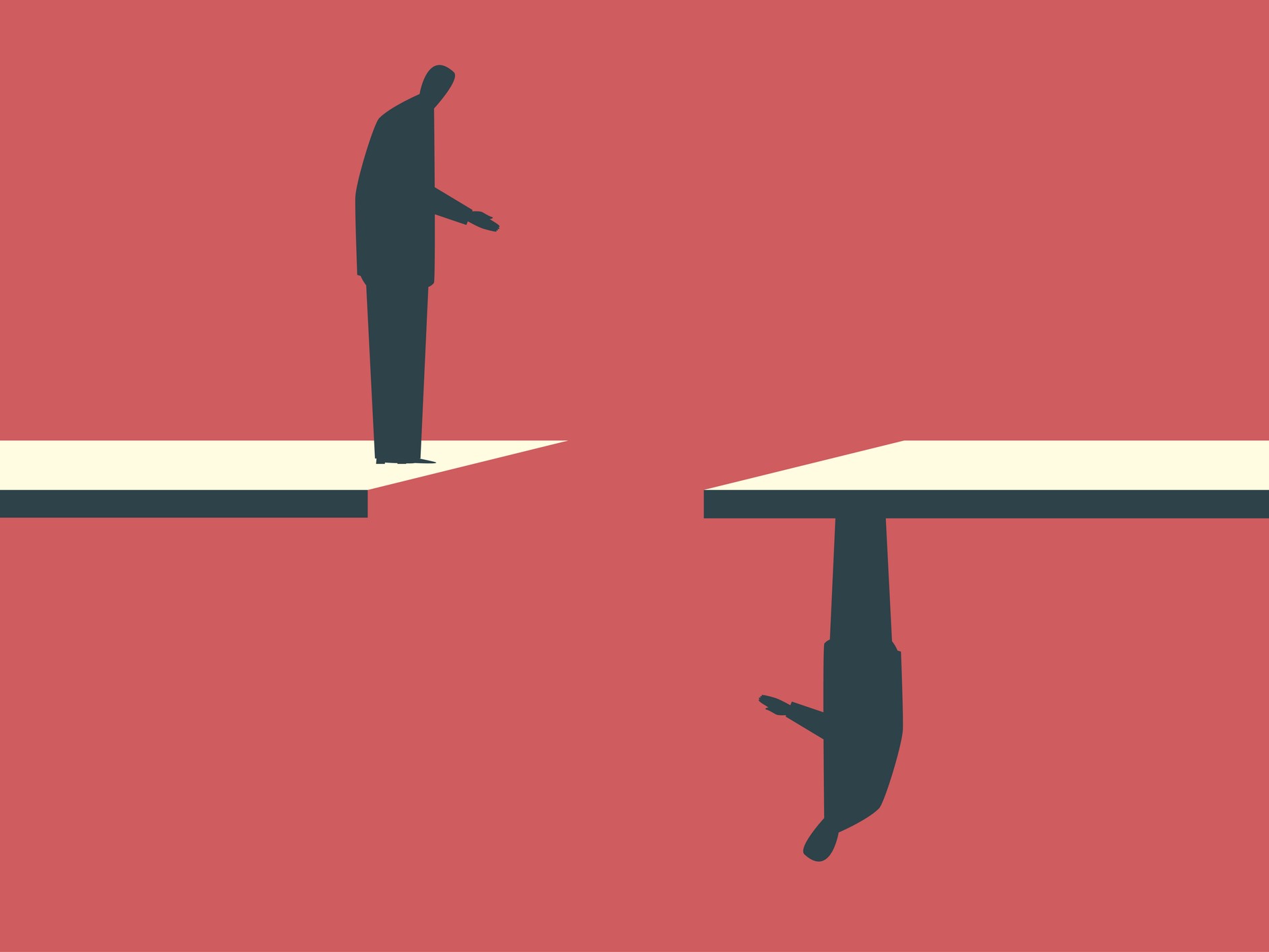

Perspective | When Risk Transfer Is Futile

Woolworth’s. Pan-Am. Toys ‘R’ Us. Famous names; reliable brands; all now essentially gone.

A very old British department store chain, operating from 178 locations, has performed so badly that this spring its lenders took control. They will break the company into pieces to recover investment.

The company’s value fell by 98% in three years. The slope of failure is vertiginous. As Hemingway wrote: “How did you go bankrupt?”

“Two ways. Gradually, then suddenly.”

The owner of a rival chain offered to buy the failing company in order to protect the shareholders, of which he was a major. The lenders — hedge funds, bankers and other slick types — rebuffed him, seeking only to protect themselves, as lenders do, and indeed should and must. A national kerfuffle kicked off and then fell out of the news cycle.

The stores, founded in 1778, were called Debenhams. (The apostrophe predeceased the chain.) That same year, Cook sighted the Oregon coast; the Liberty Bell went home to Philadelphia; and La Scala opened in Milan.

Oregon, the Liberty Bell and La Scala are intact. Debenhams isn’t, although a rump might survive and keep the name alive.

Honesty and relevance compel me to tell you that I’m ancient and buy my trousers at Debenhams. My dad bought his trousers there, and probably his dad did too.

That’s one reason the chain has foundered: In the new millennium, the loss of relevance is suicide by Internet.

Department stores trade on public confidence. Debenhams’ loss will be Mr. Bezos’s gain. The very concept of department stores is on its last legs — so last century. A third of such British establishments have failed since 2010.

What’s happening in Britain today is, presumably, happening everywhere else too.

The future of the larger city centers is residential. A few well-positioned stores will handle whatever can’t be dropped in by drone. Those who remember towns as having commercial centers will go the way of the owners of tape cassettes or blunderbusses.

One might ask why insurance couldn’t help. The answer’s simple: You can’t insure against an accumulation of poor decisions, bad luck and the times, which are a-changing. High rents; too much discounting; heavy borrowing; the need for friendly, expensive staff; and water-tight leases played their parts in the downfall.

What made good economic sense for 240 years suddenly didn’t.

Here’s the thing: Insurance makes you whole. The whole you is flawed, as you know (but might not admit). If insurance had paid for the mistakes I’ve made, I’d be living much higher off the hog. Hell, I’d have a dozen hogs.

You can’t insure against the second most significant risk, which is existential risk. (But think of the annual premiums if you could.)

Department stores are, of course, among the smaller fry going the way of licensed taxicabs, newspapers and so many other time-tried institutions.

A small nucleus of each disrupted industry might survive, as will a smattering of retail stores, mostly groceries and shoe shops — places where you need to know exactly what you’re getting.

In essence, Debenhams is going out of business because of the least insurable risk of them all: “the enemy,” time. &