Sponsored: Lexington Insurance

Innovation at the Pace of Change

The excess and surplus lines insurance market was once considered the market of last resort. It served as a safety valve for the broader property casualty industry in order to provide capacity and innovative solutions to risks that standard markets viewed as undesirable.

But much within this critical sector is changing.

The truth is that much of the property casualty industry has struggled to keep up with the pace of change in today’s technology and business environment.

“The largest companies in America at the beginning of the last century were largely manufacturers and producers of raw materials such as coal, steel and oil,” said Matthew Power, President, National Branch, Head of Wholesale Broker Engagement, Lexington Insurance Company. “These companies were fueling the engine of an unprecedented period of expansion and industrialization in this country. By the close of the twentieth century, the U.S. had evolved into a much more wealth-based economy led notably by consumer goods manufacturers and financial institutions.”

Many economists agree that the U.S. economy is quickly re-assimilating once again; this time toward a more knowledge-based foundation driven by the rapid paced convergence of technology, data and advanced information systems.

Matthew Power, President, National Branch, Lexington Insurance Company

Much of the insurance industry is adept at underwriting older, more established industries like manufacturing, real estate and construction because their associated risks are more tangible and well-known. Far fewer have prepared themselves to meet the demands of the emerging future state economy.

“Over the next 25 years, there will be new industries that challenge admitted market underwriters, like genomics, biotech, nanotechnology, robotics and alternative energy,” Power said. “How many insurers are prepared for the companies of tomorrow? Very few.”

As the U.S. economy continues to evolve and risk paradigms shift in tandem, no other insurance segment will be better able to meet the demands of a rapidly changing liability landscape than the E&S market. “With its freedom of rate and form, the excess and surplus lines industry is uniquely positioned to innovate and develop those products that will be requisite into the future,” Power said.

State of the Market

The excess and surplus lines industry is a $42 billion market that is trending toward modest growth in 2017. “The growth and aggregate profitability of the E&S sector has outperformed that of the admitted markets consistently since 2011, so we’ve seen several consecutive years of growth,” Power said.

But while composite growth remains solid, there remains an overflow of capacity and generally challenging market conditions.

“Core E&S lines are stressed,” Power acknowledged. “Part of the challenge is driven by admitted markets encroaching on the E&S space in search of growth opportunities. For E&S carriers, there is still plenty of opportunity in emerging industries — the industries of tomorrow. To achieve growth in a tough market, you need to innovate and create new market space.”

Micro-Segmentation

“The market doesn’t move in a single monolithic manner. Even in the midst of traditional soft market cycles, experienced underwriters are likely to identify attractive risk sub-segments that are performing well. Understanding the difference between those underlying segments allows you to build the best model for enhanced return for your organization,” Power said.

“The market doesn’t move in a single monolithic manner. Even in the midst of traditional soft market cycles, experienced underwriters are likely to identify attractive risk sub-segments that are performing well. Understanding the difference between those underlying segments allows you to build the best model for enhanced return for your organization,” Power said.

Lexington has taken that micro-segmentation approach by underwriting flood risk — an area many insurers choose to avoid.

“It’s an individual peril where we believe that we could make a market and have been able to build a really robust business,” Power said.

But focusing on a micro-market requires a high level of expertise in its specific risks, as well as a degree of patience. Understanding whether a segment will perform well for your book of business means watching it over a period of years to monitor loss trends and profitability potential. “We began focusing on flood risk over a decade ago, writing excess flood, building internal models, and creating a better understanding the peril and how it should be priced. There was a lot of learning that went on over the better part of a decade before we felt comfortable entering the market on a primary basis,” Power said.

Innovation

Achieving sustainable growth and preparing for the needs of tomorrow’s customer also requires an eye for innovation. Lexington Insurance has built a sustainable culture of innovation over the last 50 years, which is reflected in their ongoing Innovation Boot Camp Series. Innovation Boot Camp (IBC) is a 12-week immersion program designed to take 30-40 Lexington employees through an in-depth curriculum focused on innovation both within the insurance industry and in the broader economy. At the end of the program, participants are divided into groups and tasked with presenting an innovative idea, whether it’s a new product, new business, or new internal solution. Now on its 20th iteration, IBC has been successful in not only driving out-of-the-box ideas, but in cultivating a culture of innovation.

