Sponsored: Liberty Mutual Insurance

Social Inflation Is Unavoidable, but a Proactive Insurer Could Help Mitigate Its Effects

General liability risk is in the midst of a paradigm shift for businesses and insurance carriers. Several societal and legal trends have converged to cumulatively increase companies’ exposure to significant losses, despite their best efforts to control them.

“We’ve seen a shift in the way people think about corporations and the distribution of wealth, what duty of care companies are obligated to fulfill, and who should be responsible for paying when there are accidents,” said Meg Sutton, Senior Vice President, U.S. Casualty, Global Risk Solutions (GRS) North America, Liberty Mutual Insurance.

This phenomenon called social inflation has driven up general liability claim frequency and severity to the degree that rate increases can’t keep pace with mounting losses, and insurers’ reserves are dwindling. The market is currently in its sixth consecutive year of underwriting losses.

What does this mean for risk managers? With no sign that the effects of social inflation will abate any time soon, it’s imperative to stay on top of developing trends and build an understanding of how they might impact a company’s risk profile.

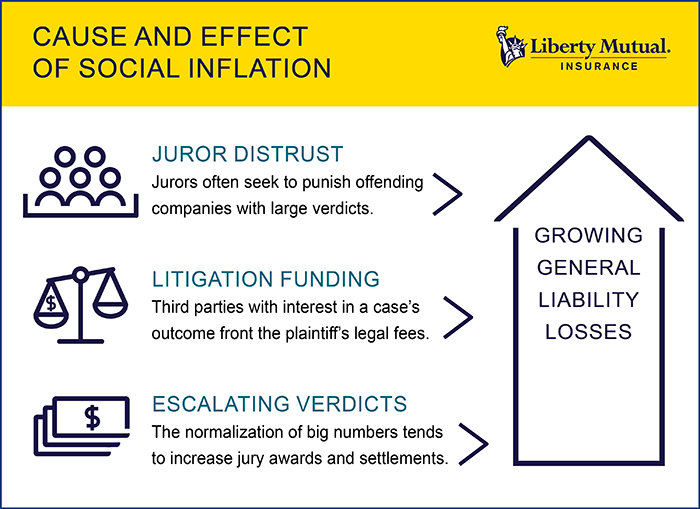

Here are three key factors driving social inflation today:

1. Juror Distrust of “Big” Business

Meg Sutton, Senior Vice President, GRS North America, Liberty Mutual Insurance

Today’s economic climate is marked in part by a growing inequality, with many believing that large corporations are mostly to blame for this disparity.

According to the 20th Annual Edelman Trust Barometer, the general public grows more distrustful of institutions the more that economic inequality grows, despite overall economic growth. About 56% of respondents said that capitalism in its current form does more harm than good, and most viewed big institutions largely as unethical and unfair.

That belief is increasingly reflected in jurors’ verdicts.

“There’s extraordinary level of empathy for plaintiffs and a general mistrust of corporations that sometimes stands in the way of people applying the law appropriately. Jurors sometimes set the facts of the case aside to do what they feel is right, which often includes punishing offending companies with large verdicts,” said David Perez, Chief Underwriting Officer, GRS North America, Liberty Mutual Insurance.

2. The Rise of Litigation Funding and Third-Party Backers

David Perez, Chief Underwriting Officer, GRS North America, Liberty Mutual Insurance

Litigation funding is the practice of an unrelated party covering a plaintiff’s legal fees in exchange for a cut of the profits should they secure victory. External funding can inspire claimants to pursue litigation where they may otherwise have settled and encourage attorneys to ramp up the requested damages.

While hedge funds and private equity firms are the most typical backers of litigation funding, they aren’t the only interested parties.

There are also “lien physicians” and physicians who treat under letters of protection. In these situations, the physician is promised that any payments owed by the plaintiff for medical treatment will be paid from the final lawsuit settlement amount or verdict award. In many jurisdictions, an injured plaintiff is only allowed to recover the expenses paid at a discount by their private health insurer to the medical provider — not the much higher amount originally billed to the plaintiff.

But, if the plaintiff is treated by a physician outside their health insurer’s network under a letter of protection, the plaintiff can claim higher damages based on medical expenses billed, since there is no health insurer payment involved.

“There could be an arrangement where the physician stands to profit if the patient is successful in the litigation, which allows plaintiffs to make their damages claims larger,” Sutton said. “We have seen some physicians taking an interest in these arrangements, but the truth is that there are a number of third parties with an interest in the outcome of claims.”

3. Normalization of Supersized Verdicts

Thanks to the two preceding trends, as well as other factors, settlement and awards continue to climb. In 2019, the largest jury verdict amounted to more than $8 billion in damages. All it takes it one large sum to set a precedent for future cases.

“As there’s more of these huge awards, they become normal. And they don’t seem so large when you look outside of these cases at things like federal deficit, or the net worth of some of the owners of these companies. A $10 million verdict used to be huge, but $10 million today doesn’t feel like the same amount of money as it did five or 10 years ago,” Sutton said.

Across state courts, the erosion of caps on punitive damages and damages for pain and suffering are also raising the ceiling on what plaintiffs can ask for. The raising or elimination of caps is in part an effect of social inflation, and a catalyst that continues fueling ever-higher demands.

Controlling Losses through Partnership

In this environment, so much is outside of risk managers’ control. While they can take steps to minimize loss events in the first place, there is little they can do to control the course of claims once they get into litigators’ hands.

That’s where partnering with the right carrier can make all the difference. A carrier partner that does these three things can help businesses stay ahead of the risk:

1. Understands the current risk environment and market conditions. An insurer should be able to explain how bigger societal and legal trends may impact an insured’s exposure. At Liberty Mutual, a dedicated public affairs team tracks legislative changes and legal decisions, so the company is better prepared for potential impact on claims.

“There are developments that go against the best interest of our customers – such as adverse interpretations of contract language, new legal approaches, potential legislative changes – that our public affairs group stays on top of constantly,” Perez said. “Their work in turn helps us keep our customers informed.”

2. Assigns the right team of specialists from the start. The way a carrier approaches claims management could make a multi-digit difference in the ultimate value of the loss. Identifying high-risk claims from the get-go and dispatching the appropriate specialists is critical.

“We collect data on severity indicators — such as the presence of a third-party interest — and other claim characteristics like client industry and injury type,” Sutton said. “When you have rich data, you’re able to seed that into a model which helps us select the claim specialists and counsel who would be most effective on the particular type of case.”

“We have adjusters that specialize in auto losses, a variety of industries, specialized products, and contractual liability issues, etc. We get the right lawyer and the right adjuster on the case as early as possible so that we can move claims quickly to resolution,” Perez said.

3. Applying a proactive litigation strategy. Once the team is in place, they should plan for a variety of pathways to resolution. Defense counsel on the legal team at Liberty Mutual conduct mock trials to test out different arguments and approaches, understanding that success depends on winning over jurors’ hearts and minds, as much as presenting the facts.

“It lets us test out different themes, find out what a jury might be thinking and then adjust our defense accordingly for the best possible outcome,” Sutton said.

One of the best ways for businesses to protect themselves from the risks associated with social inflation is to create and continually reinforce a culture of safety that reduces the likelihood of accidents in the first place. But when a loss does happen, having an insurer who knows how to mitigate the impact from multiple angles is invaluable.

To learn more, visit https://business.libertymutualgroup.com/business-insurance/coverages/general-liability-insurance-policy.

![]()

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Liberty Mutual Insurance. The editorial staff of Risk & Insurance had no role in its preparation.