Aviation Safety

Danger in the Cockpit

Improved risk management, advances in computer technology and an industry-wide focus on training and analysis transformed commercial aviation safety in recent decades, placing it among the safest industries in the world for both staff and customers.

Pilots now have their every input monitored and analyzed. This enables retraining of bad habits and a common aspiration to fly “the perfect flight.”

Improved airplane construction and in-flight safety systems also reduce the likelihood of system malfunction to a miniscule level.

However, a spate of unusual events in 2014 and 2015 serve as a tragic reminder of the ever-evolving challenges facing risk managers.

“Airlines are very determined when it comes to safety and security threats — they are constantly trying to mitigate risk, are very proactive in dealing with threats as they arise, and money is no object when it comes to implementing new safety measures.” — Nigel Weyman, CEO of aerospace, JLT

In July 2014, Malaysia Airlines Flight 17 was shot down over Ukraine by a rogue Russian missile, killing all 298 passengers> This occurred just four months after the same airline’s Flight 307 simply disappeared — prompting many to speculate that its pilot committed suicide, taking 239 passengers with him.

This once inconceivable scenario occurred again less than a year later. In March of 2015, Germanwings co-pilot Andreas Lubitz locked himself in the flight deck and deliberately crashed Flight 9525 into a mountain in the Alps, killing 150 people.

Lubitz reportedly endured severe depression in the weeks leading up to the crash, but his doctors never told Lufthansa, his employer.

Within days of the Germanwings disaster, the vast majority of airlines introduced a rule that there must always be two members of crew in the flight deck at any one time (“two-pilot rule”), while the shooting down of Malaysia Airlines Flight 17 prompted carriers to re-evaluate routes, security threats and safe altitudes over certain geographical areas.

“Airlines are very determined when it comes to safety and security threats — they are constantly trying to mitigate risk, are very proactive in dealing with threats as they arise, and money is no object when it comes to implementing new safety measures,” said Nigel Weyman, CEO of aerospace at JLT.

Malicious Acts Offset Operational Safety Achievements

“The whole airline industry is benefiting from an improved period of operational safety, but malicious acts, from pilot suicides to the deliberate or accidental shooting down of aircraft, seem to have taken the place of expected operational losses, creating a sad counterbalance to what would otherwise be a very encouraging period for the sector.

“Psychological and terrorist losses are difficult to predict,” Weyman said.

Aviation regulatory bodies are currently discussing, with input from airlines and pilots, whether to make the two-pilot rule mandatory, but not all airlines buy into the logic behind it, according to a pilot for one of the world’s leading airlines, who wished to remain anonymous.

“My airline has been reluctant to implement [the two-pilot rule], and even Lufthansa resisted it initially before backing down due to media pressure,” he said, warning that implementing a “knee-jerk reaction” could increase an aircraft’s vulnerability to terrorism.

“There are in excess of 35 million commercial flights globally each year and only one known case of pilot suicide in European airspace history, so you have to weigh up the risks,” he said.

“If a terror organization wanted to plant a sleeper on a plane, it is far easier for a radicalized person to be employed as cabin crew than to pass the pilot exams.

“Many of my colleagues feel safer trusting the pilot community, and keeping the flight deck a pilot-only environment, as the chance of a pilot committing suicide is so slim it is not worth the risks associated with giving crew access to the flight deck.”

It could be argued that some aspects of the Germanwings disaster are rooted in the industry’s reaction to 9/11.

Following that attack, all airlines installed armored flight deck doors to prevent terrorists entering the cockpit — making it virtually impossible to break in if a suicidal pilot decided to lock themselves in.

There’s the rub; in mitigating one risk, you often create new ones.

“You can’t eliminate every risk from every aviation operation, no matter how miniscule those risks might be, and that’s why people buy insurance,” said Weyman.

Insurance Protection for Malicious Acts

Malicious acts by either staff or third parties are currently covered under stand-alone hull war policies, though passenger liability is covered under airlines’ standard hull liability programs.

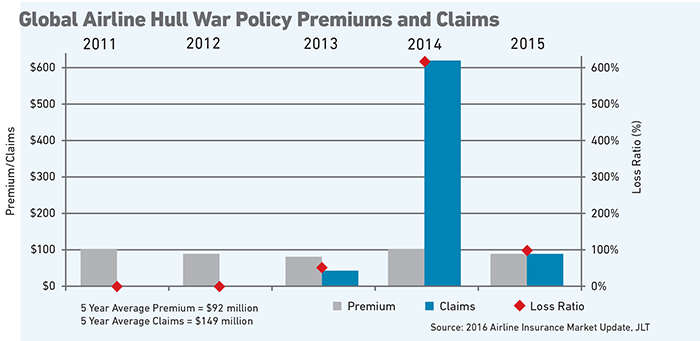

Weyman noted that, in spite of a number of significant losses between 2013 and 2015, rates continue to slide.

“This is partly because we brokers have argued that these were very unusual events, the industry has closed the door on this happening again, and the world moves on,” he said.

“Mathematically, rates probably should have increased, but the aviation market is very competitive and overserved with capacity, preventing underwriters from reacting to these events.”

“Insurers,” said Richard Power, founding partner of specialist aerospace underwriter Altitude Risk Partners, “must determine whether the recent spike in this kind of incident is a temporary anomaly or whether it is indicative of heightened risk going forward.”

Power noted that the subjective nature of the risk — and the fact that pilot trade unions have resisted the introduction of psychometric testing and the sharing of pilots’ medical information with employers — make it extremely difficult to predict how frequently malicious acts will occur or how effective new security measures will be in preventing future incidents.

“One option may be for the insurance industry to exclude malicious acts from the standard hull liability policy,” Power said.

“Unlike modeling the frequency of losses caused by mechanical failure or human error, underwriters are now faced with the challenge of pricing a much less tangible and quantifiable risk, and it may therefore be necessary to separate malicious acts out into its own separately rated policy, as is done with hull war.”

Power added, however, that brokers and clients have no incentive to accept such changes in the current environment.

The aviation insurance industry is awash with capacity and aviation insurers are under pressure to broaden terms while cutting their cost base, giving them little room for leverage.

Spotting the Warning Signs

So far, there has been no repeat of the Germanwings disaster.

While it is impossible to tell whether a similar incident would have occurred without the new two-pilot rule, the tragedy has undoubtedly brought pilot mental health firmly into the spotlight.

“The best way to prevent another Germanwings is to catch the problem at its source and stop troubled individuals from flying,” the pilot said.

His airline has increased the psychological component of its annual medical checks.

“The best way to prevent another Germanwings is to catch the problem at its source and stop troubled individuals from flying.” — anonymous pilot

It created a new “well-being officer” role, and encourages staff to “self-regulate” by coming forward with concerns about either themselves or others without fear of judgment or punishment.

French air crash investigators in March called on aviation authorities around the world to take this one step further by loosening existing privacy laws to allow doctors to inform airlines if a pilot is mentally unstable.

This clearly presents a complex ethical conundrum.

On a practical level, the pilot said, it is essential that troubled pilots are able to seek counseling confidentially.

“The emphasis has to be on the pilot being able to pick up the phone and talk about their problems and get advice,” he said.

“If they think what they say will be reported back to the airline, they may fear they are risking their careers and decide not to make the call at all, which is far more dangerous.”

However, he added, it is important to keep the risks in context.

“Aviation is so safe now,” he said.

“We dedicate a huge amount of time and resources to identifying and removing what minute risks exist, with the aim of making every flight so accurate that the chances of a crash are one in a billion.”