Achieving sustainable growth and preparing for the needs of tomorrow’s customer also requires an eye for innovation. Lexington Insurance has built a sustainable culture of innovation over the last 50 years, which is reflected in their ongoing Innovation Boot Camp Series. Innovation Boot Camp (IBC) is a 12-week immersion program designed to take 30-40 Lexington employees through an in-depth curriculum focused on innovation both within the insurance industry and in the broader economy. At the end of the program, participants are divided into groups and tasked with presenting an innovative idea, whether it’s a new product, new business, or new internal solution. Now on its 20th iteration, IBC has been successful in not only driving out-of-the-box ideas, but in cultivating a culture of innovation.

“It’s been an incredibly successful program, and a great model for us to think about how we can create new products, new income streams, and new sources of value for our customers.” Power said. “One of the core teachings in the IBC curriculum is that innovation is everybody’s job. In order to move the needle in our industry, everybody has to be thinking about it.”

Preparing for Risks of the Future

But innovation goes beyond products and services. Lexington has also harnessed the development of technology in data analytics, modeling and interconnectivity by strategically partnering with start-ups and accelerators focused on reducing risk.

But innovation goes beyond products and services. Lexington has also harnessed the development of technology in data analytics, modeling and interconnectivity by strategically partnering with start-ups and accelerators focused on reducing risk.

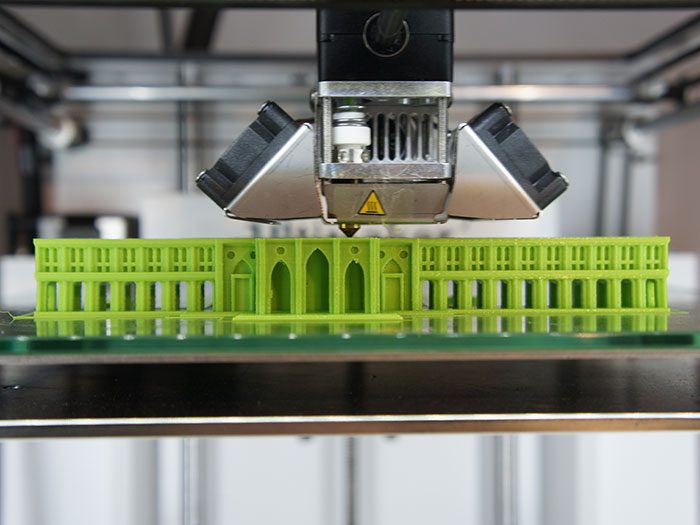

New technologies that utilize rapid sequencing laser-aided photography to create 3D images of rooms and buildings are creating new risk mitigation techniques. On a construction site, those images provide contractors and engineers with the ability to memorialize key phases of the construction process in a way that allows users to examine actual work even years after completion.

New sensor technologies can track change in atmospheric conditions, temperature fluctuation, or moisture, and send an alert to stakeholders like the project owner, insurer and site foreman that conditions that may lead to damage or physical loss are present and require intervention.

With that data in hand, a loss can potentially be prevented before it occurs.

Emerging technologies like these, along with other technologies like safety wearables, can work together to make an entire work site safer while also improving product quality. “I think that’s really exciting because over time as these technologies are introduced, they will begin to shift the associated loss experience in those industries that adopt them,” Power said.

Power also described a recent start-up that equipped a van with sonar detectors in order to identify where underlying support in roads was weakening or washing away, indicating that a pothole was imminent. Such data could help public works departments fix problems before they emerge — and prevent a lot of damage.

“Think about what that could mean for an airport, or a commercial real estate company that has live roadway systems, or a municipality,” Power said. “I’m saying to these innovators, ‘have you thought about the insurance industry?’”

To learn more about Lexington Insurance, a member of AIG, interested brokers should visit http://www.lexingtoninsurance.com/.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Lexington Insurance. The editorial staff of Risk & Insurance had no role in its preparation.