2015 Risk All Star: Elizabeth Queen

Building a Unified Travel Program

For all the conference calls, video chats and shared documents, “there are still people out there” traveling around the world on business, said Elizabeth Queen, vice president of risk management for Wolters Kluwer.

“I have worked extensively in Asia-Pacific, a good amount of time in Europe and now split my time between the U.S. and the U.K,” said Queen, whose company provides information and publishing services in the legal, finance, risk and health care sectors.

Headquartered in The Netherlands,Wolters Kluwer does business in more than 180 countries, putting it at the front lines of global travel.

So, not only are Queen’s people out on the road, but she is one them.

In early 2014, one of Wolters Kluwer’s business units asked Queen’s group to review a travel assistance program they had in place for a handful of people.

“I was skeptical,” Queen recalled. “I thought it duplicated what we already had.”

After discovering the existence of another similar program at another unit, Queen’s team consolidated the RFP and elevated it to the enterprise level. That meant instead of serving 25 international travelers, the program would serve about 1,200.

“Despite the economy and additional cost, the business case for senior management was compelling,” said Queen. “That took a lot of teamwork, creativity and perseverance.”

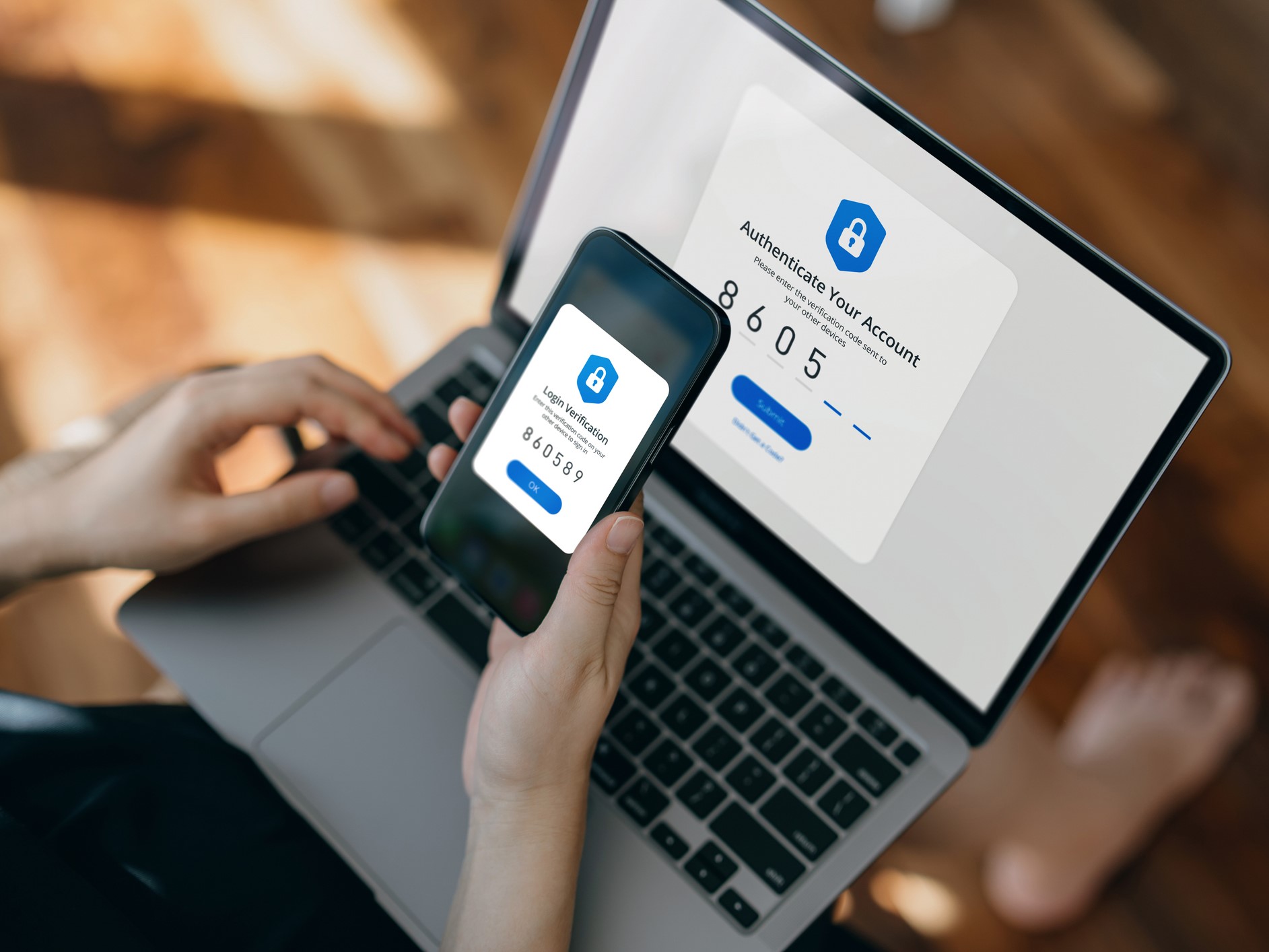

The program that Queen and the team she is quick to credit created gives all of the company’s travelers worldwide insurance coverage and access to travel-relevant information through an application on their smartphones.

“There is a GPS feature, as well as travel advisories and alerts,” Queen said.

“But more importantly, on the back side, there is a travel tracker so we are able to more efficiently detect where our travelers are and how they are doing, so we can respond quickly should the need arise.”

The system was put into active service early this year, working with outside service provider International SOS and self-bundling coverage from several different insurers.

“I was skeptical. I thought it duplicated what we already had.” — Elizabeth Queen, vice president, risk management, Wolters Kluwer

“While in early stages, the program has been a success with both the business and our travelers. I believe we are better managing travel risks, not to mention already seeing savings,” said Queen.

At the same time, she wants to see something more robust from the market to address a gap in service and coverage that she has identified both as a traveler and in her risk management capacity.

“There are currently no bundled programs on the market that offer fully integrated risk, insurance, claims and travel support services for business travelers — domestic or international, expat or cross-border,” said Queen.

