The Profession

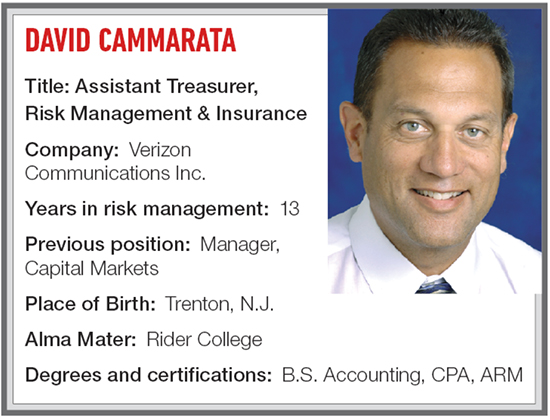

David Cammarata

R&I: What was your first job?

I was a financial analyst with the N.J. Casino Control Commission.

R&I: How did you come to work in risk management?

I was told at a Christmas luncheon in 2003 that I was being promoted into a new job.

R&I: What is the risk management community doing right?

I think the risk management community is getting a lot better at utilizing big data and analytics to manage risk. Significant improvements have been made, but there is still much more room for improvement.

R&I: What could the risk management community be doing a better job of?

I think that the insurance and brokerage communities need to really start thinking about what this industry is going to look like in 10 years. They need to start addressing how they are going to remain relevant. I think that major disruptions to existing business models will occur and that these disruptions combined with innovation and technological advances may catch many of today’s industry leaders by surprise.

David Cammarata, assistant treasurer, risk management and insurance, Verizon Communications Inc.

R&I: What was the best location and year for the RIMS conference and why?

San Diego, any year.

R&I: What’s been the biggest change in the risk management and insurance industry since you’ve been in it?

I think the advent of cyber risk and cyber insurance. For several years it has been, and it continues to be, the main topic of discussion at industry meetings.

R&I: What emerging commercial risk most concerns you?

I think the most scary scenarios include a nuclear, biological, chemical or radiological event, a widespread global health epidemic and/or a widespread state sponsored cyber shutdown.

R&I: How much business do you do direct versus going through a broker?

We do almost all of our business through a broker.

R&I: Is the contingent commission controversy overblown?

No. It’s a conflict.

R&I: Are you optimistic about the U.S. economy or pessimistic and why?

Optimistic because hopefully President Trump’s policies (lower taxes and less regulation) will be pro-business and good for the economy.

R&I: Who is your mentor and why?

My dad, who passed away many years ago. He was very influential during the formative years of my career. He taught me how important integrity and reputation were to your brand and he had a very strong work ethic.

R&I: What have you accomplished that you are proudest of?

I would have to say raising two awesome kids. My daughter is graduating from James Madison University this year as co-valedictorian. My son is finishing his sophomore year at Rutgers and has near perfect grades. But more importantly, both of my kids have turned out to be really good people.

R&I: How many emails do you get in a day?

A lot.

“I love it when the risk management organization is able to contribute in a way that makes a real impact to the corporation’s overall objectives. On several occasions we have been able to make real contributions to the bottom line.”

R&I: What is your favorite book or movie?

“My Cousin Vinny.” That movie makes me laugh no matter how many times I watch it.

R&I: What’s the best restaurant you’ve ever eaten at?

My dad used to take me to a place called Chick & Nello’s. It was an Italian place that did not have a menu. They came to your table and told you the two or three items they were making that day. The food was out of this world.

R&I: What is your favorite drink?

Iced tea. The non-alcoholic kind.

R&I: What is the most unusual/interesting place you have ever visited?

I can think of several places but for me it would be a tie between India and Italy. India just has such a different culture and way of life and Rome has breathtaking historical sites.

R&I: What is the riskiest activity you ever engaged in?

Well, one of the best thrill rides I’ve been on was Kingda Ka at Great Adventure. It feels risky but probably isn’t all that risky. I flew in a prop plane with my brother-in-law one time … that felt kind of risky. I have also parasailed, does that count? I think it definitely has to be driving on the N.J. Turnpike day in and day out.

R&I: If the world has a modern hero, who is it and why?

What about the Fukushima 50? I don’t think I could have done what they did.

R&I: What about this work do you find the most fulfilling or rewarding?

I love it when the risk management organization is able to contribute in a way that makes a real impact to the corporation’s overall objectives. On several occasions we have been able to make real contributions to the bottom line.

R&I: What do your friends and family think you do?

I don’t think they really know. My children see me as dad; others just see me as an executive with Verizon.