Sponsored: myMatrixx

From Reactive to Proactive — Combining Clinical and Data Expertise for Optimal Pharmacy Outcomes

Pharmacy management in workers’ compensation has been reactive by nature. Historically, pharmacy benefit managers (PBMs) did not have insight into a prescription for a potentially dangerous drug until the injured worker filled the prescription at their local pharmacy. By the time any intervention happened, the patient had likely already taken the drug.

“In the past, we haven’t always known something was happening until a pharmacist processed the prescription. That’s why we managed the clinical side of the industry retrospectively,” said Phil Walls, Chief Clinical Officer, myMatrixx.

Of course, preventing a problem in the first place is always preferable to fixing one that’s already happened.

For clinical pharmacy oversight to truly make a difference in the life of a claim, PBMs need to be able to get out in front of potentially dangerous or inappropriate prescriptions, even preventing them from being written at all.

The need for pharmacy management to become more proactive is clear, and the myMatrixx team believes the solution lies in the integration of true clinical expertise with comprehensive data and artificial intelligence (AI)-driven analytics.

“We’re moving our approach earlier and earlier in the process so we can progress from being reactive to proactive, and eventually fully predictive,” said Cliff Belliveau, Vice President of Business Intelligence at myMatrixx. “That requires a symbiotic relationship between clinical expertise and advanced data analytics.”

Continuation of a Journey Towards Earlier Intervention

Phil Walls, Chief Clinical Officer, myMatrixx

In 2006, myMatrixx launched its Get Ahead of the Claim clinical pharmacy strategy. This program provided a strategy for the clinical pharmacists at myMatrixx to intervene on behalf of the injured patient. Through early intervention, this approach lowered the risk of unnecessary and inappropriate drug therapy and saved countless injured workers’ lives during the devastating opioid overdose epidemic.

According to myMatrixx’s latest Drug Trend Report, client opioid utilization has been reduced by more than 40% over the past three years.

“But that’s not good enough. We still see legacy cases where injured patients receive excessive doses of opioids, new claims where marijuana is actually considered a path to return to work, claims for an aging workforce that are managed the same as one for a younger worker, as well as emerging threats such as the dispensing of egregiously priced private-labeled topical products by prescribers,” Walls said.

PBMS also must contend competing and equally valid concerns from other stakeholders involved in a patient’s care. Is it acceptable to prescribe alternative drugs regardless of cost? Is it appropriate to accept liability associated with care that focuses on pain management rather than function?

“These concerns sent us down the path of discovering if we could be advocates to both the injured patient and others involved in his or her care, and the answer is a resounding ‘yes,’” Walls said.

“The key is to intervene on problematic prescriptions even earlier than Get Ahead of the Claim allows. To focus on preventing problems rather than solving them. That led us to develop a strategy that allows us to become more and more proactive and even predictive as technology allows.”

Data is a Key Component of Proactive Pharmacy Management

Cliff Belliveau, Vice President of Business Intelligence, myMatrixx

The first step of that strategy involved an examination of what could be accomplished with existing clinical tools.

For example, myMatrixx’s data analytics platform, Clinical Analytics Results Engine (CARE), captures a patient’s entire case history. Knowing what didn’t work before enables the development of a more effective treatment plan going forward. It also monitors new data generated on that case in order to track improvement.

“If you bring the data together, it will tell the story for you,” said Walls. “That insight, combined with the knowledge and expertise of our clinical pharmacists, is necessary to redirect these claims and hopefully break the cycle of dependency.”

Additional prescribing and drug data is also generated from myMatrixx’s Alert, Review and Manage (ARM) and One Drug Review programs.

Geared toward new injuries, these early intervention programs monitor prescriber activity and review single questionable prescriptions. They are less comprehensive, but nonetheless add to a growing database of information that can be used to spot troubling trends as they take shape.

The growing popularity of electronic prescribing will make it even easier for PBMs to spot problems even earlier. “With e-prescribing, we’re no longer waiting on the pharmacists to enter prescriptions into the computer system. As soon as the prescriber transmits the prescription, we capture that data and have the opportunity to intervene at the point of prescribing as opposed to the point of dispensing” Belliveau said.

