Sponsored: Liberty Mutual Insurance

Supply Chain’s New Risk Profile

Supply chain risk is not a new concept to underwriters or risk managers. But it’s no exaggeration to say that the degree to which supply chain problems are now impairing the operations of businesses across many sectors is unprecedented in our lifetimes.

“I read the other day that something like 95% of Fortune 1,000 companies have reported significant disruption from supply chain right now. That’s about as systemic as you can get,” said Seth Hedrington, Senior Vice President, Major Accounts – Risk Management at Liberty Mutual.

Supply chain issues affect not only the ability of businesses to receive vital materials, they also impede their ability to fulfill their contracts and deliver goods to their end customers.

“The broader risk management concerns involve supply chain uncertainty, quality control, and contract liability. Talent risk is also a factor, given to what degree labor shortages are impacting manufacturing, construction, hospitality, retail and a host of other industries,” said Heath Kidd, Vice President, Industry Solutions for Liberty Mutual. “It’s really hard to overstate just how pervasive these issues are across industries and the risk landscape.”

Different causes, similar solutions

Seth Hedrington, Senior Vice President, Major Accounts – Risk Management at Liberty Mutual

The reasons why we’re seeing supply chain disruptions to this degree are many and varied and they overlap in some cases. But chief among them are an ongoing global pandemic, war in Ukraine, and the aforementioned labor shortages and inflationary pressures that are driving up the costs of materials for numerous industries.

Regardless of the causes of supply chain disruptions, yesterday, today, or in the future, the approach to managing these risks holds true over time and across sectors.

“I think a lot of companies have been taken off guard with the severity of the supply chain issues they are facing and don’t want to get burned again. Managing supply chain risk can and should be a proactive risk management decision. And it goes beyond insurance coverage. There are a lot of operational considerations that can help mitigate the risk significantly, and we’re seeing many of our customers taking those steps,” said Hedrington.

There will be those that take little action, and that is a legitimate choice, but they should understand that they’re essentially self-insuring against that risk. It comes down to a business decision.” he added.

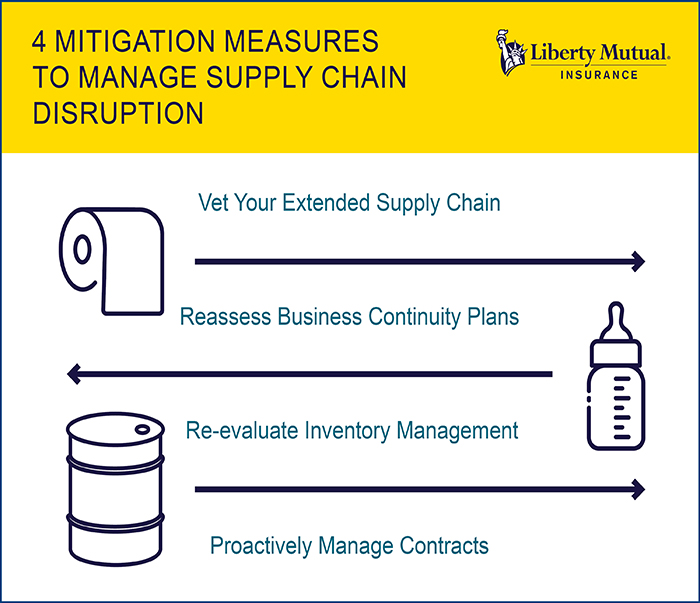

Four key mitigation measures to manage supply chain disruption

Heath Kidd, Vice President, Industry Solutions for Liberty Mutual

1) Vet your extended supply chain. “First and foremost, companies should be thinking about supply chain vetting,” Hedrington explained. “And in many cases, that can be a pretty long chain; longer or more complex than you might expect.” He outlined that most companies have traditionally studied their key suppliers to gauge whether they can deliver vital goods and services when and where they say they can.

But he said it’s not as common for companies to vet their secondary and tertiary suppliers.

“I think one of the key mitigation techniques is expanding your view of what the supply chain really is beyond those primary suppliers,” Hedrington said.

That includes vetting suppliers, especially when onboarding new vendors to meet material shortfalls from existing vendors or seeking to diversify suppliers. Businesses might also want to consider ensuring that supply chain partners include the business as an additional insured on general liability policies, Kidd said.

Communication with the insurers and brokers of suppliers at every tier should be open and as frequent as possible to make sure that all stakeholders are responding to this increased supply chain risk and managing their operations accordingly, he added.

