Sponsored: Liberty Mutual Insurance

Planning a Warehouse in the City? Here are 5 Ways Your Risks Will Change.

How quickly do you want that package you ordered today? Would you rather have it tomorrow, or a week from now?

According to the National Retail Federation, nearly 40 percent of online shoppers expect free two-day delivery, which is no surprise considering the appeal of online shopping lies in its convenience and speed.

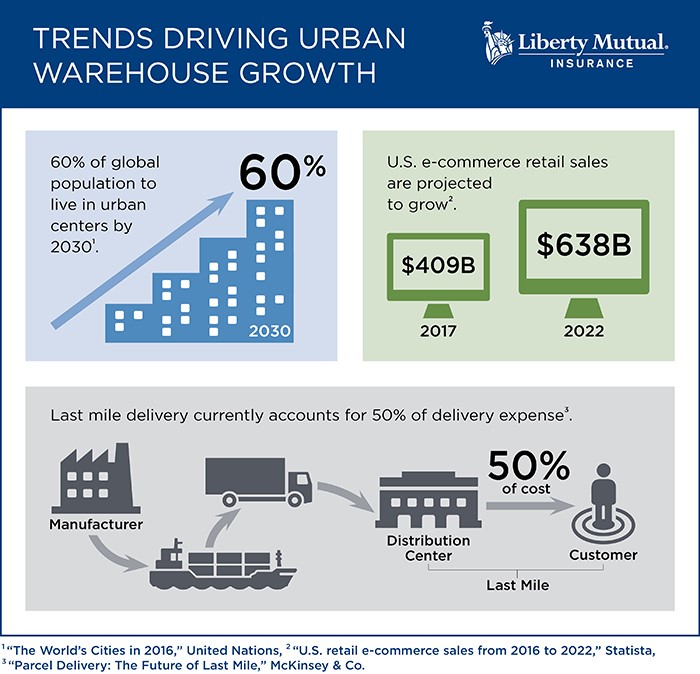

But these expectations increase the pressure on wholesale distributors to shorten last-mile delivery timelines. Where warehousing was once a mechanism to store inventory at low cost, it’s now becoming a way to keep products closer to consumers to cut down on delivery lead times and costs.

“This is where urban warehouses come into play,” said Mark Morneau, Senior Vice President and General Manager, National Insurance, East Division, Liberty Mutual Insurance. “By moving into cities and getting products closer to where consumers live, they eliminate some delivery lead time and expense.”

Warehouses in densely-populated areas, however, come with unique risks that suburban or rural warehouses don’t typically need to manage. As wholesale distributors increasingly turn to urban warehousing to meet the demands of e-commerce, risk managers should be aware of these key risks and challenges:

1. Older Properties in Densely-Packed Neighborhoods

Warehousing in an urban setting typically means moving into an older and smaller building than what would be available further outside city limits, which presents many challenges.

“Oftentimes the buildings used are old manufacturing facilities that aren’t designed for extensive storage. So, they need to be brought up to standards suitable for housing products for wholesale distribution,” Morneau said.

That means retrofitting them with standard and code-compliant sprinkler, ventilation, electrical, and alarm systems and reconfiguring the space to properly store and move inventory, which could include raising ceilings, adding racks, and widening loading docks.

“Being much closer to your neighbors also presents risks,” Morneau said. “In densely populated areas, a fire that starts three buildings down can still take out your facility. Older water systems may not supply sufficient water pressure for fire sprinkler systems, so fire pumps may also need to be installed.”

While infrequent, fires can result in total loss without the proper safeguards. Clear emergency response and recovery plans can help mitigate the damage.

2. Premises Security

Fully-stocked warehouses make an attractive target for thieves.

“Urban environments mean more people, which means more potential for crime,” Morneau said. “The logistical realities of urban warehousing also make it more difficult to keep crime out.”

