Sponsored Content by BHSI

As Leisure Travel Returns, There’s a New Focus on Travel Insurance and the Vital Protections It Can Provide

Leisure travel is rebounding, with The U.S. Travel Association forecasting a 45% jump in international leisure travel spending in 2021, and a whopping 115.4% jump in international travel spending anticipated for 2022, both versus 2020 levels.

Happy but hesitant returning travelers are looking at travel insurance protection in new ways.

Dean Sivley, Berkshire Hathaway Travel Protection (BHTP), sat down to discuss these trends in travel and how travel insurance is adapting to protect customers in a changed world.

Editor: Has the pandemic changed perceptions of travel insurance?

Dean Sivley, Head of Berkshire Hathaway Travel Protection

Dean Sivley: People are finally out there traveling, and they want it to go smoothly, but they are nervous. Just watching the news, travelers see a lot more volatility out there — from unruly passenger behavior disrupting flights; ongoing changes in travel restrictions, particularly internationally; and uncertainty around new COVID-19 variants.

Equally, travel supplier challenges — including crew shortages for airlines causing last second delays and cancellations, rental car shortages and hotel staffing challenges — are all contributing to higher levels of disruption and the need for assistance and travel insurance.

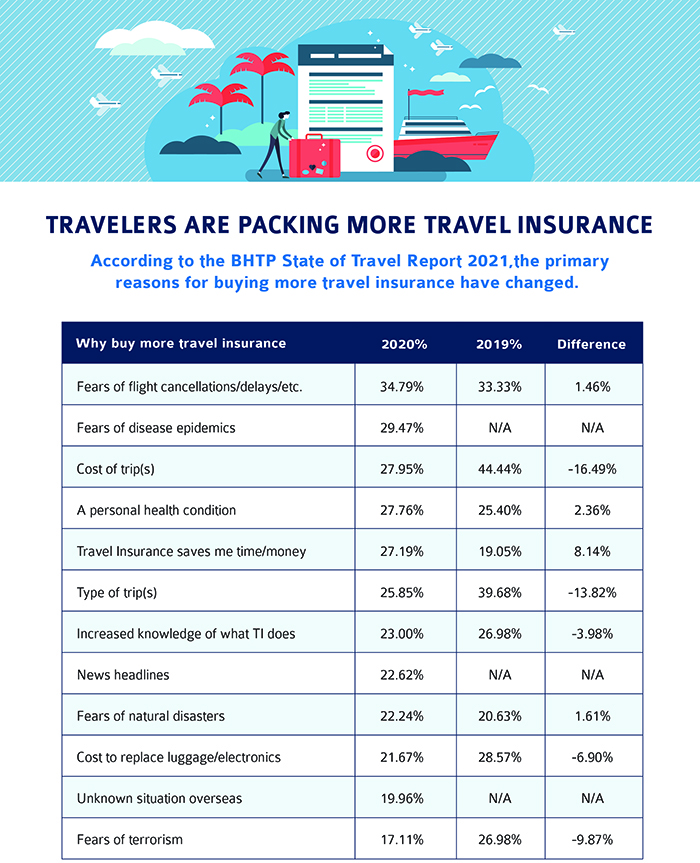

In 2019, the main reason, by far, for purchasing travel insurance was the cost of a trip. According to our 2021 State of Travel Insurance Report, fears of cancellations and delays now top the list of reasons travelers purchase coverage, followed, unsurprisingly, by fears of disease epidemics. In addition, a surprising 22.6% of travelers said news headlines were a chief driver for buying more travel insurance.

Already, our travel insurance bookings in many product lines are surpassing 2019 levels pre-COVID; our event ticket and vacation rental segments are showing record growth. Travelers are also looking for more than financial protection from travel insurance — they want help to ensure their long-awaited trip can go smoothly despite unexpected developments such as lost luggage or delays by short-staffed airlines.

At BHTP, we were issuing fast electronic claim payments for travelers facing events like these before the pandemic, and that convenience and simplicity is even more appreciated now with all the new complexities of travel. We have also worked to dramatically simplify and tailor the claim process, including providing online claim forms that guide claimants through the process.

Editor: How is ongoing remote work impacting travel?

DS: Remote work has enabled individuals and families to travel and stay longer at destinations they can enjoy while still working. Why not work when visiting family for a few weeks? While this trend may not continue for many as they head back into the office, we are noticing travelers are eager to ensure they and their families are protected during their trip and have the support of solid services if something goes wrong.

It may make sense in this new era for employers to consider what their accident & health benefit programs provide for employee travelers — and share information on leisure travel solutions that could fill gaps for remote workers.

Editor: How has travel insurance been adapting and evolving from the pandemic?

DS: First, we need to always be cognizant of the changing travel landscape and be there to support our insureds with information they need and assistance they require. While some travel insurance policies have specifically excluded COVID-19 as a covered reason for cancelling travel, our policies can provide trip cancellation coverage for those diagnosed with COVID-19.

We watch the evolving travel restrictions and regulations in various countries closely and adapt our travel insurance programs to best equip customers for this new world. For instance, we increased our coverage limits expressly to ensure travelers have additional coverage for trip delay if they are traveling abroad and unexpectedly are required to quarantine or if they need to provide proof of out-of-country emergency medical expense insurance, which some countries, such as Costa Rica, have recently required.

Second, we know customers are happy but perhaps hesitant to resume travel — and we want to do all we can to make them feel comfortable and give them peace of mind. To that end, we are relaunching Cancel For Any Reason (CFAR) Travel Insurance — which gives insureds the freedom to cancel their trip for any reason and have 50% of their unreimbursed expenses covered.

Editor: How has this transition impacted travel agents?

DS: Their businesses slowed dramatically as travel ground to a halt at the height of the pandemic. We knew our travel agent errors & omissions insureds were going through a difficult time and issued refunds or credits for a portion of their policy premiums.

Now with leisure travel returning to prior levels, their role is more important than ever as travelers rely on them to help them navigate a changing and more complex travel environment. With entry requirements varying country to country, airlines facing worker shortages, and other challenges, the need for their service is paramount.

Editor: What advice do you have to consumers re-embarking on travel?

DS: Pack your patience! It’s a transition for everyone, and travel is different now. Airlines and hotels remain understaffed. As mentioned, airlines have cut back on flights to match crew availability, but they are trying to accelerate rehiring of staff.

In addition, airlines and hotels that had offered more flexible cancellation policies are beginning to reinstate stricter ones like they had prior to the pandemic.

And be prepared — with travel insurance that can ease and simplify your trip and provide peace of mind by protecting your investment and helping to ensure smoother travels. Work with a travel insurer that will help you avoid unwanted surprises and help navigate any that do occur.

The product descriptions provided here are only brief summaries and may be changed without notice. The full coverage terms and details, including limitations and exclusions, are contained in the insurance policy. CFAR can only be purchased at the time of base plan purchase and within 15 days of initial trip payment. 100% of trip cost must be insured to purchase CFAR coverage and trips must be cancelled with a minimum 48 hours notice. Coverage not available in all states. All products listed are underwritten by Berkshire Hathaway Specialty Insurance Company; NAIC #22276.

For more information, please visit: https://www.bhtp.com/.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Berkshire Hathaway Specialty Insurance. The editorial staff of Risk & Insurance had no role in its preparation.