Sponsored Content by Conduent

Property and Casualty Carriers and Claims Administrators Are Struggling With the Talent Gap. Digitizing Medical Billing and Payment Systems Can Help.

The insurance industry is struggling with a myriad of talent issues, putting additional strain on adjusters and other claims professionals — and they’re not all caused by the Great Resignation. A wave of baby boomers left the industry when they retired, leaving a sizeable gap in experience and domain knowledge. Many property and casualty insurers and claims administrators (collectively, payers) have been finding it difficult to attract and retain younger generations.

“Even before the Great Resignation, the property and casualty industry was experiencing challenges recruiting younger generations,” said Gail Koza, director of product management, business intelligence solutions for Conduent Casualty Claims Solutions LLC.

The Great Resignation may not have caused the insurance industry’s talent problems, but it certainly compounded them. Between April 2020 and April 2022, sixty-five percent of people who resigned from jobs in the insurance and finance sector left for jobs in other industries or exited the workforce all together, a recent McKinsey study found.

Given the talent shortage, many claims departments are turning to technology to help manage their increased workloads with process automation, online self-service, and tools that provide next-step support to enable faster and more effective decisions.

Where Do Claims Organizations Need Support?

Gail Koza, Director of Product Management, Business Intelligence Solutions for Conduent Casualty Claims Solutions LLC

In the wake of the talent gap, claims departments are scrutinizing adjuster and customer service workloads and processes. Adjusters are juggling a variety of tasks for every claim they manage, and in some organizations, they are also responsible for responding to provider inquiries about payment of medical bills. In other organizations provider customer support is handled by a separate team which can also face resource constraints.

“Adjusters are managing somewhere between 100 and 200 claims at any given time,” Koza said. “That’s a high volume of claims that they need to stay on top of and they are constantly being prompted to perform various tasks, many of which are time sensitive. It can be challenging to keep up with everything while ensuring high quality.”

One area where claims staff could use support is in the medical bill management process and the customer support services associated with it. Entering medical bills into claims systems, determining compensability, calculating the correct amounts to pay, ensuring timely delivery of payments and explanations of review (EORs), and providing customer support to providers throughout the process can be time-consuming tasks.

Often, providers will send paper bills to payers by mail. These bills must be entered into the claims management system and reviewed by an adjuster and compared to regulatory rates and network contracts before payments can be issued. Payment is often delivered through the mail, adding more time to the process. “Paper-based processes are really slow,” Koza said. “It could take up to 25 days end-to-end for a paper-heavy medical billing process.” During this time, a provider may make multiple phone calls to payers to inquire about the status of their bills. While awaiting payment, providers also resubmit bills, causing adjusters to have to sort through duplicates to ensure no payment errors were made, adding to their workloads.

Technology Provides Support in the Wake of the Talent Gap

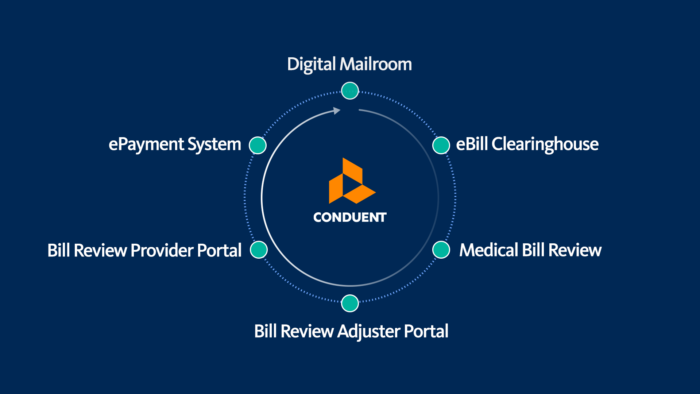

Several technology solutions have entered the market in recent years to help reduce the workload associated with the medical bill intake, adjudication, bill review, and payment processes for payers and speed up the end-to-end process.

Digital mailroom technology reduces the time and cost associated with transforming claims department mail into standardized digital files for use in downstream processes. Using a centralized high-capacity digital mailroom that automates document classification and data capture processes that integrate with claims systems electronically is an important first step in a faster medical bill management process.

“We receive the bills and other claims documents through the mail, fax, and other channels to be scanned. We use artificial intelligence (AI) and optical character recognition (OCR) technologies with business rules to automate document classification and data capture, creating standardized digital versions of the documents,” Koza said. “We then use automation to index the documents to the payer’s claims.”

E-billing clearinghouse solutions can be faster and less costly for providers and payers alike. E-billing portals allow providers to submit their bills electronically, avoiding delays associated with mail delivery and with the process to transform paper bills into a standardized digital format. An e-billing provider portal typically enables self-service to verify payer receipt of bills and deliver notice of acceptance or rejection of bills, reducing the need to call the payer for this information.

