Sponsored Content by AmTrust Financial

COVID-19 Disrupted Modified Duty Options, but a Strong Return-to-Work Program Keeps Injured Workers Engaged

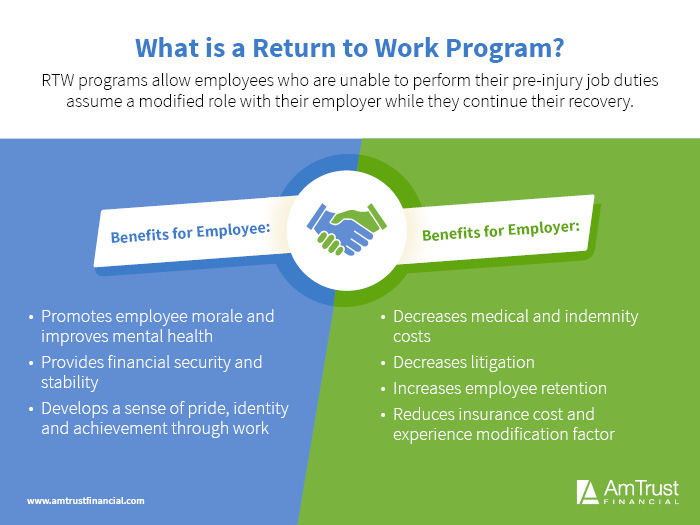

Offering modified duty to injured workers is a critical component of return-to-work programs. By providing purpose and structure, modified duty roles keep injured workers mentally engaged, productive and focused on the end goal of returning to full function. That has benefits for injured workers, workers’ comp payors and employers.

“The more an injured employee gets back into the workforce and a regular routine, we see improvements in their recovery. We see less identification with chronic pain, because they’re focused more on what they can do as opposed to what they can’t do. We see less attorney representation, because they don’t feel so isolated and stagnated. Overall, those pieces together really drive a positive claim outcome,” said Melissa Burke, Vice President and Head of Managed Care and Clinical for AmTrust.

Added Brent Bland, Senior Vice President and Head of Workers’ Compensation Claims for AmTrust, “It’s oftentimes in the injured worker’s best interest financially, as well, because it’s an opportunity for them to be earning full wages versus partial wages based upon how temporary total disability is calculated in their jurisdiction.”

Despite these benefits, however, identifying or creating modified duty positions can be challenging for employers that have not proactively altered job descriptions to accommodate for injury. COVID-19 introduced even more wrinkles by disrupting work environments altogether.

Here’s how the pandemic impacted modified duty opportunities and how employers can adapt to keep injured workers engaged.

How the Pandemic Disrupted the Modified Duty Process

Melissa Burke, Vice President and Head of Managed Care and Clinical, AmTrust

Creating modified duty roles begins with the job description. An accurate and up-to-date job description should delineate the essential functions of a position and the physical abilities required to fulfill them.

“Typically, one of our telephonic nurses will go over the job description with the employer and the medical provider, working to align the role to the functional capabilities of the injured employee,” Burke said.

That could involve identifying ways to change how the job is done, perhaps by providing equipment that allows the injured worker to modify their body position or reduce strain on injured body parts. Or it could mean looking for other duties outside of that role that the worker is able to perform.

Typical accommodations might include decreasing the load that the worker is required to lift, reducing hours spent performing manual tasks, providing assistive equipment or reassigning a worker to a less physically demanding role or administrative function until their physical restrictions are lifted.

The pandemic severely limited modified duty opportunities in a few ways.

For one, state-mandated shutdowns forced most non-essential employees to halt work altogether. Some typical alternative roles — such as a store greeter or cashier — were eliminated given capacity restrictions and the need to minimize in-person interactions.

“The pandemic disrupted all of us at first. Everyone packed up their stuff and went home and had to regroup. But small businesses were hit particularly hard by pandemic restrictions. Brick-and-mortar establishments like restaurants, flower shops, bookstores — those small places of employment were severely limited in how they could accommodate injured workers. Without the ability to do their regular job differently, we had to be creative in finding new tasks for them to do,” Burke said.

Adapting to Keep Injured Workers Engaged

Brent Bland, Senior Vice President and Head of Workers’ Compensation Claims, AmTrust

Technology played a key role in keeping workers connected and helped to preserve some job functions.

“We were able to figure out how to connect and keep working utilizing technology and virtual communication platforms,” Burke said. “To some extent, that’s here to stay. It may not be our only option moving forward, but it will be a supplemental option, and that will enable us to be more creative with modified duty roles when on-site work isn’t safe or feasible.”

But what about injured workers whose skills and essential functions can’t be adapted to virtual, remote work? Here, employers, workers’ comp carriers and risk management partners had to think outside the box.

While the pandemic curtailed demand for some goods and services, it drastically increased the need for others. Non-profits providing supplemental food packages, for example, became critical lifelines for families struggling financially. And they needed more staffing than ever.

“Charitable organization need grew quite a bit throughout the pandemic, and that presented opportunities that we’ve been able to utilize in situations where employers were simply not able to modify a position,” Burke said.

“We’ve partnered with several non-for-profit return-to-work programs that provided us options outside of the current employers’ physical place of business. We were able to bring injured employees to one of those non-for-profit locations where they could manage the check-in counter or help to organize, bag and distribute goods, all within their medical restrictions. It’s an unconventional modified duty option, but it kept employees in a routine and gave them a meaningful purpose.”

Adaptability and flexibility were critical components to keep injured workers engaged in the midst of unforeseen challenges. But a little preparation goes a long way, too. Workers’ comp carriers who also serve as partners in risk management can help employers get proactive when it comes to modified duty.

Get Proactive About Return-to-Work

A return-to-work program outlines a process and details acceptable modifications for injured workers to come back to the workplace. Even if the workplace is temporarily shut down, that process at least gives employers a starting point. When appropriate modifications are planned, adapting roles and functions to off-site positions becomes easier.

“As soon as a customer onboards with AmTrust, we discuss very early on the importance of getting a return-to-work program in place. It’s always better to know how you can modify your positions before you actually have an injury,” Bland said.

Loss Control and Client Account Management teams understand each industry and the specific demands of each workplace. This helps employers build realistic and applicable return-to-work plans. Telephonic nurses also act as liaisons between injured employees, employers and medical providers.

“Over this past year and a half, we’ve brought on nurses who work directly with injured workers, employers and providers to bridge that gap of understanding what an injured employee can do and how to allow them to get a release to work,” Bland said.

By connecting the medical provider’s insight with the duties and requirements outlined in the job description, nurses clarify necessary accommodations and realistic expectations for injured workers on modified duty.

“We spend a lot of time reviewing job descriptions with medical providers and advocating for the injured employee. If they can still perform some of their job duties with no negative impact on their injury, we make that the focus. A tremendous amount of education takes place with all three parties to establish that positive mentality — that focus on what a person can do rather than what they can’t do,” Burke said.

“That’s embedded in our approach from day one. As far as best practices go, nothing is more important than making sure the focus is on function. If we start there, we can always find ways to keep injured workers involved and engaged in active recovery.”

To learn more, visit https://amtrustfinancial.com/insurance-products/workers-compensation.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with AmTrust Financial. The editorial staff of Risk & Insurance had no role in its preparation.