Mergers & Acquisitions

IP Due Diligence Seals the Deal

Last year’s flurry of mergers and acquisitions looks set to continue at a steady clip, according to an annual M&A outlook survey by KPMG, which canvassed 550 deal-making executives.

Seventy percent of those executives said that technology companies would be most actively involved in M&As in 2016, driven by innovations and constant market disruption.

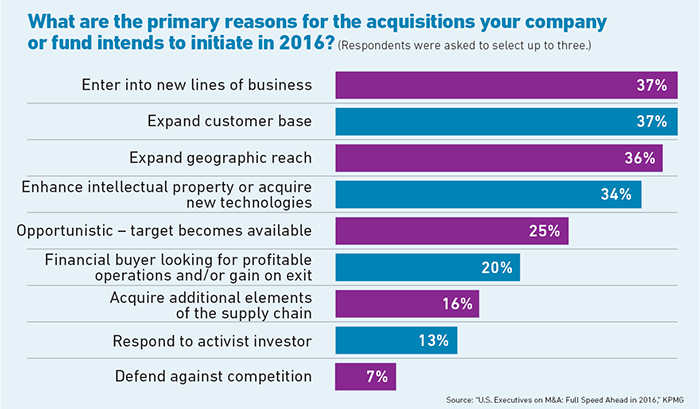

In this sector, perhaps more than any other, intellectual property drives the value of a deal. Thirty-four percent of surveyed executives said enhancing intellectual property or gaining access to new technologies would be a primary reason for acquisitions in 2016.

Yet buyers and sellers frequently push IP due diligence too late in the negotiation process, or fail to properly evaluate its value altogether.

Sixty-three percent of survey respondents said valuation disparity between buyer and seller would be a key challenge in the tech industry, and over half identified valuation disparity as a challenge in every sector. Thirty-one percent said correct valuation was the most important factor in a successful acquisition.

The Risks

The risks of undervaluing IP or failing to protect it during negotiations threaten both buyers and sellers.

Misjudging the monetary value and revenue-generating potential of a piece of registered IP — like a patent or trademark — could mean that the seller misses an opportunity to cash in.

“For smaller, more high-tech companies such as medical device or semiconductor producers, the IP patents are an important driver of value,” said David Wanetick, an IP valuation consultant for Warren Averett CPAs and Advisors. “If the value of the patents isn’t articulated in the context of a negotiation, the buyer won’t make note of their value and the seller leaves a lot of money on the table.”

Of course, buyers also face the risk of paying too much.

“The inventor is usually enamored of their patent because it may reflect 20 years of hard work, and a lot of ego is built into it, so they may be overly aggressive in their asking price,” Wanetick said.

Patent valuation specialists can generate reports to show both parties what a patent is really worth.

These specialists have to know the potential market for a patent-protected product and what the patent may be able to pull in from licensing fees. Financial modeling can forecast expected revenue by comparing a patent to comparable products.

They would also look for past infringement, which “would actually be a good thing, because it’s proof that somebody is using the patent and selling the product, so the patented technology works,” Wanetick said.

A buyer could then reach out to those infringing on the patent and offer them the opportunity to license it. Most infringers are likely to choose licensing over the alternative — litigation.

“If we see that a buyer has not engaged third-party consultants in addition to its IP lawyers, it raises the question: Why didn’t you dig a little further into that exposure?” — Jeff Anderson, Allied World’s senior vice president, mergers & acquisitions, North America.

“There are multiple definitions of value,” said Robert Surrette, shareholder and firm president at McAndrews, Held & Malloy. “There’s monetary value, of course, but there’s also competitive value. A patent could have competitive value depending on the scope of its claims.”

In addition to financial worth, patent valuation reports indicate how much risk a patent carries in its assignment and litigation history.

“The biggest fear in the IP space is when there are larger buyers. When the buyer makes the announcement publicly, you tend to have a situation where someone in their garage says, ‘I invented that,’ or an independent contractor claims they had a role in it, so they should have a role in the sale,” said Jeff Anderson, Allied World’s senior vice president, mergers & acquisitions, North America.

