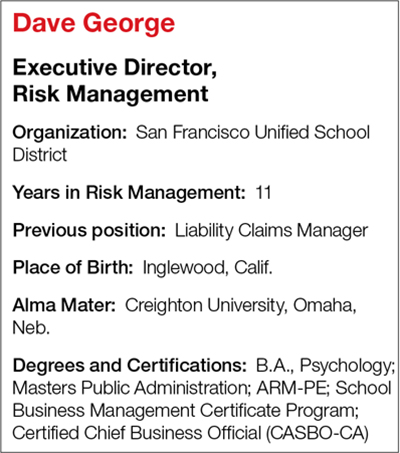

Risk Management

The Profession

R&I: What was your first job?

At my first ever full time job, I was a counselor in a group home for emotionally disturbed adolescents. I was 22. It was part of a volunteer program in Phoenix.

R&I: How did you come to work in risk management?

R&I: How did you come to work in risk management?

I got a claims job at a TPA back in Orange County, Calif., where I grew up. I had a degree in psychology and the claims business has always been open to liberal arts majors.

R&I: What is the risk management community doing right?

I think we are doing well in strategic and enterprise risk management areas in terms of spreading the word about these disciplines within our organizations.

R&I: What could the risk management community be doing a better job of?

I think we could still improve on the above, particularly in terms of communication. Getting the buy-in from management remains a challenge.

R&I: What was the best location and year for the RIMS conference and why?

For me, Vancouver was the best venue. I attended RIMS’ annual conference there roughly four years ago and to me, it seemed to have a more international audience.

R&I: What’s been the biggest change in the risk management and insurance industry since you’ve been in it?

I’d come back to the focus on enterprise risk management. I get to spend more time in a broader context instead of just being the “insurance guy.” For example, we have some 300 community-based organizations — nonprofits doing mentoring, tutoring, reading, etc. — that want to come and work in our district comprised of 140 schools. [We] work together to bring quality control and internal structure to those nonprofit programs to help us bring more effective programming to our students.

R&I: What emerging commercial risk most concerns you?

I would say cyber security. For me it’s the risk of exposing student data and being sure students are using technology in a safe manner because technology is so integral to the curriculum today.

R&I: What insurance carrier do you have the highest opinion of?

Not an insurance carrier, but an underwriter. His name is Rich Vincelette and he is consistently an excellent thought partner beyond any parameters of an insurance policy.

R&I: Is the contingent commission controversy overblown?

I would say no. Working in the public sector, transparency is paramount and any business model that has the potential to compromise that — or even give the appearance of a compromise — is going to be problematic and rightly so.

R&I: Are you optimistic about the U.S. economy or pessimistic, and why?

Optimistic. I happen to be in a part of the country that is booming right now, in terms of technology, construction and real estate.

R&I: Do you think the technology surge is sustainable this time around?

I would say more sustainable than it was last time because I believe there were lessons learned by those who invest in these companies.

R&I: Who is your mentor and why?

It’s my boss, Myong Leigh. He is the deputy superintendent for policy and operations for our district. He is very good at thinking big picture and helps give me the latitude to do the same and a broader perspective along with it. He has supported our efforts at enterprisewide risk management and gets the broader application of what we do.

R&I: What have you accomplished that you are proudest of?

We have reduced our risk management expenditure 25 percent and have held that steady over the last five years — partly by looking at operational efficiencies across our work, but primarily by more tightly managing our workers’ comp claims.

R&I: What’s the best restaurant you’ve ever eaten at?

Probably Spago in Los Angeles when I was about 25; it was trendy then and I was young and impressionable.

R&I: What is your favorite book or movie?

My favorite book is called “The Kindness of Strangers,” by Mike McIntyre. It renews your faith in people. It’s a true story about a guy who attempts to hitchhike across the country without bringing any money or credit cards, wanting to see if he can make it all the way “on the kindness of strangers.” The title probably gives away the ending, but well worth a read regardless.

R&I: What is your favorite drink?

A good craft brew IPA.

R&I: What is the most unusual/interesting place you have ever visited?

Vietnam. It was not what I expected. What surprised me was it did not feel very “Communist.” It felt very entrepreneurial. They had wholeheartedly embraced tourism, for instance.

R&I: What is the riskiest activity you ever engaged in?

Driving a Ford Pinto at over 100 mph on a Los Angeles freeway, as a teenager.

R&I: What about this work do you find the most fulfilling or rewarding?

The fact that I contribute to things that make a real difference, in this case educating kids.

R&I: What do your friends and family think you do?

I joke that they think I am just always saying “no” to people, in terms of things they can’t do.

R&I: Is it true?

Not at all. We help people find solutions to their problems.