This Leader Sees Risk Management and Insurance as an Innovation Arm of the Organization

R&I: How did you come to work in risk management?

After graduating law school in 2001, I became a defense litigator. For 13 of my 15 years in litigation, my practice included insurance coverage litigation.

I began working for Groupon in 2013 as senior litigation counsel. For the next three years, in addition to my litigation responsibilities, I became more involved in the insurance procurement and renewal process. I began to realize the company would benefit from a full-time risk manager. I then developed, pitched and filled that role. I officially stepped into the position in October 2016.

R&I: What emerging commercial risks would you say are top of mind?

Regulatory risk changes/regulatory fragmentation is on my mind. That, coupled with the insurance/risk financing industry’s ability to respond to regulatory changes.

R&I: What are some of the trends or changes you’re keeping an eye on?

I’m watching the Insurtech boom and, hand-in-hand, the use of advanced technology to solve business and risk problems — the use of AI, machine learning, IoT and blockchain.

R&I: What role does technology play in your company’s approach to risk management, and how do you think technology will continue to shape the industry?

I’m trying to be really thoughtful in how to use data to drive risk insights; how to leverage technology to collect, analyze and visualize that data and those insights to better manage risks; drive strategy; and to better partner with our insurers and brokers to develop smarter and/or more efficient risk financing.

R&I: Were there any particularly unique or difficult challenges you’ve overcome in your career?

It took me a while to figure out what I truly wanted out of my career. For a long time, I had a growing, unnamed feeling that I was dancing around where I should be. I felt I was missing the mark in terms of what truly interests me, drives me, what makes me tick, and ultimately what would make me feel fulfilled.

It wasn’t until I stopped to give serious consideration into what it is that gets me “fired up;” what keeps me up at night in a good way; what ideas lead me to “daydreams” of what I could do/build/create. I slowly realized I had an entrepreneurial spirit; that I am most fulfilled when developing/articulating a vision and executing on it.

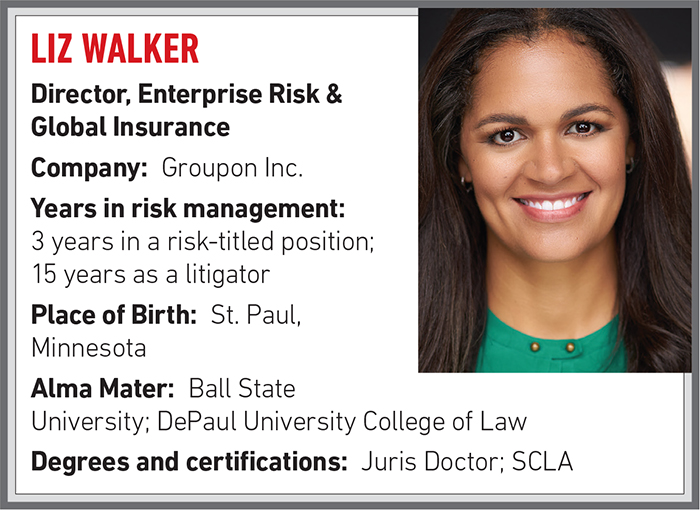

Liz Walker, Director, Enterprise Risk & Global Insurance, Groupon Inc.

R&I: What about this work do you find the most fulfilling or rewarding?

The invitation to innovate; the ability to shape a function in an organization; the relationship building in the industry (and cross-industry) that can drive innovation. I also love the idea that the risk and insurance industry is here to provide resilience to businesses and people.

At its most altruistic, it is here to ensure we survive to thrive and drive progress. I think that’s a powerful purpose, and one I keep in mind as I move through my career.

R&I: What do you find most interesting about the industry you work in?

Here at Groupon, we are trying to support our local businesses by redefining how they attract and retain customers. We strive to provide them the right tools and services to enable them to grow profitably.

Therefore, I’m challenging myself now to find opportunities to use my role to not only manage our risks but to also find opportunities to leverage risk and insurance tools for the benefit of our customers and merchants.

R&I: What advice might you give to students or other aspiring risk managers?

I’d say the best you can do for yourself is to be open. Don’t ride in the backseat of your career (as I think I did for the beginning of mine). Try to find the balance between pursuing paths that are being paved for you and recognizing when you need to stray from those paths to forge something different.

A lot of that involves paying close attention to yourself; recognizing when you are excited about something. It also involves a certain level of risk taking. Going a different direction; pitching an idea you care deeply about at the risk of being denied. You need to have the courage to do that and also the sense to know when the timing is right to do so.

R&I: What are your goals for the next five to 10 years of your career?

I want to continue to build and innovate the risk/insurance function using technology, where appropriate, to drive better insights and risk/insurance products. My goal is to lead the innovation arm of an organization — at the insured or insurer level.

R&I: What do your friends and family think you do?

I talk about my career a lot — maybe too much — so they all probably know pretty well what I do! Though I think my family would say something like, “She spends her time worrying about everything that could possibly go wrong.”

R&I: What is the riskiest activity you ever engaged in?

Being a passenger on an ultralight aircraft. I was in Germany on a short music tour with my band. We had a day to explore Juterbog, Germany, and while there, we visited an old WWII bunker. I did not (and do not) speak German; however, a pilot working there asked if I wanted to “fly with the dragons?” Thinking that sounded too cool to pass up, I blindly said, “Yes, why not?”

I was instructed to don a purple jumpsuit and was led to the ultralight aircraft, resembling a three-wheeled dune-buggy with wings. It had a metal frame but no doors or closed-in compartment. It was not at all what I’d expected (not that I knew what to expect) and not at all secure-looking.

Being too embarrassed to back out, I climbed in and we took off. The pilot and I could not communicate due to our language differences, so he just motioned to me to not lean in either direction. (I should add I was at least a full foot taller than this pilot and likely outweighed him). It was terrifying. And a bit fun. And I will never do it again! &