6 People on the Move

Allied World Appoints SVP of North American Accident & Health

Allied World Assurance Company Holdings, Ltd (Allied World) recently hired James Walloga to serve as senior vice president of its new North American accident and health (A&H) division.

Walloga will be responsible for the strategy, management and underwriting of the division.

Joe Cellura, president, North American casualty, commented, “We see great opportunity and need in the A&H market and are thrilled to have someone of James’ caliber and experience to build out this new division.”

Walloga brings 25 years of A&H experience to Allied World having held various leadership and underwriting management roles in the sector.

Most recently, Walloga was responsible for the strategic direction, operations, underwriting profit and new business growth of the North America specialty accident and health business at Chubb, according to a press release.

Lou Iglesias, Allied World’s president & CEO, commented, “We are very excited to have James join Allied World. He is a strong A&H executive with a proven track record.”

“I have great confidence that James will be successful in building out the division and further diversifying our overall product offerings,” Iglesias added.

One Call Announces New Chief Operations Officer

One Call has appointed workers’ compensation industry veteran, Patty Onion, to the role of chief operations officer overseeing operations and service delivery for the company.

Onion has more than 20 years of leadership experience in the workers’ compensation industry spanning operations, sales, data management, and business development, according to a press release.

Prior to joining One Call, she was chief executive officer at Berkley Medical Management Solutions. Her industry tenure also includes previous leadership roles at Coventry Workers’ Compensation Services and Premera Blue Cross (Calypso).

“Patty is an excellent addition to our leadership team,” said Jay Krueger, One Call president.

“Her extensive experience and demonstrated success in the workers’ compensation industry will be instrumental as we continue to optimize our operations organization to deliver exceptional service to all of our stakeholders.”

The Hartford Names Head of Navigators Wholesale

The Hartford has named Michael Garrison as head of wholesale for Navigators, a brand of The Hartford, to lead the strategic direction, growth, and underwriting for the business. He will also be responsible for managing relationships with the company’s wholesale distribution partners, according to a press release.

“Michael’s deep knowledge and extensive expertise in a broad range of specialty lines, both domestic and internationally, will be a tremendous asset as we continue to invest in and grow our wholesale franchise,” said Adrien Robinson, The Hartford’s head of global specialty.

Garrison brings more than 28 years of insurance industry experience to The Hartford as well as a broad range of business insights in global risk, according to a press release.

Before joining The Hartford, he was president, head of global construction and international first-party lines at Allied World, after being president, Asia Pacific based in Singapore for the company.

He also held the role of senior vice president and chief underwriting officer at Starr Companies where he “created and developed first-party underwriting platforms for international onshore energy, global construction, global exploration & production, and international general property,” per the press release.

Robinson added, “We are in the midst of an historic global market transformation, and Michael’s leadership will only strengthen our commitment and ability to continually provide valuable solutions to unique and complex risks in primary and excess casualty, financial lines, property, inland marine, transportation and environmental.”

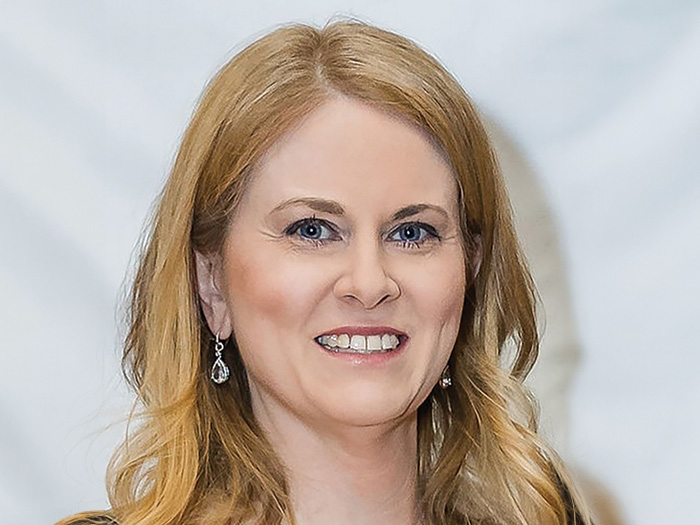

HUB International Hires North American Complex Risk Practice Leader

Hub International Limited (HUB) recently launched its North American complex risk practice tapping Mary-Beth Hahn to lead the practice.

Hahn will lead the development of the practice and its overall strategy, “enhancing its capabilities with talent development and recruitment, and creating products and resources for complex risk issues,” according to a press release.

“Whether changing business models as a result of COVID, or confronting emerging risks like cyber, nuclear verdicts or increases in catastrophic weather events, our clients are facing complex risk issues from every direction,” said Marc Cohen, president and CEO of HUB International.

“Mary-Beth’s extensive expertise and leadership combined with HUB’s existing boundaryless network of specialists throughout North America will formalize our solutions to transfer risk, retain risk and manage losses for any size organization from Fortune 500 to middle market.”

Hahn joins HUB from Wells Fargo/USI where she previously led the risk management practice. She brings more than 30 years of experience providing consultative risk advice and alternative risk solutions.

Liberty Mutual Appoints New Executive Vice President for Global Risk Solutions

Liberty Mutual Insurance has appointed Neal Bhatnagar as executive vice president, major accounts casualty, global risk solutions (GRS).

Bhatnagar was previously head of field operations at Chubb Global Casualty where he was responsible for overseeing Chubb’s U.S. risk management and multi-national casualty business. He also has held roles at Zurich, The Hartford and State Farm.

“Neal has demonstrated a strong track record of success through his senior leadership roles in the risk management and casualty space for the past decade,” according to GRS President, Major Accounts, Mike Fallon.

“His strategic approach, deal-making passion and broad relationships will foster continued growth and a broker- and customer-centricity for our Major Accounts Casualty division,” Fallon added.

At Liberty, Bhatnagar will oversee the underwriting and risk management teams for a national accounts portfolio that includes construction and healthcare, as well as excess casualty and sharing economy expertise, per a press release.

Vesttoo Names Expert Insurance Analyst as Portfolio Manager

Global reinsurance and investment platform, Vesttoo, has named Robert Hauff as portfolio manager for its Insurance Linked Program (ILP).

Hauff previously served as the managing director of fixed income research at Wells Fargo Securities and brings over two decades of experience in insurance and finance to his new role at Vesttoo.

“We are thrilled to add Robert – one of the foremost insurance analysts in the sector – and his deep understanding of fixed income and capital markets,” said Yaniv Bertele, CEO and Founder of Vesttoo.

“As a highly accomplished leader within the financial services industry, and an expert in leading growth initiatives, Robert will help Vesttoo bridge the reinsurance funding gap with our ILP program.”

In addition to establishing the ILP investment strategy at Vesttoo, Hauff will be charged with overseeing day-to-day operations of the program, leading research for insurance-linked opportunities, and serving as one of Vesttoo’s primary liaisons to insurers and investors, according to a press release.

“Vesttoo is the perfect opportunity for me – combining advanced technology with sound alternative investments. This is the future of the industry,” Hauff, said.

“They have been extremely successful at bringing together insurers and investors and expanding the alternative reinsurance market. I’m excited to join their global team and help deliver results for our clients and industry partners,” he added. &