing to grow, but sustainable growth depends on balancing an expanding customer base with the cost of insuring the accompanying exposure.

“Getting to that point where the platform can be viable over the long term requires an understanding of how to manage their insurance expense and having a carrier partner who can help them do that is important,” Blessing said.

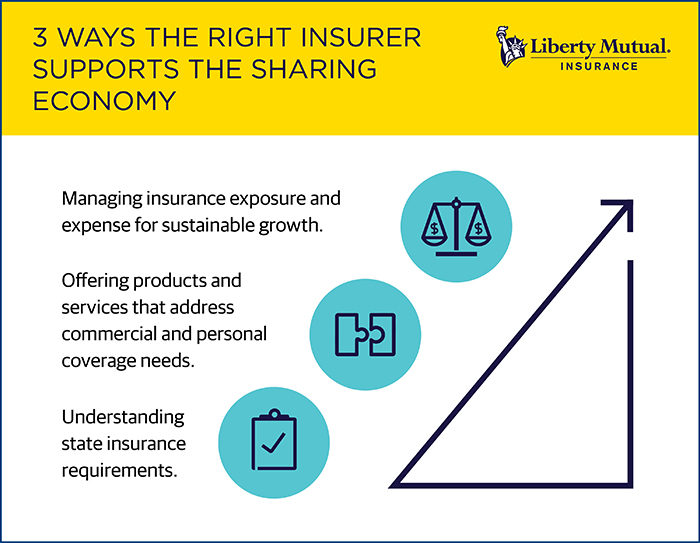

An Experienced Insurer Can Support Profitable Growth

In order for the sharing economy to keep flourishing, maintaining trust between all parties is critical. Insurers with experience in this emerging market can help sharing economy and on-demand platforms keep their customers’ confidence.

Carriers should understand local regulatory requirements, the applicability and limits of relevant personal policies, and how best to address any remaining gaps and overlaps. But they also need to deliver the level of customer service that participants in the sharing economy have come to expect.

“These are technology companies at their core, and their business revolves around removing obstacles to convenience. When they have insurance claims, they expect the same type of smooth experience from their carriers,” Blessing said.

Liberty Mutual Insurance’s sharing economy and new mobility practice bridges together commercial and personal insurance resources. The group shares data as well as internal claims and underwriting expertise. But it also brings together the different perspectives involved in managing personal and commercial claims.

“We understand the personal aspects of a loss—someone’s livelihood is involved. We also understand how important it is to provide a simple and seamless experience throughout the claims process,” Blessing said. “In addition, we combine that with the experience to manage complex claims litigation with million-dollar limits at stake.”

The company has a claims practice dedicated to the sharing economy and new mobility space, and it brings together expertise in both personal and commercial claims. Adjusters understand the insurance requirements in different states, the nuances in policy language, and the way that commercial policies fit with personal policies. The team also works hand-in-glove with the underwriting group to ensure there is consensus on policy intent. This collaboration also aids the building of new solutions that fill in the gray areas and gaps created by this commercial/personal hybrid industry.

“We’re solving for the whole ecosystem,” Blessing said. “It’s rare for a carrier to have the same focus on both personal and commercial lines. At Liberty Mutual, we’re uniquely positioned to stay at the forefront of this emerging industry and bring the solutions companies need to be successful.”

To learn more about Liberty Mutual’s sharing economy practice, visit https://business.libertymutualgroup.com/business-insurance/Pages/Industries/sharing-economy.aspx

![]()

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Liberty Mutual Insurance. The editorial staff of Risk & Insurance had no role in its preparation.