Sponsored Content by AIG

3 Risks Holding Back Renewable Energy Growth — and How One Insurer Approaches the Challenge

The renewable energy sector looks poised to continue its years-long growth trajectory. Falling technology costs, availability of tax credits, rising consumer demand and an urgent need to mitigate greenhouse gas emissions to combat the effects of climate change have all driven interest and investment dollars to wind, solar and battery storage projects.

This growth has continued despite uncertainties introduced by the COVID-19 pandemic. A market outlook report by Deloitte states that as energy demands dropped in the spring amid state shutdowns, the share of energy produced from wind and solar plants actually increased by 2%.

“Renewable energy sources beat coal in the generation mix for 116 days” as of June, compared to just 39 days over the same period last year, according to the report. This demonstrates grid resiliency and reliability — two primary concerns with the scalability of renewable energy projects.

“There are 117 gigawatts of new capacity that will be brought online from wind and solar sources between 2021 and 2023. Additionally, we’re seeing a proliferation of battery storage projects — around 470 megawatts of new battery storage produced in Q3 2020 — to alleviate the risk of unreliable or inconsistent power supply,” said Ian Kirejczyk, Property Underwriter – Energy and Construction at AIG.

Despite these trends, and an ongoing desire from individuals and big corporations alike for cleaner, more sustainable energy, the renewables sector is facing challenges that could stymie its growth.

Here are three key risks the industry is grappling with and how the right insurer-partner can help renewable energy companies keep moving forward.

1) Increased natural hazard exposure in remote building sites

Ian Kirejczyk, Property Underwriter – Energy and Construction at AIG Contact: 770-671-2214 / [email protected]

The demand for more renewable energy has resulted in bigger projects, which require more space.

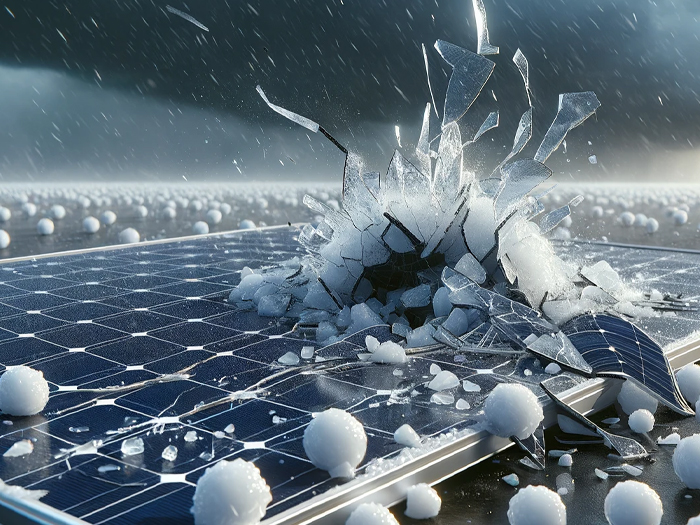

For that reason, wind, solar and battery storage projects are increasingly sited in remote areas in states that have more available land — mostly Midwest and Southwestern states that are also more vulnerable to natural hazards like wildfire, hail and tornado.

“As new projects are being built, they’re being built in remote areas, and we’re definitely starting to see some of those more catastrophic losses from hail, wind, flooding and wildfire events that impact the ability to access project sites, which can impact maintenance schedules or delay repairs and in turn can result in increased claim costs,” Kirejczyk said.

Advancements in drone technology have alleviated this slightly by allowing for remote loss assessments when physical inspections aren’t feasible, but increased exposure to natural hazards and roadblocks to a quick recovery will remain challenging as renewable energy projects expand into new territory.

2) Increased repair and replacement costs on large projects

Bigger projects also mean increased exposure to equipment failure.

“These units are growing in size and scale. When wind turbines were first commissioned, they were 225 kilowatts and now are pushing five megawatts, from an onshore wind perspective. Offshore, they’re even larger. As the technology has matured, we are seeing a decline in the cost of manufacturing, but an increase in the cost of the repairs. This can be attributed to more complex designs and engineering making repairs more costly,” Kirejczyk said.

