Sponsored: Liberty Mutual Insurance

Modernizing Healthcare by Embracing Telemedicine

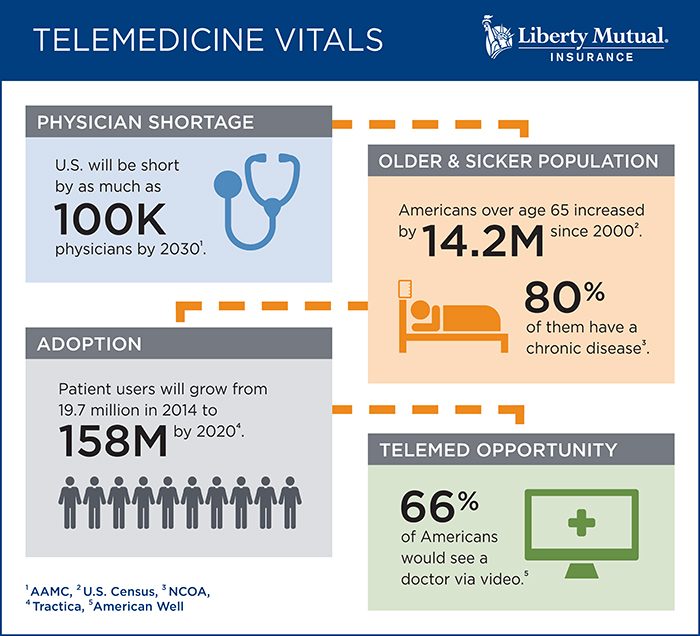

Today, we can request a ride, order groceries, and stream a television show with just a simple click. And increasingly, we can also access healthcare. According to the American Telemedicine Association, more than 20 million Americans will have access to a remote healthcare service by the end of 2017.

Whether receiving or administering care, telemedicine can have advantages. For patients, telemedicine offers convenience and speed, and for healthcare providers, it allows medical professionals to see more patients.

With these advantages come new challenges, such as technical requirements, compliance, and licensing of personnel. By taking a holistic, cross-team approach to implementation and working closely with their insurance partners, healthcare providers can successfully embrace telemedicine and also protect patients, medical professionals, and their own operations from the potential downsides.

A New Model to Meet Patient Needs

A variety of factors drive the need for telemedicine. Many people live in areas where getting to a healthcare facility is challenging, or where there’s a shortage of physicians and specialists. And, those who benefit most is also growing: the number of elderly Americans has increased from 35 million to 49 million1 in the past 16 years. This group typically needs more care, but often has difficulty getting to a doctor’s office.

“Many senior care facilities are using videoconferencing to access telemedicine. Physicians see the senior citizens at the facility, diagnose ailments, and prescribe treatments remotely,” said Kristin McMahon, President, U.S. Liability and Regulatory Healthcare Products, IronHealth.

Cutting out the need for transportation means faster care for patients, which could also translate to fewer hospital readmissions.

“Faster diagnosis and treatment could translate into fewer professional liability claims. For example, you could more quickly address pressure sore ulcers or recommend appropriate fall precautions to minimize the risk of resident bodily injuries,” said Jeff Duncan, Chief Underwriting Officer, Healthcare Practice, Liberty Mutual Insurance.

Healthcare providers can also potentially see more patients in a day by addressing more minor ailments through videoconferencing or telephonic methods.

“Organizing the logistics of face-to-face consultations with multiple patients takes time,” Duncan said. “By addressing less serious cases using telemedicine, doctors have more time to analyze and treat complex cases.”

But significant clinical and technical risks go hand-in-hand with these benefits.

Risks to Telemedicine Providers

“Healthcare can’t be treated like any other consumer product; it’s much more complicated than requesting a ride to the airport,” Duncan said. In exchange for convenience and efficiency, patients and providers may sacrifice quality of care.

Without in-person interactions with patients, medical professionals may run the risk of misdiagnosis, which can cause physical harm to the patient and professional liability to the healthcare provider.

Traditional malpractice policies cover the medical professional for an error in judgment or treatment that fails to meet the standard of care. Technology introduces another layer of uncertainty.

“If the clinician fails to diagnose an abnormality on a CT scan, is it due to his or her professional error, or did the technology contribute to the oversight?” McMahon asked. “Perhaps the internet connection was weak or the image quality wasn’t high enough, which resulted in the clinician missing an area of shading that could suggest cancer, for example.”

There have not been many claims stemming from this type of technology failure, but McMahon and Duncan are keeping a close eye on this potential issue as telemedicine grows more prevalent.

Delivering healthcare online also increases cyber and privacy exposures that could land providers on the wrong side of HIPAA compliance. Electronic records shared with third-party telemedicine technology platforms may be at greater risk.

Licensure issues also arise when state lines can be so easily crossed in the cloud. Medical professionals must be properly licensed in the states where they provide care, but using telemedicine means that a patient’s location could be anywhere. Telemedicine regulations can vary by state in areas such as informed consent, standard of care, credentialing of providers, and remote prescription practices.

A Cross-Functional Approach to Mitigate Risk

Telemedicine may be the healthcare delivery model of the future, but providers should implement it strategically, with the help of a cross-disciplinary team.

“Billing and finance team members should be involved to determine how telemedicine-related reimbursements will work. Currently, 29 states and D.C. mandate reimbursement for some telemedicine services, but amounts vary,” Duncan said.

Clinical input is necessary to determine what staff will use it for which types of injury, and what patient population it might serve. The IT group should discuss the cyber and information privacy exposure, as well as the technical aspects of implementation. Legal and compliance teams can weigh in on contractual, jurisdictional, and licensure issues.

The full team needs to monitor the quality of care—is it the same or better than before?

“No one discipline has enough perspective to solve these challenges effectively in isolation. You need to engage cross-functional teams early, and then think about where telemedicine can be effective,” Duncan said.

Manage Liability Holistically

Insurance is the final piece of the puzzle.

Organizations should work with insurers and brokers to make sure current policies will meet their needs. Cyber and professional liability limits may need to be increased. Technology partners should also have the appropriate cyber and E&O coverage.

In particular, professional liability policies should respond to both the traditional exposure of a physician making a medical error, as well as exposures introduced by the telemedicine technology itself.

“If the technology malfunctions and that leads to a misdiagnosis or bodily injury, the healthcare provider can still be held liable on a negligent credentialing theory,” McMahon said.

One solution is to have the medical malpractice exposure and the technology E&O coverage from the same insurer, to avoid potential conflicts if there is a liability claim implicating both parties. Said McMahon, “We are looking very closely toward developing an integrated product to provide a comprehensive solution.”

Notes Duncan, “Telemedicine is here to stay, and we want to help protect our healthcare clients as they embrace it.”

To learn more, visit https://business.libertymutualgroup.com/business-insurance/industries/health-care-providers-insurance-coverage.

1 United States Census Bureau. https://census.gov/newsroom/press-releases/2017/cb17-100.html

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Liberty Mutual Insurance. The editorial staff of Risk & Insurance had no role in its preparation.