Specialty: Tech Risks

Data Breaches, Hacks and Brand Damage: Welcome to Technology’s Legacy

Technology’s evolution is moving so quickly that many organizations are struggling to keep pace. While technology is becoming more complex and powerful, it’s also becoming smaller, cheaper, easier to use and accessible to organizations of all sizes.

Deploying new devices, systems and software solutions can increase competitiveness, but can also create new risks and vulnerabilities. Because most emerging technologies are intricately intertwined through the Internet, the potential for data loss is greater than ever. And susceptibility to hacking is also presenting threats to property, labor and brand.

Analysts and risk managers say organizations will need to tread carefully by making a commitment at the top to assess the risks and limit their exposure with planning and insurance.

New Opportunities With New Risks

Virtually every industry is now being disrupted by technology. 3D printers, artificial intelligence, collaborative robots, the Internet of Things, cloud-based software solutions and data are driving rapid change.

Leslie Chacko, director of Marsh & McLennan Companies’ Global Risk Center, Emerging Technology Program, said technologies that have emerged in the past five years are fundamentally disrupting the way companies operate, transact and interact with their customers.

“We are in what is being widely accepted as the fourth industrial revolution … Most companies are looking to leverage these technologies as part of their strategic imperative of ‘going digital,’ ” Chacko said.

“Many companies will need to re-evaluate their cyber risk exposure as a result of adopting these technologies,” — Leslie Chacko, director, Marsh & McLennan Companies’ Global Risk Center, Emerging Technology Program

Many of these technologies are so new that risk managers don’t yet have enough data to accurately identify and assess such risks. Mike Thoma, VP, chief underwriting officer of global technologies at Travelers, said new technologies can carry additional risk of “bugs and kinks that haven’t been worked out.” But problems can extend beyond simple glitches to include data breaches, hacks, financial loss, brand damage and lawsuits.

“Technology is evolving so quickly. You have to evaluate the ROI to ensure a large [capital expenditure] purchase you’re making today won’t be obsolete. And you have new risks associated with it,” Thoma said.

These risks are now emerging in nearly every industry. Mark Locke, senior vice president of manufacturing and government contractors at Chubb, said it’s a big issue for manufacturers deploying robotics and IoT devices.

Whereas manufacturers used to be primarily concerned about fires or accidents, they’re now concerned about hacking, data breaches and a “series of exposures that didn’t even exist 10 years ago,” Locke said.

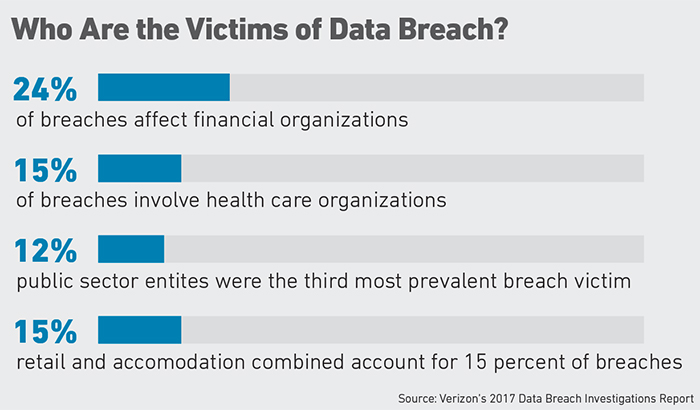

Many manufacturers made the leap to technology so quickly that their security plans haven’t kept pace. Verizon’s 2017 Data Breach Investigations Report found manufacturing to be one of the top at-risk industries for data breaches.

The medical industry is also facing heightened risk. Insurers and hospitals are collecting more data than ever, and physicians are now using collaborative robots to perform surgical procedures. Sam Friedman, insurance research leader at the Deloitte Center for Financial Services, said such devices can muddy the waters of liability in the event of a patient injury.

Liability could be pegged to the doctor’s decision to use the technology, the manufacturers of the robot, the software developer that wrote the program or improper use by the doctor. “You could have a free-for-all if a patient is injured. Who pays? These types of things need to be resolved by the entity’s risk manager as they start deploying these new technologies,” Friedman said.

New risks are also emerging in the financial services industry where firms are using AI to manage portfolios and select investments. Even in the hands of a small business, a tablet-based POS system or smart device can be a portal to hacking and financial loss.

Aftab Jamil, partner and national leader of the technology practice at BDO USA, said for many organizations, the question shouldn’t be “if” but “when” a liability will arise.

Assessing and Insuring Technology Risks

While the risks presented by new technologies can vary depending on how they’re being used, one shared factor is the threat of hacking. Jamil said many businesses now have access to “huge amounts of unstructured data” and need to balance the flexibility to use it with systems to protect that data.

Virtually any device or piece of technology connected to the Internet can be an access point for hacking. Chacko points to the October 2016 Mirai Botnet attack on unsecured IoT devices as an example of how a device can be exploited to conduct a larger-scale attack. Something as simple as a sensor on a machine, a smart thermostat, POS system or software interface can leave an entire company vulnerable.

“Many companies will need to re-evaluate their cyber risk exposure as a result of adopting these technologies,” Chacko said.

High-profile attacks in recent years encouraged more companies to aim for a greater level of preparedness. Jamil said security starts at the top with the CFO, CIO and business leaders with “real decision-making power” who can commit to understanding the risks and creating action strategies to mitigate those risks.

The risks associated with emerging technologies are also creating demand for new insurance products. Insurers wrote more than $1.35 billion in cyber insurance policies last year, a 35 percent increase over 2015.

More companies are also addressing things like IoT, automation, software solutions and robotics in their policies.

Some experts say there’s a need to blend policies that could include all aspects of a tech liability, including data loss and the potential for property damage and liability.

AIG Group last year released CyberEdge Plus, a stand-alone policy that covers cyber-related bodily injury, property damage, business interruption and product liability.

Friedman said the emerging technologies are evolving so quickly that risk managers “cannot assume anything” and need to continually reassess those risks and how they align with their existing policies. He said insurers can be slow to evolve and often take a “reactive” approach — a reason why businesses need to ensure clarification on new technologies.

Friedman said the first instinct of most insurers is to add it to existing coverage, either in the policy or through an additional rider. Many insurers are starting to see claims related to technology that they haven’t dealt with before.

“It’s an exciting time but you don’t want to take anything for granted … You don’t want an insurer to come back and say ‘Wait a minute — you didn’t say anything about robots in your ROR,’ ” Friedman said.

Thoma recommends companies consult with technology-specific experts when evaluating those technologies. Beyond external risks, he said organizations can encounter internal risks to their processes and operations if they integrate emerging technologies without proper planning. Many organizations start with limited pilot programs to test effectiveness and work out bugs before scaling up.

While analysts, insurers and risk managers contemplate new exposures being created by emerging technologies, nearly all agree that the biggest risk will be falling behind the curve. Jamil said organizations will have to move forward by identifying the right technologies and applications for their businesses, creating plans to mitigate risks and double-checking their policies to ensure exposures are covered.

“Any business should be keeping an eye on these emerging technologies. Those that do not will be at a competitive disadvantage,” Jamil

said. &