“There are concierge services — lost passport, medical advice, destination intelligence — but those services are not currently linked to insurance at a single point of contact for the travelers and the program managers.

“A more innovative and integrated approach to how travel risk and insurance programs are packaged brings opportunity to insurer and insured alike. If they build it, we, the clients, will come.

“Now, it is up to the market to rise to the call to help risk managers bring their programs to even higher levels.”

Responsibility Leader

Elizabeth is also being recognized as a 2015 Responsibility Leader®.

A Maternal Force

Any working mother will surely appreciate the following. Risk All Star Elizabeth Queen, a force in global risk management, has five children and has fostered a number of others.

Two of her children are adopted Pacific Islanders, and she has taken in several other children and families in need. She has served on the boards of nonprofits dedicated to child welfare and is a champion of diversity.

“Having grown up in the American South during the 1960s, I have a strong belief in the right and freedom of every person to work, eat, pray, go to school, love, live freely and on a level playing field irrespective of their ‘differences,’ ” she said.

Queen— who splits her time between the United State and the United Kingdom — is also credited with creating a comprehensive travel risk management program for her Netherlands-based company, Wolters Kluwer.

In March of 2014, the graduate of Tulane University and Tulane Law served as an expert panelist for an Aon presentation on cyber risk in Kuala Lumpur, Malaysia.

Queen also advocates for the risk management community in urging insurers to craft state-of-the-art travel insurance risk management programs, an area of keen interest for many companies.

“If they build it, we, the clients, will come,” she said.

_____________________________________________

Risk All Stars stand out from their peers by overcoming challenges through exceptional problem solving, creativity, perseverance and/or passion.

Risk All Stars stand out from their peers by overcoming challenges through exceptional problem solving, creativity, perseverance and/or passion.

See the complete list of 2015 Risk All Stars.

Responsibility Leaders overcome obstacles by doing the right thing over the easy thing to find practical solutions that benefit their co-workers and community.

Responsibility Leaders overcome obstacles by doing the right thing over the easy thing to find practical solutions that benefit their co-workers and community.

Read more about the 2015 Responsibility Leaders.