The Profession

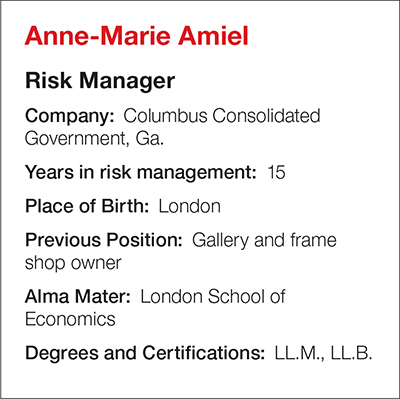

Anne-Marie Amiel

I worked for The Women’s Royal Naval Service — part of Britain’s Royal Navy. I was a so-called wren and worked in communications: I did coding, decoding, air traffic control, ship-to-shore communications, that sort of thing.

R&I: How did you come to work in risk management?

When I was still living in England I worked for a P&I club — a third party liability insurer. I was a maritime adjuster. This was back in the late ’70s and early ’80s. Soon thereafter I came to America.

R&I: What precipitated the move?

Koch Industries asked me to come to America and work for them. [They] had been one of the companies whose claims I handled in London. The company needed my maritime law expertise so they asked me to come and work in their risk management department. I was there for over two years. I got back into risk management in 2000, when I was hired by the Chesapeake, Va., public works department.

R&I: What is the risk management community doing right?

We’re realizing there’s a lot more to risk management than just looking at the bottom line and finding a way to incorporate into our plans the less obvious factors that lead to increased risk.

What the risk management community is doing more of, I think, is looking beyond the bottom line at things like: What are the other parts of the company or the entities doing that we can incorporate into improving safety, reducing our exposure to injuries and the costs of injuries, and asking more questions from the other parts of our organizations. One sign of that is we’ve begun talking a lot about predictive analysis, which incorporates a lot of factors that never used to be incorporated.

“We have a ‘geographic isolation’ tendency as American businesses. We tend to think that we are safe from a lot of things.”

R&I: What could the risk management community be doing a better job of?

That’s the other side of the coin. For those still working under the old system we used to operate by, we do need to bring more people into the wheelhouse. This is why I try to go out to other parts of the organization so I can see them in action. That helps me to identify areas we need to look at. It also helps people in the other parts of the organization to communicate with me their needs and how we can work together.

R&I: What emerging commercial risk most concerns you?

For public entities, law enforcement liability is one of the big issues these days. In the past year, there has been so much in the news about police and lawsuits against law enforcement. I know that is something that is concerning many public entities right now and this is going to be a big one for us as a local government.

R&I: What insurance carrier do you have the highest opinion of?

CCG is basically self-insured. However, our excess coverage on workers’ comp is carried by Safety National of St. Louis, and I really like Safety National.

R&I: How much business do you do direct versus going through a broker?

Most of our business is through a broker. We place our workers’ comp excess coverage through broker APEX Insurance, and we are doing property and casualty insurance through a different broker.

R&I: How do you grade the insurance industry’s response to the threat of cyber attacks?

This is a big issue for us as well. For the industry as a whole, I think it’s been a little off the mark. We have a “geographic isolation” tendency as American businesses. We tend to think that we are safe from a lot of things. For instance, look at how the U.S. credit card industry has only recently begun to catch up to what Europe is doing in terms of the upgraded security of the card.

R&I: Are you optimistic about the U.S. economy or pessimistic and why?

In the short term, I think we are basically treading water but long-term, I am optimistic. Americans work hard and want to succeed so I think that in the long term, we will.

R&I: Who is your mentor and why?

There have been a lot of people who come to mind but probably the key person would be my boss when I was a temporary researcher working for the Secretariat at the Council of Europe in Strasbourg. He told me I could do or be anything at a time when there were no women or almost no women in my field.

R&I: What did you do there?

I was a temporary researcher working for the Secretariat. I actually prepared the documentation for the first ever European Parliamentary hearing on maritime pollution. I even got to meet Jacques Cousteau.

R&I: What have you accomplished that you are proudest of?

I think probably it was when I worked for a nonprofit organization that helped people uphold their constitutional rights. It was for people who couldn’t afford expensive lawyers.

R&I: What’s the best restaurant you’ve ever eaten at?

The Chop House in London.

R&I: What is your favorite drink?

Peach Bellini.

R&I: What is the most unusual or interesting place you have ever visited?

It’s a hard question since I have been around the world since I was 15. Probably New Zealand, because there is a bit of every country in the world in New Zealand in terms of its landscape and weather.

R&I: What is the riskiest activity you ever engaged in?

Probably going down into a coal mine, which happened to be in New Zealand. It was an educational expedition. I was only about 15 at the time and in the summers we went on wonderful field trips with my school and I got to pan for gold and all sorts of wonderful things.

R&I: If the world has a modern hero, who is it and why?

Our military. They risk their lives to save ours and to keep us free.

R&I: What about this work do you find the most fulfilling or rewarding?

I get to help our employees recover their health and get fit while at the same time saving the taxpayers money.

R&I: What do your friends and family think you do?

They think I try to make things safer for our employees, that I talk to a lot of unhappy people, and that I’m always trying to save money!