When it comes to medical bill review, most payers partner with a company like Conduent that provides software and services delivering highly automated, accurate comparisons of billed charges to regulatory fee schedules, provider network contracts, utilization review decisions, treatment guidelines, and use additional methods to identify the appropriate amount to pay. They generate an EOR that informs providers of the rationale for any reductions applied to the billed charges.

An integrated adjuster portal can be offered by bill review vendors like Conduent to augment claim systems with features that streamline the adjuster’s medical bill adjudication steps. An effective adjuster portal will automate select bills that require an adjuster decision. The portal presents the bills along with contextual information that supports fast, effective adjuster decisions ensuring that only compensable medical services are paid for, any incremental reductions are applied to bills efficiently, and medical reserves will cover the payments.

Like Conduent, some bill review vendors also offer an integrated self-service portal that providers use to check the status of their bills, view EORs, and retrieve payment details, eliminating the need to call payers for this information. In some portals providers can also look up the payer’s claim number for a new patient, preventing the need for another phone call.

“The provider can confirm receipt of the bill and see if it has been paid or denied; they can access the EOR to understand the reasons for reductions; and they can retrieve the claim numbers for their patients,” Koza said. These self-service capabilities help providers to be more efficient and avoid phone calls to payers and alleviate workloads. Koza estimates that approximately 68% of questions related to medical bill review and payments can be answered through a fully utilized bill review provider portal.

The process of paying providers can also be digitized through an e-payment solution, further reducing bill payment turnaround time and cost for payers. Using a digital payment solution avoids paper-based costs related to data entry, printing, and postage for the delivery of checks and EORs to providers. Payments are delivered to providers instantaneously, and faster receipt of payment reduces duplicate billings and customer service inquiries. Koza says that the average cost of a paper check transaction can be as much as 75% more than when a digital payment system is used. Digital payment solutions also include a self-service portal that providers can use to retrieve payment details and EORs.

Combining e-billing, bill review, and e-payment services can enable delivery of payment to providers in as little as five days from receipt. “Providers like it because they get paid faster and they have better visibility into bill status and payment information through online self-service. Payers benefit from saving time and money associated with bill intake, bill review, payment processing, and customer service calls. Faster turnaround of medical bill payments also reduces the risk of potential penalties due to late payments.”

These systems can go a long way in reducing costs and workloads for claims teams and freeing up adjusters so they can apply their expertise to deliver higher value.

Choosing a Technology Services Partner

Conduent provides industry-leading end-to-end support for medical cost management. The firm’s extensive experience with artificial intelligence, data science and automation, combined with its workers compensation and auto medical claims domain expertise helps it deliver solutions that increase efficiency, improve clinical outcomes, and cut costs for clients.

Payers can optimize efficiency when partnering with a company like Conduent who provides end-to-end medical bill management solutions from mailroom and e-billing to bill review and payment processing.

Conduent’s breadth of claims management and operational expertise allows it to empathize with its clients’ needs and create unique, tailored solutions.

The company’s newest solution, Shield Provider Portal, is a bill review provider portal that offers self-service access to the status, payment details, and EORs for bills as they progress through the adjudication, bill review, and payment processes.

Conduent partnered with Jopari Solutions, LLC, a leading e-billing clearinghouse and e-payment vendor, to deliver the Shield Provider Portal features to providers through the Jopari Remittance Gateway provider portal. This gives providers access to bill review information for Conduent’s clients within the same portal where providers submit e-bills to and manage digital payments from numerous healthcare and property and casualty payers, Having the ability to manage a larger percentage of their medical bills within one multi-functional, multi-payer, multi-line portal increases adoption of the self-service tools, reducing pressure on payer customer service staff and adjusters.

“We encourage adoption of the bill review self-service features by delivering them in a portal that providers already use for e-billing and e-payments for multiple business lines,” Koza said. Providers can have end-to-end visibility into their bills as they move through the adjudication, bill review, and payment processes, dramatically reducing the need to place phone calls to our clients.”

Conduent’s bill review, adjuster portal, and provider portal solutions can be paired with their integrated digital mailroom, e-billing and e-payment services to increase automation of the end-to-end medical bill management process. This reduces workloads for claims departments, condenses the time from billing to payment, and further reduces provider need for duplicate billings and status inquiries to payers.

“It is a powerful combination,” Koza said. “It is a much faster, more efficient process when a payer uses all three of these solutions together: e-billing, bill review, and e-payments. Through automated processes, shorter turnaround time from billing to payment, and provider self-service, payers can significantly reduce workloads for claims staff.”

To learn more, visit: https://www.conduent.com/.

The event is RIMS RISKWORLD 2023. Meet with us at our Booth #1340.

Schedule a time that works best for you!

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Conduent. The editorial staff of Risk & Insurance had no role in its preparation.