Sponsored Content by QBE

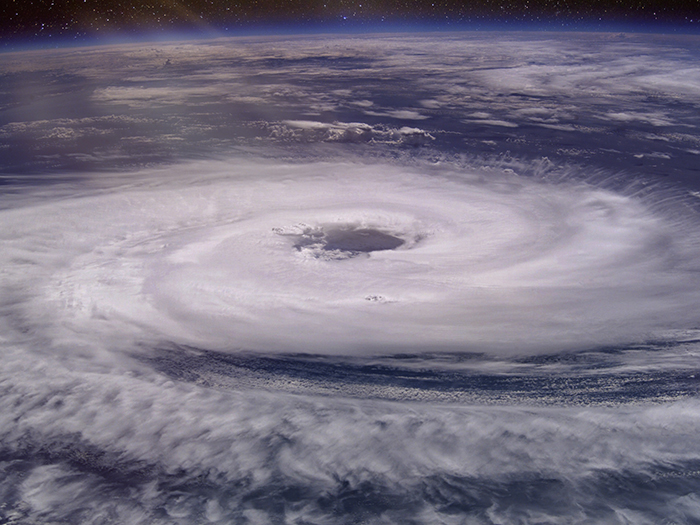

How Technology Is Significantly Impacting the Claims Process for Hurricane Losses

Since Hurricane Matthew hit the shores of Haiti and the southwestern United States in 2016, catastrophic-sized storms have dropped historic amounts of rain. While building codes and other measures have helped curb the impact of wind damage for insureds, the vexing challenge of water and flood damage has kept many insurers on their toes.

2017’s Hurricane Harvey alone dumped more than 27 trillion gallons of rainwater over Houston, creating property damage as well as lasting mold and other environmental hazards. It remains the wettest hurricane on record, causing $125 million in damages.

“At QBE, we’ve seen more than 50% of hurricane claims starting in 2016 involve water damage,” said Alyssa Hunt, head of technical operations, QBE North America.

The recent hurricane activity was one of the key factors prompting QBE to seek out new platforms that are able to respond to and address water damage head on.

“Post-loss response time is critical for water and flood loss,” said Hunt. “New technologies can lead the charge and help us better serve our customers when they need it most.”

Technology and Targeted Communication

Eric Sanders, Senior Vice President, Claims, QBE North America

Eric Sanders, senior vice president, claims, QBE North America, said water has become one of the most prevalent post-hurricane risks. It’s why “we’re building technologies to accommodate those types of losses that can lead to mold or structural issues, and the ensuing increase in customer stress, if not addressed quickly,” he said.

Communication before the start of an impending storm can go a long way for both confidence on the side of the customer and mitigating loss.

“Each storm comes with some uncertainty,” explained Sanders. “That uncertainty raises several questions: How intense will the hurricane be, how much water is it carrying, and how many and which customers are in the projected path of the storm?

“Our CAT modeling team is able to assess where our policyholders at risk are. From there, we can send many of our customers a proactive message alerting them to the possible dangers,” said Sanders.

This first line of contact through proactive messaging drives the conversation between insurer and insured. Targeted email alerts to customers act as a reminder to put top safety measures in place before the storm hits, as well as provide insureds with information on how to report a claim if need be.

Hunt said that communication doesn’t stop with the customers, either; QBE’s team is working with the adjusting companies, first-notice-of-loss partners, mitigation partners and more to make sure the claims process is easy and accessible for the customer.

“The ultimate goal is to think about minimizing loss and how to help customers detect water damage sooner and prevent or mitigate it faster,” Hunt said.

Reporting Through Virtual Assistance

Alyssa Hunt, Head of Technical Operations, QBE North America

When a business has been damaged by a hurricane, establishing the first line of communication with an insurance carrier can provide a huge sense of relief for the customer and help in improving the speed of mitigation efforts.

TextQBE is one way to go.

“TextQBE is our texting platform that’s equipped with an intelligent virtual assistant,” said Hunt.

“It speeds up the claims process because it enables the customer to capture damage on their property in moments using a smartphone,” added Sanders.

This texting platform automatically acknowledges the receipt of a claim via text and puts customers in contact with an adjuster, which is beneficial for both claimant and insurer. The number of field adjusters has declined in recent years, exacerbating the shortage of boots-on-the-ground adjusting that often develops after a major hurricane.

Having limited access to adjusters in the wake of a storm can significantly impact the length of a claim. But technologies like TextQBE alleviate the pressure and lead to faster estimating.

“Customers capture hurricane damages on their phone through video or photos. The automatic assignment platform brings that claim with those images to the adjusters, who can then handle the claim remotely,” said Hunt.

QBE reports that virtual adjusting has cut down the estimating process time by as much as 40% since they implemented it into the claims process.

“The ultimate goal is to think about minimizing loss and how to help customers detect water damage sooner and prevent or mitigate it faster.”

— Alyssa Hunt, Head of Technical Operations, QBE North America

Embracing the Benefits of 3D Modeling

Continued technological advancement has led to even more streamlined claims estimating and mitigation. 3D modeling is one of the latest advancements that has done just that.

Sanders said, “We’ve got all these great technologies helping us model the interior and exterior of a property, which dramatically changes how the property itself is assessed.”

Customers who take pictures of the exterior of their business can upload the images into an app. The app will then create a 3D model of the building using an algorithm. It renders an accurate scale of the property with measurements included.

3D interior modeling is also coming into play. Instead of sending a field adjuster, mitigation technicians equipped with a 3D-camera can quickly and accurately measure interior dimensions in a fraction of the time it would take with a laser-measuring device.

“The 3D modeling process has two great benefits: First, moderate claims are being assessed faster. Second, licensed field adjusters can concentrate on more complex, higher value activities than measuring,” said Sanders.

And, said Hunt, the business owner will always have this 3D model of their property for any future incidents, making the claims process run that much more smoothly.

Partnering With the Right Team

“A claim after a hurricane is not a financial transaction; it’s an emotional one,” Sanders said. “Customers are dealing with a very real catastrophe, and they want their carrier positioned to provide them with fast, personal assistance.

“We’re working on the kind of technology that’s geared towards achieving those goals at QBE,” he said.

From its texting platform down to its post-storm 3D modeling, QBE is working to proactively get in front of the customer and place them in the driver seat of their claims.

“We’re constantly thinking about which solutions make the most sense, that make it convenient for the customer,” said Hunt.

At QBE, they know the quality of the vendor engaged after a hurricane greatly affects customer experience as well as the outcome of the claim. Utilizing the top technologies in place, QBE is dedicated to accelerating the mitigation and estimating process as well as improving customer service.

To learn more, visit https://www.qbe.com/.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with QBE North America. The editorial staff of Risk & Insurance had no role in its preparation.