Sponsored Content by Riskonnect

The Missing ERM Puzzle Piece

The risk management community has talked about the benefits of enterprise risk management (ERM) for years. But an honest assessment of most ERM efforts concludes that execution remains exceedingly difficult.

Finally, the latest breed of risk management information systems (RMIS) such as Willis DataWize, powered by Riskonnect, makes these much-talked-about benefits possible. DataWize empowers risk managers to support enterprise-wide needs, such as risk identification and assessment, crisis response and asset tracking in addition to traditional claim and policy information management.

The new capabilities increase a risk manager’s strategic value to their company and are even earning them board-level exposure through new reporting and dashboard capabilities. George Haitsch of Willis understands the importance of this, both as a former risk manager and through watching the efforts of past colleagues and current clients.

The new capabilities increase a risk manager’s strategic value to their company and are even earning them board-level exposure through new reporting and dashboard capabilities. George Haitsch of Willis understands the importance of this, both as a former risk manager and through watching the efforts of past colleagues and current clients.

“I’ve seen the new RMIS systems have a significant impact on their deliverables and frankly on their careers,” Haitsch said. “A risk manager can facilitate a high-level conversation with insightful data and analysis, instead of walking into a meeting with a four inch thick TPA report and a spreadsheet on the cover.”

“It takes work off your desk. It frees up your time to do more strategic things. It’s hard to convey just how much the system alleviates many pain-points experienced by risk managers.”

— George Haitsch, Executive Vice President, North American Practice Leader, Willis Global Solutions

Not all RMIS technologies are created equal, nor can they have the same impact upon a risk manager’s success. Haitsch, now serving as practice leader, Willis Global Solutions North America, illustrated the point with a recent client meeting.

“I went into a meeting with a client who was a longtime user of another RMIS system, and when the client started to see the capabilities of Willis DataWize, an ‘ice-cold courtesy’ meeting turned into an ‘I gotta get that’ meeting in 30 minutes,” he said.

What won that risk manager over? Ultimately, it was the unique capabilities inherent in Willis DataWize–capabilities that would enable this client to transcend traditional policy tracking.

Some of the most important benefits Haitsch sees Willis DataWize, powered by Riskonnect providing his clients include:

Data Collection and Tracking: Any system is only as good as the data that it collects. Willis DataWize enables risk managers to easily configure fields and create custom web-based forms that can be completed by users in the field. Automated tracking, reminders and data controls help to ensure accurate, clean data. Information for renewals can now be collected in weeks, not months, and injury reports can easily be submitted in real time.

“It takes work off your desk. It’s almost as if the system is functioning as a member of your team,” Haitsch said. “It frees up your time to do more strategic things. It’s hard to convey just how much the system alleviates many pain-points experienced by risk managers.”

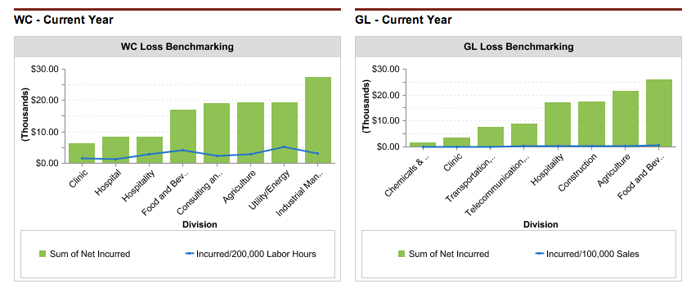

Underwriting Differentiation: One of the most important responsibilities of a Willis broker is to represent their clients to the underwriting community. “Willis is always working hard on our clients’ behalf to differentiate their risks to the underwriting community,” said Haitsch. Willis brokers leverage the quality data provided by DataWize to support those efforts.

“When a company can present detailed, timely information about their risk profile, it certainly helps build credibility and trust in the eyes of an underwriter,” Haitsch added.

Global Integration: DataWize unifies global organizations with one fully integrated system. Most RMIS tools cannot be integrated on a global risk platform. Previously, Fortune 50 users had to buy separate systems from different providers in Europe and patch them together. A risk manager must have a RMIS solution that matches their global footprint.

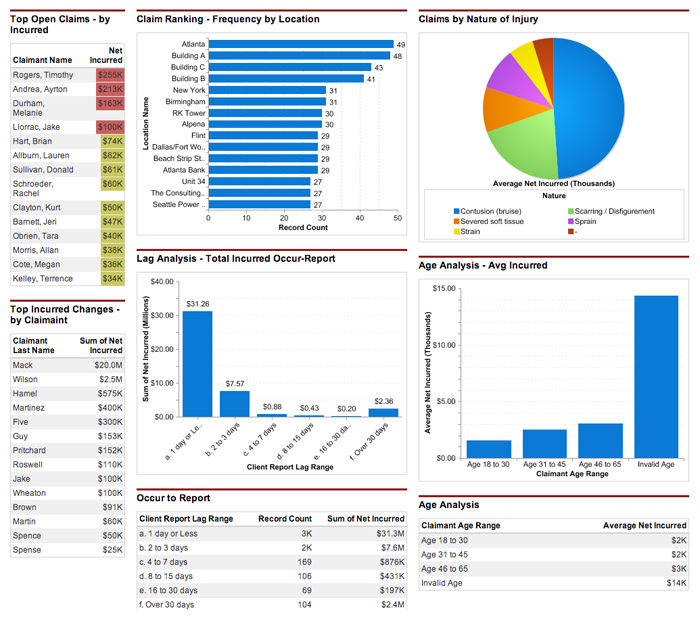

Board Level Reporting: Risk managers are utilizing DataWize’s easily configured dashboards and reports to produce highly valued information for executive management and directors.

“Board reporting components are simply spectacular!” asserted Haitsch. “The system is truly transformative to a risk manager because it enables them to provide the information that senior executives and directors crave. I’ve seen multiple clients become valued facilitators of board level strategic discussions.”

The Willis Approach

Willis’ primary goal is to empower its clients to be successful when it comes to risk, and it accomplishes this goal by remaining focused and partnering with leading companies to provide best-in-class complimentary service to their clients. The Riskonnect partnership, launched in 2010, demonstrates how providing enterprise-class risk technology helps Willis stand out from their competition.

“Board reporting components are simply spectacular!” exclaimed Haitsch. “The system is truly transformative to a risk manager because it enables them to provide the information that senior executives and directors crave. I’ve seen multiple clients become valued facilitators of board level strategic discussions.”

Ultimately, Haitsch appreciates Riskonnect’s positive response when his clients have asked for custom solutions and RMIS innovations. He said,

“They always want to get to YES.”

Haitsch knows that risk managers appreciate the value of people saying “YES,” from underwriters and TPAs to property managers – all the way up to executive leadership.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Riskonnect. The editorial staff of Risk & Insurance had no role in its preparation.