White Paper

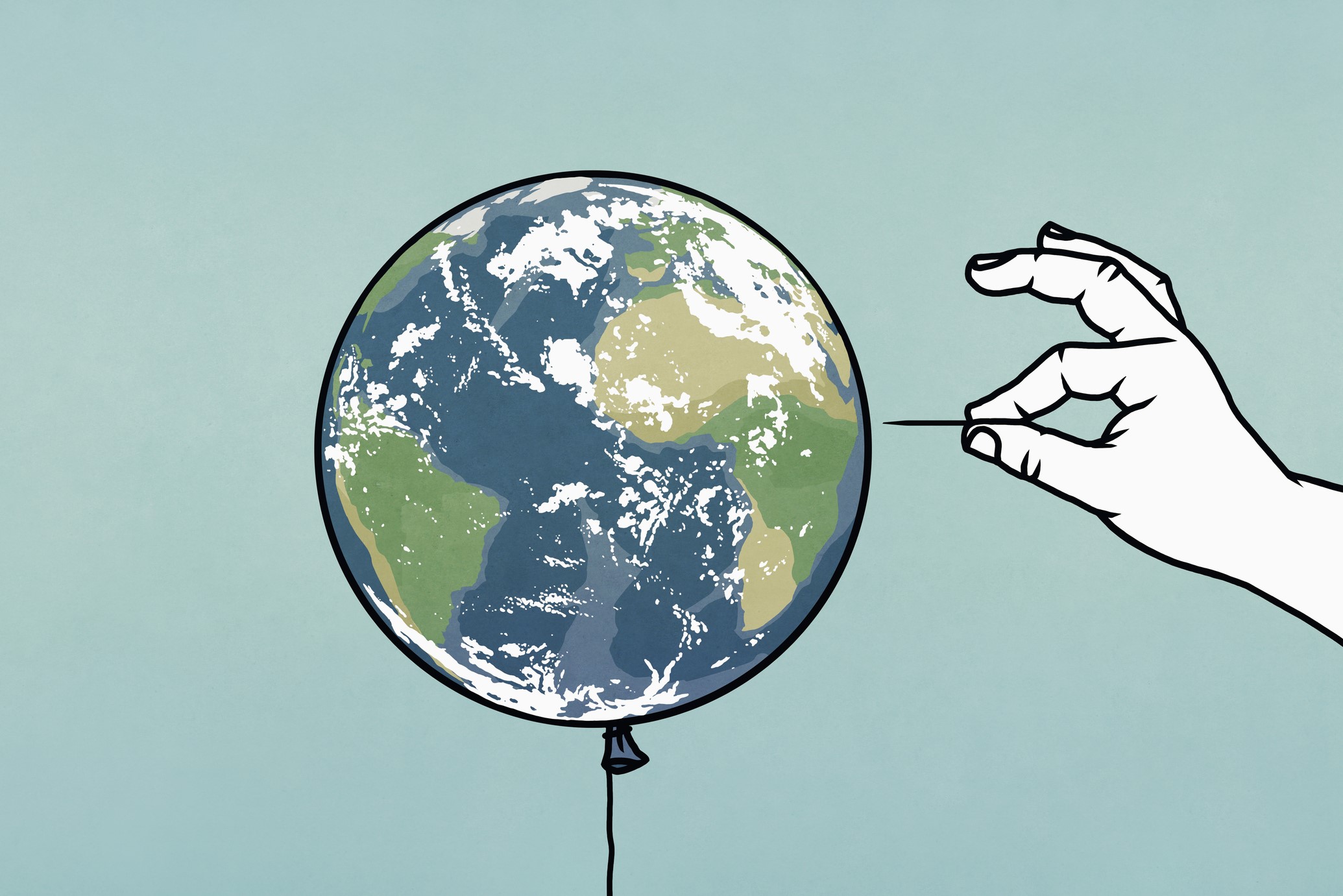

Three Trends Driving Up Casualty Loss Costs — and How Businesses Can Reduce Their Risk

White Paper Summary

Casualty claim loss costs have been on the rise. According to a new AM Best report analyzing losses in the first half of 2023, the U.S. property and casualty industry reported a $24.5 billion net underwriting loss for the first two quarters alone, on track to surpass the $26.5 billion in total losses recorded for all of 2022.

This is thanks in part to the confluence of several social and macroeconomic factors.

“In bodily injury cases — including construction accidents, auto accidents, premises liability cases et cetera — we are seeing the effects of social inflation, litigation funding and nuclear verdicts. These are increasing loss costs across all casualty portfolios. They are driving up claim severity as well as costs on more attritional frequency claims. Settlement expectations are increasing across the class of business, and that is putting a lot of pressure on insureds and carriers alike,” said Christopher Celentano, SVP, Head of Coverage & Complex Claims with Sompo International, North America.

While awareness is growing around these factors, it is safe to say that 2024 will bring more of the same. There are, however, steps that insureds can take to reduce their risk, especially with the help of a carrier that has expertise in the legal landscape.

Here’s how these trends are developing and impacting the casualty claims space today, and what to expect in 2024 and beyond.

To learn more about Sompo International, please visit their website.