Concentrated areas mean less space for fences and other barriers that limit access. Narrow roadways necessitate smaller delivery trucks which will have to enter and exit the facility more frequently, increasing the opportunities for vandals or thieves to gain entry.

“Your inventory is a critical asset and must be well-secured,” Morneau said.

Around-the-clock security guards and security equipment that includes video surveillance can help to deter thieves, while protocols dictating who can enter the facility and when can help to limit opportunities for criminals.

3. Workforce Safety in Confined Spaces

The tighter floorplans of urban facilities also present safety risks to employees.

“Older facilities with less space won’t have as much automation, which means workers are doing more material handling. That alone increases injury risk,” Morneau said. “Employees are also likely to interface more with forklifts and other machinery, which are also operating in more confined spaces. Whenever people work near this type of machinery, the risk of bodily injury goes up.”

Investing in equipment like conveyer belts and elevators to streamline workflows can help mitigate that risk. Whatever changes are made, thorough safety training for employees is paramount.

4. City Fleet Operations

Cities’ crowded streets and tight corners aren’t built for hulking delivery trucks.

“A benefit of being in an urban warehouse is access to highways and roads, but larger vehicles can’t navigate as easily in a city environment. With more people, vehicles, and distractions on the part of both pedestrians and drivers today, accidents become much more likely,” Morneau said.

The pressure to meet quick delivery timelines could also lead to overscheduling drivers. Not only could this run afoul of regulations, but it can also lead to driver fatigue and a greater likelihood of accidents.

“Warehouse managers need to determine if they can operate effectively with their current fleet and should also consider city ordinances that may limit hours of business operation or affect parking,” Morneau said.

Distributors may also choose to outsource delivery rather than manage their own fleets. In cities, new sharing economy platforms are taking up this task along with traditional players. But farming out delivery to the sharing economy comes with its own liability challenges.

5. Relying on the Sharing Economy for Delivery

The sharing economy is introducing opportunities for businesses of all types to offer better, faster, and more cost-effective service, and the wholesale sector is no exception.

Wholesalers are finding available vehicles and drivers to deliver inventory to client locations via online transportation marketplaces. In the future, gig workers using their own cars and bikes as delivery vehicles could even help wholesalers get packages directly to consumers’ doorsteps. While these services can help expand distribution operations, they can also introduce general liability risks.

“Risk managers may be exposing their companies to a host of emerging liability issues by using sharing economy platforms because the drivers and fleets are relatively unknown,” Morneau said. “A third party is responsible for verifying drivers and their credentials, backgrounds, and vehicles, but you are trusting them to make deliveries. It’s a much harder situation to control.”

These relationships can offer the benefits of speed, efficiency, and capacity, but contracts with third-party platforms should outline service expectations and clearly delineate which party assumes liability.

Access Risk Management Resources and Comprehensive Coverage

Wholesale distributors are already making use of multistory urban warehouses in Europe and Asia, with a few cropping up in U.S. hubs like San Francisco and New York. The trend is likely to continue as e-commerce keeps growing and consumers keep expecting speedy delivery.

Risk managers can best plan and prepare for the unique exposures associated with urban warehouses by working with well-resourced insurers. Liberty Mutual’s risk control consultants can assess property, safety, and fleet risks and recommend strategies to mitigate them, such as developing a fleet safety program, evaluating a new or existing fire protection system, or reviewing an emergency response plan.

“Our risk control team helps risk managers identify the exposures they’ve overlooked so they can bring down their residual risk and focus on operating their businesses profitably,” Morneau said.

Along with core primary property and casualty products, Liberty Mutual also offers specialty coverages like environmental, cyber, and professional policies through Ironshore, a Liberty Mutual company.

“We have the full suite of products to address urban warehousing exposures and help distributors take advantage of these opportunities,” Morneau said.

To learn more, visit https://business.libertymutualgroup.com/business-insurance/industries/wholesale-business-insurance-coverage.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Liberty Mutual Insurance. The editorial staff of Risk & Insurance had no role in its preparation.