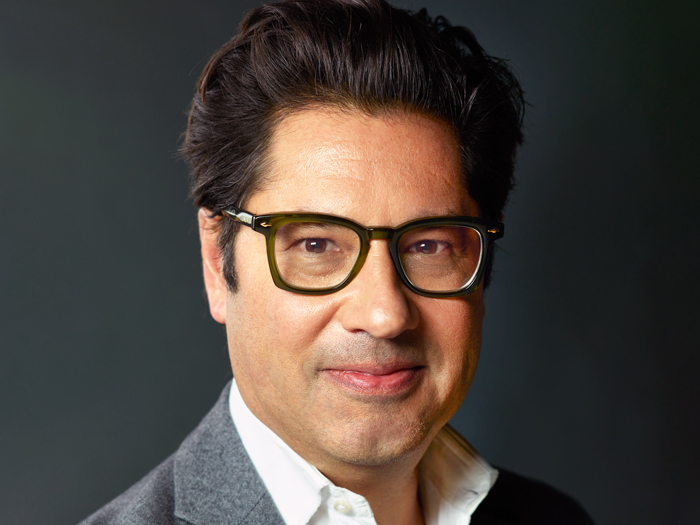

2015 Risk All Star: Jeannie Garner

A Firm Hand at the Wheel

Residents of Florida’s cities and towns can be thankful that nature has spared them the fear and chaos of a major hurricane landing for the past nine years.

They should be doubly thankful that for much of the last six years, Jeannie Garner, director of insurance and financial services for the Florida League of Cities, has been hard at work creating a systemic disaster recovery program that will serve all 600-plus members of the league’s insurance pool.

With a background in finance, Garner was given the insurance position when the league’s previous insurance director stepped aside. In the aftermath of Hurricanes Charley (2004) and Wilma (2005), both of which resulted in billions in losses, the league’s insurance staff was understandably focused on building up surpluses.

But when Garner took over, she added a focus on creating a FEMA-compliant disaster recovery plan that would strengthen the resiliency of the pool’s members. To do so, she had to spend a little money — actually, a lot of money.

“We invested in some new services and some new programs, I don’t want to say it was risky but you have to spend money,” Garner said.

So meticulous are the program’s assessments and surveys for creating insured values, that Garner and her team have not only a picture of every insured public building on the program, but every bench and every coat hanging in every municipal fire department.

“We invested in some new services and some new programs, I don’t want to say it was risky but you have to spend money.”

The disaster recovery program also includes a turnkey claims system. Should an event occur, members of Garner’s team will be on-site, paying claims and vendors.

The system is also integrated with FEMA, so that claims information received by the league’s administrators is automatically shared with the administrators of the federal emergency program.

This has been no small task.

“It’s taken us years,” said Garner, who says her team has spent much of the past three years traveling to cities and towns covered by the league’s insurance program to fine-tune participation.

“We feel now that even though we haven’t had a hurricane in nine years, we’re ready,” Garner said.

Well, at least 75 percent of the pool’s members are ready. Garner and her team are still working with some of the smaller towns, with understandably limited resources, to integrate them into the disaster recovery and claims system.

That’s not all that Garner has done with the state’s insurance pool members. Over the last six years, she also launched a wellness program, Hometown Health, which features two full-time wellness coordinators who visit each member city of the pool, providing biometric screening, smoking cessation programs, diabetes awareness programs, or whatever is most needed in each location.

“It also took money. It was something that took a lot of consideration. But I think it is something that is going to pay off long term,” she said.

Is she done? No, 2015 Risk All Star Jeannie Garner is not done. The Florida League of Cities is also the only public insurance pool that Garner knows of that has gone to the capital markets for reinsurance CAT bond protection.

The pool issued a total of $40 million in CAT bonds and is going back out to the markets with that amount in 2016.

“That was something that, because of my finance background, didn’t frighten me. For insurance people it was a little frightening,” Garner said.

_____________________________________________

Risk All Stars stand out from their peers by overcoming challenges through exceptional problem solving, creativity, perseverance and/or passion.

Risk All Stars stand out from their peers by overcoming challenges through exceptional problem solving, creativity, perseverance and/or passion.

See the complete list of 2015 Risk All Stars