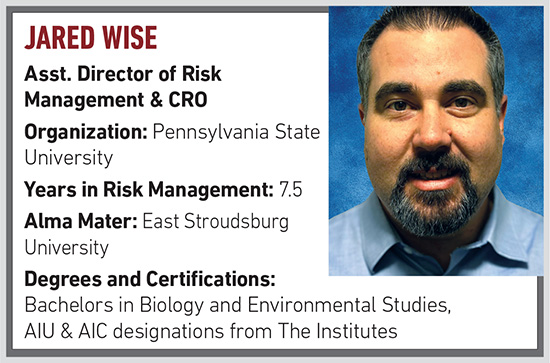

Penn State’s Jared Wise on Risk Management in Higher Education and Cyber’s Impact on the Industry

Risk & Insurance: What was your first job?

My trajectory toward Risk Management first began on the insurance carrier side, as a multi-line claims professional. This role gave me a great baseline understanding of policy forms, coverage, and litigation management, which are skills that have been valuable throughout my career.

R&I: How did you come to work in risk management?

I discovered Risk Management while working with varying clients as a commercial-lines underwriter. Clients and peers suggested the Risk Management career path because of my varied and broad roles in both commercial claims and underwriting, and overall analytical mindset. Penn State was my first foray into a true Risk Management function, in which I was able to progress through varying roles within the PSU Risk Management Office, culminating as Chief Risk Officer.

R&I: What is the risk management community doing right?

The risk management community, particularly in higher education is a cohesive and collaborative group. This environment allows for a plethora of learning opportunities, benchmarking, and shared ideas. As the world we live in evolves and challenges faced become more unpredictable, this collaboration is a wonderful resource.

R&I: What could the risk management community be doing a better job of?

Generally, I believe the risk management community can do a better job of marketing our value add to organizations and educating the next generation professionals about the risk management profession. Also, I believe the community can work toward being more agile and speedy in adopting and deploying new technology initiatives.

R&I: What’s been the biggest change in the risk management and insurance industry while you’ve been in it?

First, a seismic shift has occurred in the risk management and insurance workforce since the baby boomer retirement exodus and COVID-19 pandemic, which is certainly not a surprise or isolated to our industry. However, this has had significant impact and led to substantial loss of experience and knowledge, as well as some talent gap issues. Second, technology innovation surrounding data collection and utilization for better informed decision making has greatly evolved.

R&I: What emerging commercial risk most concerns you and why?

Cyber threats and data security continue to be an area most concerning to me. While this general risk threat is not emerging per se, the dynamic nature and speed of new initiatives used by bad actors continues to evolve. When adding artificial intelligence in the mix, the true capabilities of these bad actors and exposures are difficult to keep pace with from an IT security perspective. In essence, I view the exposure as an “arms race” of sorts, in which the IT Security function continues to play catch up with bad actors.

R&I: How much business do you do direct versus going through a broker?

Most of our insurance business is procured through brokers, however we do have one direct relationship with an insurer. We also leverage our Captive insurance company to achieve our overall risk financing and coverage objectives.

R&I: If you were to point to two people who served as mentors to you, who would they be and why?

Gary Langsdale (retired), former CRO of Penn State provided me with the opportunity to begin my Risk Management career in higher education. Gary had a tremendous amount of knowledge and experience, also being a great storyteller, who was able to easily and effectively make learning risk management fundamentals interesting and fun. Besides being a professional mentor, he was also the greatest natural leader I have come across, setting a wonderful example for me to mimic in the CRO role.

Dave Snowe, who also retired from PSU as Assistant Director of Risk Management was also a great mentor to me. He had a plethora of broad insurance knowledge and had a knack for simplifying complex situations. He had an open-door policy and always made time to address any questions or situations I was faced with. This accessibility was key in continuing my knowledge growth and was instrumental in my career success.

R&I: What about this work do you find most fulfilling or rewarding?

Assisting my University in advancing the education and research missions, by creating a positive and safe environment for our students to become the next generational leaders, progress technology and improve society is a driving factor for my self-fulfillment.

R&I: What have you accomplished that you are proudest of?

I have had much behind the scenes interaction with The Penn State IFC/Panhellenic Dance Marathon (THON), the largest student run philanthropic endeavor in the world, which raises money to beat childhood cancer. While many others do much more significant work than I, my involvement creating risk management and loss control framework to allow the students an opportunity to raise these dollars safely and effectively has been extremely rewarding. I implore anyone reading this to research THON and view the wonderful assistance this organization provides to children in need.

R&I: What do your friends and family think you do?

Friends believe I have a mundane role, mostly focused on buying insurance and reviewing contracts. While buying insurance and reviewing contracts is part of what I manage, it is far from mundane and is an extremely vast, interesting, and challenging environment. My family believes my role is to say “no”. Meanwhile I am actually looking to get to “yes” in as many situations as possible. &