Sponsored: Healthesystems

The Next Wave of Workers’ Comp Medical Cost Savings

Managing medical costs for workers’ compensation claims is like pushing on a balloon. As you effectively manage expenses in one area, there are bound to be bulges in another.

Over the last decade, great strides have been made in managing many aspects of workers’ compensation medical costs. Case management, bill review and pharmacy benefits management are just a few categories that produce significant returns.

And yet, according to the National Council on Compensation Insurance (NCCI), medical costs remain the largest percentage of workers’ comp expenses. Worse still, medical costs continue to be the fastest growing expense category.

Many medical services are closely managed through provider negotiations, bill review, utilization review, pharmacy benefits management, to name a few. But a large opportunity for medical cost containment remains largely untouched and therefore represents a significant opportunity for cost savings.

Ancillary medical services is a term used to describe specialty or supplemental health care services such as medical supplies, home health care, durable medical equipment, transportation and physical therapy, etc.

According to Clifford James, Vice President of Strategic Development at Healthesystems in Tampa, Fla., modernizing the process for managing ancillary medical services presents compelling opportunities for cost savings and improved patient care.

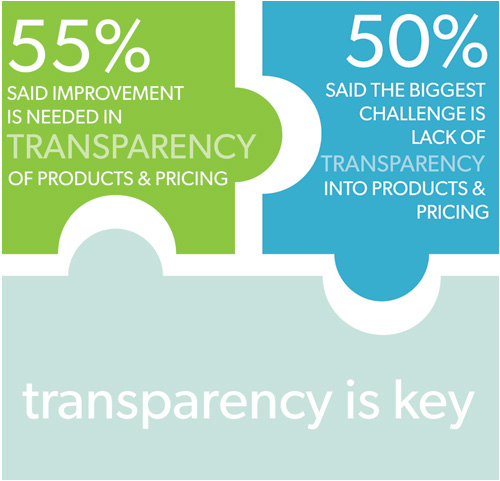

Source: 2014 Healthesystems Ancillary Medical Services Survey

Source: 2014 Healthesystems Ancillary Medical Services Survey

“The challenge of managing these types of medical products and services is a cumbersome and extremely disconnected process,” James said. “As a result, it represents a missing link in an overall medical cost management strategy, which means it is costing payers money and patients the most optimal care.”

James singled out three key hurdles:

Lack of transparency

As the adage goes, you can only manage what you can measure.

Yet when it comes to the broad range of products and services that comprise ancillary benefits, comprehensive data and benchmarking metrics by which to gauge success are hard to come by.

The problem begins with an antiquated approach to coding medical services that was developed in the 1970s. The coding system falls short in today’s modern health care environment due to its lack of product and service level detail such as consistent units of measure, quantity and descriptors.

As a result, a meaningful percentage of ancillary benefits spending is coded as “miscellaneous,” which means a payer has little to no visibility into what product or service is being delivered — and no way to determine if the correct price is being applied or if the item is even necessary or appropriate.

Source: 2014 Healthesystems Ancillary Medical Services Survey

Source: 2014 Healthesystems Ancillary Medical Services Survey

“It’s a big challenge. Especially when you consider that for many payers, it’s difficult to determine exactly what they are spending, or identify what the major cost drivers are when it comes to ancillary services,” James said. And when frequently over 20 percent of these types of services are billed as miscellaneous, payers have zero visibility to effectively manage these costs.

Measurement and monitoring

Often, performance that is monitored is given the most attention. Therefore, ancillary programs that are closely monitored and measured against objective benchmarks should be the most successful.

However, benchmarks are hard to determine because multiple vendors are frequently involved using disparate data and processes. There isn’t a consistent focus on continuous quality improvement, because each vendor operates off of their own success criteria.

“Leveraging objective competitive comparisons breeds success in any industry. Yet for ancillary services there is very limited data to clearly measure performance across all vendors,” James said. “And for payers, this is a major area of opportunity to promote service and cost containment excellence.”

Source: 2014 Healthesystems Ancillary Medical Services Survey

Source: 2014 Healthesystems Ancillary Medical Services Survey

Inefficiency

If you ask claims executives about their strategies for improving the claims management process, a likely response may be “workload optimization.” The goal for some is to enable claims professionals to handle a maximum case load by minimizing administrative duties so they can leverage their expertise to better manage the outcome of each case.

But the path towards “workload optimization” has many hurdles, especially when you consider what needs to be coordinated and the manual way it frequently is done.

Ancillary benefits are a prime example. For a single case, a claims professional might need to coordinate durable medical equipment, secure translation services, arrange for transportation and confirm the best physical therapy plan. Unfortunately they often don’t have the needed time, or the pertinent information, in order to make quick, yet informed, decisions about the ancillary needs of their claimants.

In addition there is the complexity of managing multiple vendor relationships, juggling various contacts, and accessing multiple platforms and/or making endless phone calls.

“We’ve been called the ‘industry integrator’ by some people, and that’s accurate. We are delivering a proven platform connecting payers with providers and vendors on the ancillary medical benefit front. It’s never been done before.”

— Clifford James, Vice President of Strategic Development, Healthesystems

Modernizing the process

To the benefit of both payers and vendors, Healthesystems offers Ancillary Benefits Management (ABM).

The breakthrough ABM solution consists of three foundational components — a technological platform, proprietary medical coding system and a comprehensive benefits management methodology.

The technological platform integrates payers and vendors with a standardized architecture and processes. Business rules and edits can be easily managed and applied across all contracted vendors. All processes – from referral to billing and payment – are managed on a single platform, empowering the payer with a centralized tool for managing the quality of all ancillary providers.

But when it comes to ancillary products, the critical and unique challenge Healthesystems had to solve is the antiquated coding system. This was completed by developing a highly granular, product-specific coding system including detailed descriptions and units of measure for all products and services. This coding provides payers with the clearest understanding of all products and services delivered including pricing and all the necessary utilization metrics.

“We bring the highest level of transparency and visibility into all ancillary products and services,” James said, adding that the ABM platform uses an extensive preferred product coding system 15 times more detailed than any other existing system or program.

This combination of sophisticated technology, proprietary coding system and benefit management methodology revolutionizes the ancillary category. Some of the benefits include:

- Crystal-clear transparency

- A more detailed and comprehensive view into ancillary products and services

- An automated process that eliminates billing discrepancies or resubmittals

- Integrated and consistent processes

- Strategic program management

Taken together, the system leapfrogs over the existing hurdles while creating entirely new opportunities. It’s a win for vendors and payers, and ultimately for patients, who receive the optimal product or service.

“We’ve been called the ‘industry integrator’ by some people, and that’s accurate,” James said. “We are delivering a proven platform connecting payers with providers and vendors on the ancillary medical benefit front. It’s never been done before.”

To learn more about the Healthesystems Ancillary Benefits Management solution visit: http://www.healthesystems.com/solutions-services/ancillary-benefits

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Healthesystems. The editorial staff of Risk & Insurance had no role in its preparation.