According to 2019 research by Wood Mackenzie Power & Renewables, a research and consulting firm, the global onshore wind industry spent roughly $8.5 billion on unplanned repairs for component failures, representing 57% of all operations and maintenance costs.

“Unplanned failures can cost the asset owner as much as $30,000 per turbine per year in terms of repairs and spare parts and up to 7 days’ worth of lost production per year. … Capital components alone — gearboxes, generators and blade — can cost up to $10,000 per turbine per year in replacements,” according to the firm’s report.

“Proactive and preventative maintenance programs are key for owners, and they can do a lot of this through remote monitoring and maintenance forecasting powered by artificial intelligence,” Kirejczyk said. Though these tools are becoming more prevalent, adoption remains slow among smaller players.

3) Shortage of skilled contractors to meet demand.

The rapid rise in project demand can only be met with skilled contractors experienced in renewable energy projects. According to the 2017 Global Energy Talent Index Report, 80% of hiring managers in the industry believe there is a skills shortage due to lack of planning for knowledge transfer.

“As the pipeline of these projects under development has risen exponentially, we have seen a rise of claims on the construction and installation of these projects. This points to the limited pool of contractors who are able to install and commission a project successfully,” Kirejczyk said.

“The pool of available, reputable and experienced contractors is small, and everybody wants to partner with those contractors. When there is a lot of competition for skilled labor, the larger owners tend to win out, and startups are more likely to find themselves working with less experienced contractors.

“That’s where we start seeing issues like, for example, micro-cracking in solar panels that aren’t stored, transported or installed correctly. That then leads to performance issues.”

Renewable energy companies — large or small — can protect themselves by not only selecting contractors carefully, but also establishing clear expectations for quality and minimum limits of contractors’ liability coverage.

How One Insurer Supports Sustainable Clean Energy Growth

Though the future of renewable energy looks bright, these factors have nonetheless made the sector difficult to insure.

“From an insurance perspective, we still see attritional claims that are eroding profitability in this industry,” Kirejczyk said.

But loss history can’t shoulder all the blame. Undisciplined risk selection has also driven poor outcomes.

“The lack of profitability may have been due to markets focusing on production goals as opposed to taking a disciplined underwriting approach — not taking the time to get to know their customers yet continuing to support terms and conditions that were set in a soft market,” Kirejczyk said, “which is why we’re coming at this from a little bit of a different angle.”

After several years of watching this market’s growing pains, AIG decided to throw its hat in the ring, mitigating the challenges to profitability through a thoughtful and targeted approach. Amid the proliferation of new projects, the company is focused on asset owners with a track record of success in the business and dedication to the long-term viability of a project.

“We have a specific appetite, and we’re looking for people who are truly invested in this space for the long haul,” Kirejczyk said. “For us, sustainability is not just about supporting the technology, but supporting the major players in the space that care about being here for the long term and are not just looking for a quick return on their investment.”

The support comes in the form of risk management expertise as well as disciplined underwriting. In-house risk engineers with product development and plant management experience have extensive knowledge on how to operate, maintain and protect both renewable energy plants and battery storage projects.

Captive funding abilities can also support larger owners who want to insure more of their risk themselves, but need assistance unlocking their captives’ capabilities. “That’s where AIG can partner with them and take a different approach instead of the traditional risk transfer property contract. The renewable energy space is poised for change and some clients who have captives may look at utilizing them as a means for risk transfer, which is an area in which we specialize and can offer our expertise,” Kirejczyk said.

As the world moves toward a future powered by renewable energy, companies need both reliable insurance coverage and risk management solutions to address their exposures and continue growing sustainably.

“Both consumers and corporations increasingly care about where their power comes from. They want to be good actors toward the environment, but they require a reliable, continuous supply of energy. We know we have a role to play in the transition to cleaner energy and are excited at the opportunity in front of us,” Kirejczyk said.

To learn more, visit https://www.aig.com/business/industry/energy.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with AIG. The editorial staff of Risk & Insurance had no role in its preparation.