2) Reassess your business continuity plan. A second key factor, Hedrington said, is maintaining an up-to-date and quality control-focused business continuity plan.

“Does your business continuity plan include where you will source key materials if a primary supplier dries up?” is a question Hedrington posed.

He also explained that many companies may be considering material substitutions to adapt to shortages, but that this can carry unaccounted for risks.

Many of us remember the notable substitution of Chinese drywall after the American made drywall supply ran out due to the rebuilding demand after several severe hurricanes hit the Southeast. The Chinese drywall that was used to build thousands of homes there between 2002 and 2007 was found to be defective, causing health issues and property damage.

“Make sure you proactively have and maintain relationships so you can go to a secondary, even a third source as needed,” Hedrington said.

Kidd noted that product liability and product defect claims can have serious consequences and long tails.

Beyond taking all the preventive measures to ensure the quality of materials, that also means developing plans to respond to situations where a substituted material isn’t up to snuff and anticipating how to manage the fallout.

Analyzing to what degree labor shortages could impact quality is also something to keep in mind given the challenges many businesses are facing in finding skilled workers and keeping their operations fully staffed.

3) Re-evaluate inventory management. A third mitigation technique, and one that represents a significant change in how companies operate their businesses, is inventory management.

There was a time in the not-too-distant past that just-in-time delivery was all the rage in manufacturing, retail, and other sectors. The logic was that companies could save money by ordering and receiving the products they needed within a predictable target date, forestalling the need to tie up capital in extensive inventory levels. But it has left a lot of businesses empty handed amidst the recent challenges to the supply chain.

“Healthcare and the crisis of PPE, even ventilators, in the early days of the pandemic are examples of this vulnerability,” said Kidd. “Many, probably most, hospitals didn’t have enough protective equipment available during the first surges of the virus. Because of the lead times and supply chain issues, you just couldn’t get them. A lot of them are rethinking that.”

“Now the same thing is happening across all sorts of industries, and that applies to raw materials, as well as parts and equipment. Many businesses are trying to offset this risk by keeping more items on hand. But this introduces some other risks that insureds may not be thinking about.”

For example, as inventory levels rise many businesses are faced with warehousing constraints. It’s important to consider other related issues, like scaling property coverages to match what’s on-hand, as well as maintaining up-to-date appraisals to ensure coverage is adequate.

4) Proactively manage contracts. A fourth technique is contract vigilance and flexibility. Widespread supply chain disruption means that many companies are at risk of not being able to deliver goods and services at the price level and delivery date they promised.

“A lot of companies right now are scrambling because they’re potentially facing breach of contract issues,” Hedrington said.

Their contracts weren’t flexible enough so that if they came up against adverse conditions, they’d have some wiggle room.

“We’re having them proactively look at that as another non-insurance technique as well,” Hedrington said.

This should include a sober assessment of a company’s ability to complete projects on time, within contract specifications, and on budget. Breach of contract or financial performance issues can result in professional liability claims. It’s important to continually assess the adequacy of coverage and adapt to reflect the changing environment, even with the knowledge that these types of claims tend to have long tails, so the true impact may not be seen for some time to come.

A productive partnership

Whether it be a need for supply chain vetting, strengthening a business continuity plan, identifying alternate suppliers, or analyzing the suitability of customer contracts, Liberty Mutual is working with customers and brokers to help see them through this period of disruption, they said.

“I think it’s at times like this that you come to really appreciate those collaborative partnerships. Maybe the whole lesson of all this is just how interconnected business is today. No one is going to be able to get through this alone. That applies to insurance and is why it’s so important to have a team that can bring the best insights to those planning conversations and offer the risk control guidance that can help minimize some of these impacts in the future,” said Kidd.

“Where we differentiate ourselves, beyond the products and services we offer, is that we meet clients where they are from a risk perspective and truly help them fill in the gaps,” Hedrington said. “We are partners in all areas of risk management, not just the product [insurance coverage] side of things,” he added.

“We incorporate feedback based on what we’re seeing, what the claims data is telling us, and what our customers are experiencing in the market and then respond to that with industry insights, trends — observations that then allow us to inform a better process going forward,” Kidd said.

“I think that’s what sets Liberty apart. And I think that allows us to be in tune with what our customers need and be responsive to the demands in the marketplace.”

To learn more, please visit https://www.business.libertymutual.com/.

![]()

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Liberty Mutual Insurance. The editorial staff of Risk & Insurance had no role in its preparation.