Pharmacovigilance — Leveraging Data to Stay Ahead of Dangerous Drugs

All of that data lends itself to the development of predictive models. AI and machine learning platforms may be able to see familiar trends emerge and raise red flags over drugs that aren’t even on the radar yet.

This will be critical to get ahead of the next wave of dangerous drugs — and there will always be another wave.

“When I first started in workers’ compensation, the number one drug of concern in this industry was Prozac. Can you imagine today if the only thing we had to worry about was the overuse of antidepressants? But that was a really big deal before compounds or opioids had become problematic,” Walls said.

“Pharmacovigilance is monitoring all dangerous drugs. And that can include a broader category of substances than most people realize.”

Benzodiazepines, tranquilizers, amphetamine and even nonsteroidal anti-inflammatories (NSAIDs) are all included in this group. NSAIDs increase the risk of GI incidences and stomach ulcers, which will require their own pharmaceutical treatment. They are also associated with increased risk of cardiovascular events like arrhythmias.

A skilled pharmacist may understand the risks of NSAID overuse, but assessment can’t happen on a broad scale without a similarly broad view of the prevalence of NSAID prescribing.

“A lot of these pharmacists go and look at all these scripts like a long accounting measurement. And what we want to do is scale the ability to effectively look for all dangerous drugs, or drugs that can be abused or misused,” Walls said. “We need to be able to use the data and leverage that with the thought process and the knowledge of pharmacists. And we need to do all that to scale.”

A Comprehensive Suite of Clinical and Data Solutions, Focused on Proactive and Predictive Modeling

Leveraging data and expertise to predict and prevent problems is what every PBM aspires to, but the task is easier said than done.

The key, Walls said, lies in integration. Individually, data platforms, business intelligence reporting and clinical intervention programs cannot support the goal of becoming proactive if they exist in silos. Holistic patient advocacy is vital in the care of an injured worker.

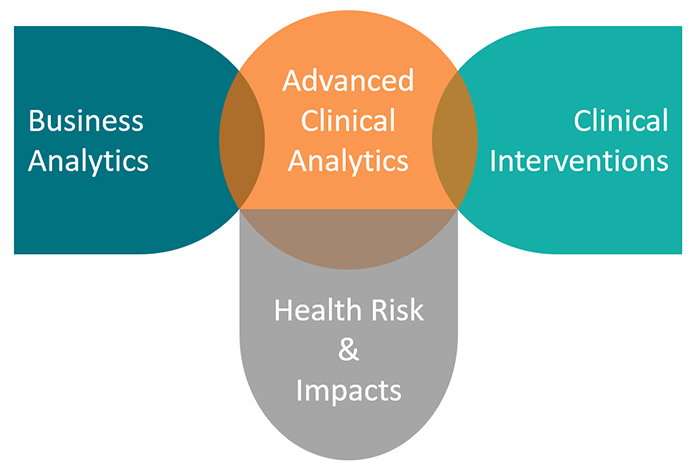

That’s why myMatrixx created the myMatrixx myRxAdvocateSM program, a portfolio of clinical and data services that work together to connect insights and drive more effective intervention strategies. Analytics and reporting platforms, intervention programs, formulary rules and other services are all pulled under one roof to create a comprehensive suite of solutions.

“myRxAdvocate is really about bringing clinical pharmacy expertise and data analytics together to drive lower costs and better pharmacy outcomes in the short term, while enabling pharmacovigilance over the long term,” Walls said, “and it allows us to be advocates to not only the injured patient, but to all stakeholders involved in the care and management of an injured patient.”

“It is an expansion of what we offer now, but with more cohesiveness. It’s more data-driven,” Belliveau said.

In the end, proactive intervention produces better clinical pharmacy outcomes for injured workers. Their safety and recovery are kept top of mind. Better still, the cost savings associated with acting early can be measured definitively.

“When we do the right thing clinically, everyone wins,” Walls said.

To learn more, visit https://www.myMatrixx.com/.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with myMatrixx. The editorial staff of Risk & Insurance had no role in its preparation.