Sponsored Content by CorVel

Case Study: How Big 5 Saved Big

Big 5 Sporting Goods began as five Army-Navy surplus stores in Southern California when it opened in 1955. Since then, the company evolved its brand and has successfully remained a sports retail leader. Big 5, publicly traded since 2002, employs over 9,000 people in over 430 stores across 11 western states.

Challenge

One major challenge for the company was the widespread employee population and retail hours. Injuries occurring during the weekend were not reported timely and medical care and treatment were delayed. To resolve the issues, Big 5 began to explore a 24/7 nurse triage program. Big 5 wanted a program that would allow employees to report a claim from any location at any time. This would not only facilitate and streamline the claims reporting process, but would also direct care and authorize treatment at facilities.

In 2013, Big 5 partnered with CorVel to alleviate this challenge by implementing immediate intervention via 24/7 nurse triage during early claims reporting, in addition to CorVel’s full suite of services.

“Our team members are our most important assets and when one of them sustains a work related injury, they deserve to receive prompt and effective medical treatment. We need to leverage technology for employees that work a non-traditional schedule. With CorVel, we look forward to more technology driven solutions that result in best outcomes for every Big 5 employee.”

Karen Nash, HR Supervisor, Benefits & Disability

Trust the Process

At first, there was a slight challenge to receive buy-in for the immediate intervention model as this was a big change for the employees. However, everyone quickly understood the long-term benefits of reporting an injury and seeking treatment if needed. Utilization has since been at an all-time high, increasing the percentage of claims initiated through nurse triage from 75% in 2013 to 95% in 2017.

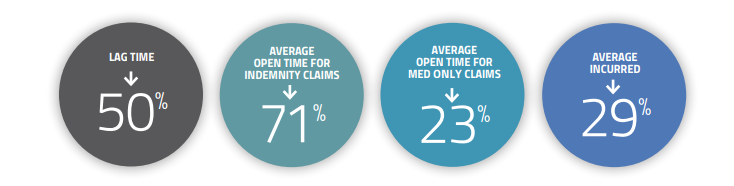

By focusing on removing hurdles for reporting a claim, Big 5 has seen dramatic changes across their claims book of business. Average open time for indemnity claims has dropped 71% and average incurred rates dropped 29%.

High Five Worthy Savings

Additionally, Big 5 has seen savings program wide. Big 5 experienced steady increases in their pharmacy savings, up 95% since program implementation, which can be attributed to getting pharmacy cards into the hands of injured workers from the outset of the claim.

Like the mantras of the weekend warriors and athletes that frequent Big 5’s stores, similar concepts can be applied to the company’s workers’ compensation program – practice makes perfect, mind over matter, to name a couple. Now, with the resources they have set in place, and their eyes on the prize of continuous improvement and savings, Big 5 is set up for sustainable success.