Sponsored: Helmsman Management Services

The Quality Assurance Journey

Not too long ago, if you were planning a trip, you would buy a map or an atlas and draw out the route you would take. If you continued to drive this route repeatedly, you might discover better ways to avoid a heavily congested area or take advantage of a new highway.

Similarly, a third party administrator (TPA) draws on years of experience to develop best practices for claims handling, discovering better routes and avoiding areas of delay. Payers trust their TPA to formalize these best practices, and to develop a Quality Assurance (QA) program that helps ensure claims are effectively managed. Like a roadmap, a QA program tracks the journey to the desired destination.

Mark Siciliano defines a quality assurance program.

With today’s technology, a cumbersome map is replaced with a GPS; just follow the step-by-step instructions. Sometimes the technology works flawlessly, and other times, it doesn’t deliver the best route.

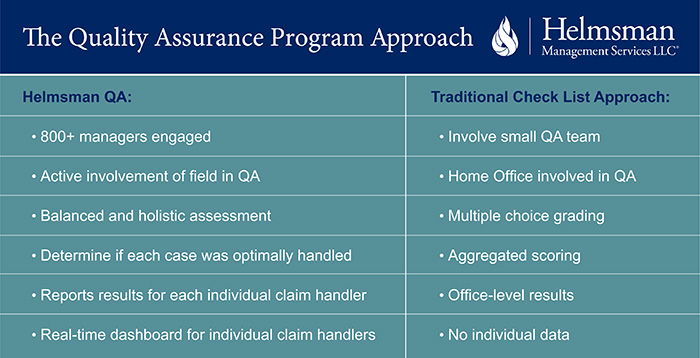

Likewise, many QA programs have developed a checklist mentality, listing the steps to take. Such QA programs typically involve a small team reviewing a limited number of claims to ensure that key standards are consistently applied. While important, this doesn’t necessarily guarantee claims are optimally handled, or uncover ways to improve claim workflows and performance.

Mark Siciliano explains how Helmsman’s QA approach differs from the industry’s standard “checklist” mentality.

A New Process

Helmsman Management Services LLC, a third-party claims administrator and a member of Liberty Mutual Insurance, began to re-examine its QA program with the help of its clients several years ago. In doing so, they developed a new methodology that is a welcome departure from robotic checklist behavior.

“Our QA program dives deeper to find actionable ways we can improve claims outcomes, the performance of claims professionals, and the entire claims management process,” noted Mark Siciliano, vice president and managing director of Helmsman Management Services. “We conduct more in-depth reviews on a higher volume of claims – more than 80,000 each year – at key points in the lifecycle. We involve over 800 field claims professionals and engage individual claims handlers and their managers through an online dashboard that reports performance and highlights opportunities to improve performance through additional training and coaching.”

Mark Siciliano discusses the Helmsman approach to quality assurance.

The new approach to QA was successful, enabling Helmsman to improve the overall quality of its clients’ claims by eight points in 2014. In fact, 92.7 percent of the claims Helmsman managed met or exceeded the TPA’s service standards in the fourth quarter of 2014, up from 84.5 percent in the first quarter of that year.

“Re-engineering our QA program and moving it beyond the standard industry checklist approach took our claims management from really good to great,” said Siciliano. “And, it is helping us drive further improvements.”

One of the reasons for that improvement is Helmsman’s QA process keeps adjustors focused on what works best.

“We looked at the common characteristics of really great outcomes and worked backwards,” said Siciliano. “We found that when our claims professionals start with an empathetic approach, they are better able to connect with the injured employee and deliver better outcomes, both for the claimant and her or his employer.”

Like blindly following GPS instructions, a claims professional can easily fall into a pattern of completing tasks and forget that an injured person may be experiencing a very challenging time in their life. Helmsman trains its claims professionals to treat the injured worker as if they are dealing with a family member. It’s not just asking questions and moving through a checklist; it’s answering an injured worker’s questions, providing important information, and doing so with a level of compassion.

Once a conversation has begun and the injured worker is more at ease, the claims professional can ask questions beyond what might be in the process to really understand the injury, the individual, and the claim, and to find that best route to the ultimate destination of return to work. This inquisitive nature of the claims professional also allows for early discovery of any specific challenges in the claim – such as co-morbid conditions or psycho-social issues – paving the way for intervention to get the claim back on track.

“We call it humanistic common sense,” said Siciliano. “We know we have to ask the tough questions and protect our clients’ financial interests, but when we do so through a positive and supportive lens, it permeates throughout the entire process, facilitating the journey.”

Building a relationship with medical providers using this same approach can also assist the claim.

“Re-engineering our QA program and moving it beyond the standard industry checklist approach took our claims management from really good to great. And, it is helping us drive further improvements.”

— Mark Siciliano, Vice President and Managing Director, Helmsman Management Services

In the case of light duty restrictions, instead of ‘check’ and move on after the initial call with the treating physician, Helmsman asks for more details on what the injured worker can do, and helps the physician understand the claimant’s duties and the temporary jobs available. Helmsman might ask the doctor to join them for a site visit to better understand the work environment.

As a result, light duty jobs become gainful and meaningful work for the injured worker because they are tailored to their capabilities.

“We’re not just asking for medical information and work capacity; we’re actually working with our clients and the physicians to create a return-to-work environment that works for the injured worker, employer, and physician,” said Siciliano.

Evolution of Change

A QA program that delivers a high level of value to the employer and improves outcomes for the injured worker is just the beginning. QA is more than a program—it’s a process. Quality assurance programs are critical for tracking and improving performance. It’s a continuous cycle of training, learning, client feedback, and process improvement.

A QA program that delivers a high level of value to the employer and improves outcomes for the injured worker is just the beginning. QA is more than a program—it’s a process. Quality assurance programs are critical for tracking and improving performance. It’s a continuous cycle of training, learning, client feedback, and process improvement.

“Our enhanced QA program helps us better service our clients, but we know it’s an ongoing process,” said Siciliano. “Our continuous improvement process is built around the investment that we put in our people, systems, and technology. It’s also response to the changing landscapes around us, and how well we adapt to them.”

Mark Siciliano describes characteristics of effective quality assurance programs.

As a result, quality assurance programs are not working towards just a destination; they’re working towards the evolution of change, and how risk managers, brokers, and TPAs respond to it. The QA process becomes that journey.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Helmsman Management Services. The editorial staff of Risk & Insurance had no role in its preparation.