“It all comes back to the assignments and releases.”

Problems arise when there are multiple co-authors on a piece of IP, which often happens in the case of research conducted by a team of professionals. Buyers should make sure that their target company had procedures in place whereby any patents generated by employees belong to the company, which is usually established in employee agreements.

“If you don’t have that in place and the company gets acquired, the buyer may not have rights to the patents that it thinks it now owns,” Wanetick said.

The waters become muddier when trade secrets and “know-how” come into play. Companies don’t patent this information because that would require public disclosure, but the lack of a patent means one less layer of legal protection. Sellers must establish confidentiality agreements to ensure any information shared during the negotiation process doesn’t leave the room.

“Over the last several years, I’ve noticed non-registered IP becoming a more critical piece,” Surrette said. If a deal falls through, sellers can fall back on their confidentiality agreements to file a trade secret appropriation claim if their potential buyer furtively worked the seller’s IP into its own products.

Prioritizing Due Diligence

Unfortunately, companies tend to leave IP due diligence until the end, focusing instead on legal, environmental, real estate, cultural and financial risks first.

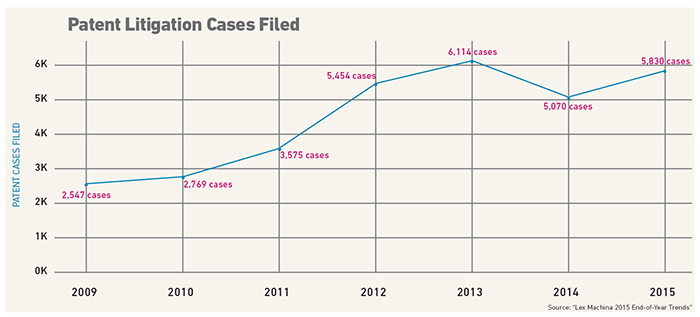

“That’s because patent due diligence is expensive, and companies don’t want to invest in that unless they’re almost certain a deal is going to go through,” Wanetick said. Delaying the process though, could mean skeletons in the closet regarding patent history stay hidden for too long. Buyers should not underestimate the ability of intellectual property disputes to bring a deal to a grinding halt.

“There was a lot of talk about Foxconn acquiring Sharp in Japan, which was supposed to be a $6 billion deal, but it was derailed at the last minute by potential liabilities associated with IP lawsuits and damages from patent infringement,” Wanetick said. “That’s an example of how a deal can go awry if due diligence with patents isn’t conducted earlier on.”

“For smaller, more high-tech companies such as medical device or semiconductor producers, the IP patents are an important driver of value.” — David Wanetick, an IP valuation consultant for Warren Averett CPAs and Advisors

One way to streamline IP due diligence is to establish early what patents are on the table, and what are not. Knowing the structure of the deal allows a buyer to prioritize due diligence and adjust its offer accordingly.

Bringing in third-party consultants to dig deeper into patent history also saves the buyer time while providing a more thorough understanding of the target’s IP.

“If we see that a buyer has not engaged third-party consultants in addition to its IP lawyers, it raises the question: Why didn’t you dig a little further into that exposure?” Anderson of Allied World said.

From the seller’s perspective, establishing ownership and proper assignments of its intellectual property is also critical to avoiding future disputes. Contracting a specialist to build a valuation report not only protects the seller’s interests in a sale, but expedites a buyer’s due diligence to move a deal forward.

Insurance Solutions

In addition to thorough due diligence and confidentiality agreements, both buyers and sellers can protect themselves through reps and warranties insurance.

The buyer is covered in the event of a breach of the seller’s representations of the value and ownership of its IP. The seller is protected if a third party makes a claim on its IP once a large buyer announces its plans to acquire it.

“When a large buyer comes in and demands a certain representation and indemnity package from the seller, the seller can procure its own R&W coverage to backstop that indemnity,” Anderson said.

Innovations in mobile tech tend to be the most difficult forms of IP to underwrite, given the lack of history surrounding them and a higher likelihood of third parties making claims on the technology. But with tech sector mergers and acquisitions set to rise, IP protection will prove a valuable investment.