Liability Claims Crisis: Non-Economic Inflation Reshapes Insurance Markets

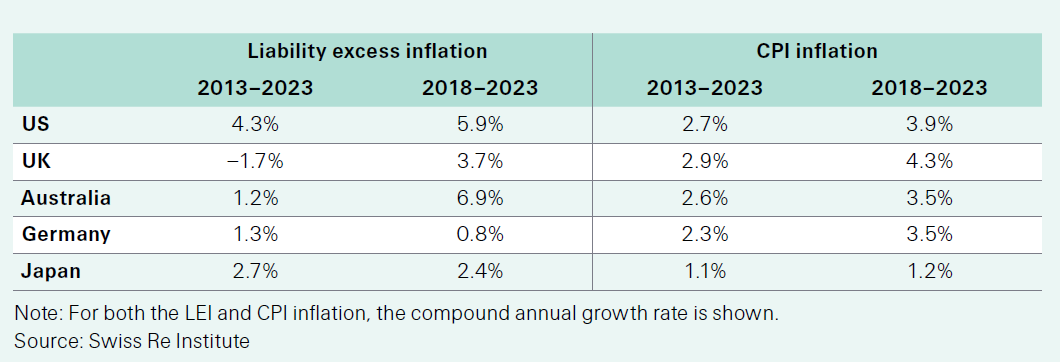

Liability excess inflation—the acceleration of insurance claims costs driven by legal system changes, litigation funding, and evolving social attitudes rather than traditional economic factors—has become a defining challenge for the insurance industry, accounting for an estimated 60% of liability claims growth over the past decade in the United States alone, according to analysis by Swiss Re Institute.

The data paints a striking picture of how American attitudes toward corporate accountability and compensation have transformed in less than a decade, according to the report.

In 2016, 58% of U.S. consumers believed that damage awards were too low. By 2025, that figure had jumped to 76%, signaling a fundamental recalibration of what the public considers fair compensation. This attitudinal shift has concrete consequences: the number of so-called “nuclear verdicts”—awards exceeding $10 million—more than quadrupled between 2020 and 2024, while the median value of these verdicts more than doubled in the same period. By 2024, more than 130 nuclear verdicts were recorded, representing a 50% increase from the previous year, the report said.

Age demographics are amplifying these trends. According to Swiss Re’s 2025 Behavioral Science survey, 83% of respondents under 40 years old believe damages are too low or fair, compared with just 41% of those aged 60 or older.

As younger cohorts increasingly populate jury pools, defense teams face mounting pressure to reassess trial strategy versus settlement calculations. Further compounding the challenge, 85% of survey respondents agreed that large corporations prioritize profit over safety, and 79% view punitive damages as the best deterrent against corporate wrongdoing.

Litigation Funding and Legal System Architecture Drive Claims Growth

Third-party litigation funding has emerged as a critical accelerant of liability excess inflation, Swiss Re said. Assets under management in the commercial litigation finance sector grew to $16.1 billion in 2024, with 82% of U.S. law firm lawyers now reporting use of litigation finance—a dramatic increase from just 9% in 2012.

This capital availability is reshaping claims patterns. Multi-district litigation (MDL), which represented only 16% of civil cases in 2000, now accounts for approximately 60% of federal civil cases. This expansion has enabled a proliferation of mass tort actions, including class actions around emerging issues such as data breaches, social media mental health impacts, and alleged harms from ultra-processed foods, the report said.

The scope of what constitutes a liability exposure has also broadened, with new litigation expanding into environmental claims, product liability, and artificial intelligence-related disputes.

Emerging Vulnerabilities Across Markets and Business Sizes

A particularly sobering finding from Swiss Re’s research concerns small and medium-sized enterprises. Contrary to assumptions that nuclear verdicts primarily threaten large corporations, SMEs face comparable jury-driven verdict exposure when injuries are severe, according to the report. However, because of thinner capital buffers and lower insurance policy limits, a single large verdict can prove catastrophic for smaller businesses. When survey respondents were presented with sufficiently high damage anchors, 25% supported nuclear verdicts against SMEs—only slightly lower than the 30% willing to see such verdicts levied on major corporations.

The challenge extends well beyond U.S. borders, Swiss Re said. The United Kingdom remains the highest-risk jurisdiction outside the U.S. for class actions, with common law systems facilitating mass tort growth.

The Netherlands and Portugal are emerging as particular focal points for expansion due to opt-out class action schemes that enable broad party inclusion. In the European Union, a revised Product Liability Directive coming into force in December 2026 will broaden corporate exposure by redefining product defects and expanding the universe of companies against whom claims can be made, Swiss Re said. Australia and Canada also face elevated exposure due to robust collective redress mechanisms and largely unregulated litigation funding sectors.

Reserve analyses reflect these mounting pressures. The “Other Liability Occurrence” line, which captures general liability, posted its highest reserve charges in a decade during 2024, affecting accident years as far back as 2015—suggesting that recent economic inflation alone cannot explain the adverse development, Swiss Re said. Industry profitability faces a potential squeeze if reserve releases from shorter-tail lines of business, which offset these liability charges in 2024, diminish in coming years.

Policy Reform and Strategic Recalibration

U.S. policymakers are beginning to respond. Georgia enacted litigation funding transparency legislation in April 2025, with other states considering similar measures. At the federal level, Congress continues to debate transparency requirements and appropriate tax treatment for litigation funding profits. These targeted reforms represent initial momentum toward restoring system balance, though insurers cannot rely on regulatory intervention alone.

Obtain the full report here. &