Insurance Broker M&A Deals Hit Four-Year Low in Q1 2025

North American insurance brokerage merger and acquisition activity plummeted to its lowest level in four years during the first quarter of 2025, signaling a significant cooling in a sector that had previously seen robust consolidation activity, according to S&P Global.

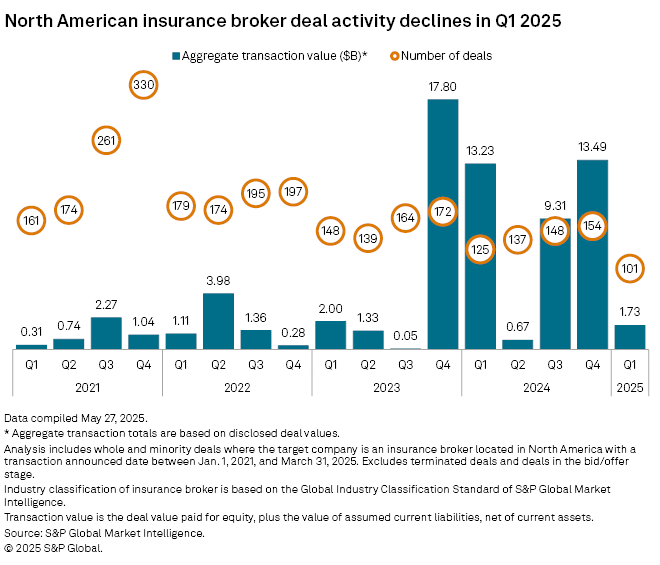

Only 101 deals were announced in the first quarter, representing a substantial decrease from the 125 transactions recorded during the same period in 2024. The first three months of the year marks the weakest quarterly performance in terms of deal count over the past four years, according to S&P.

The financial impact proved even more pronounced, with total transaction values collapsing to $1.73 billion in the first quarter. This figure represents a stark contrast to the robust $13.49 billion in deal values recorded in the previous quarter and the $13.23 billion logged during the first quarter of 2024. The combination of fewer transactions and lower aggregate values suggests a fundamental shift in market dynamics affecting the insurance brokerage consolidation landscape.

This downturn in insurance broker M&A activity mirrors broader trends across North American markets, where deal volumes declined amid economic uncertainty. However, the insurance sector’s experience diverged from general market patterns, S&P noted, as overall M&A aggregate values in the US and Canadian markets actually increased despite fewer transactions, driven partly by uncertainty surrounding trade policies implemented by President Donald Trump.

Strategic Positioning Amid Market Uncertainty

Despite the overall market slowdown, several significant transactions demonstrated that well-positioned companies continue to pursue strategic acquisitions. The quarter’s largest deal involved Arthur J. Gallagher & Co.’s acquisition of Woodruff-Sawyer & Co. Inc. for $1.2 billion, a transaction that was completed in April and exemplified how major players remain committed to growth through acquisition strategies.

The second-largest transaction featured Ryan Specialty Holdings Inc.’s purchase of Velocity Risk Underwriters LLC from Oaktree Capital Management LP for $525 million in upfront cash consideration. Velocity, a managing general underwriter specializing in catastrophe-exposed property coverage, joined Ryan Specialty’s Underwriting Managers division following the February closing. The deal structure included Factory Mutual Insurance Co.’s acquisition of Velocity’s excess and surplus carrier subsidiary, Velocity Specialty Insurance Co.

View the full report here. &