Sponsored Content by Nationwide

Staying Ahead of Employment Practices Liability Risk

No human resource manager wants to hear that an employee feels discriminated against or harassed. It means that workers don’t feel safe or comfortable at their job, which hurts morale and productivity. And it also means that, if not promptly addressed, a lawsuit may be on the horizon.

In the world of employment practices liability, it’s a well-known risk.

“Gender, age, race, or national origin discrimination and harassment complaints account for about 96 percent of the EPLI claims coming across a claims person’s desk,” said Joe Werner, director, Management Liability and Specialty.

Most companies know that having an employee handbook that outlines expectations and consequences for workplace behavior, as well as clear policies and procedures for handling a complaint, are the best ways to mitigate the risk of a lawsuit.

But legislative and regulatory changes could make EPLI risk more dynamic and complex.

Emerging Employment Practices Risks

State and local laws can vary from federal regulation – and often have higher compliance standards.

“The new medical marijuana laws are a good example of state-specific legislative changes,” Werner said. “There are currently 29 states that allow marijuana for medicinal purposes. This could potentially open the door for new discrimination claims.1”

Employers in a state with legalized medical marijuana cannot discriminate against an employee with a legitimate marijuana prescription. But they also have to be wary if a worker is using marijuana on the job. The law does not yet address whether employers can or should make accommodations for employees using medicinal marijuana.

“It’s a gray area. But as more states allow marijuana for medical use, I think we’ll start to see discrimination claims coming in around this issue,” Werner said.

Disparities also exist between federal and local minimum wage laws. While the federal minimum wage is currently set at $7.25 per hour, some states and cities have set a minimum wage that exceed the federal requirements. Unaware employers are thus more exposed to wage and hour claims, which can be costly to settle or litigate.

Even if companies have all their ducks in a row regarding policies and practices to prevent the known risks of harassment and discrimination, they need to remain vigilant and monitor these regulatory changes to stay ahead of emerging issues.

Practicing Proactive Loss Control

No matter what changes come down the pike, companies have a few ways to protect themselves.

Education and training are key. Human resource managers should stay up to date on the legislative changes happening in their city and state, and determine if those changes will impact their risk exposure. Training employees thoroughly and regularly on employment law and on workplace policies regarding harassment, discrimination, and ethical behavior in general can help to prevent problems.

Managers and the HR team should also know when and how to investigate if an employee reports feeling discriminated against or harassed in any way at work.

But even those measures will occasionally fail. When that happens, companies need to know who to turn to for legal advice. Because of the variances between state and federal laws, relationships with attorneys who specialize in employment law in their specific state are critical.

Through a partnership with Littler Mendelson, Nationwide policyholders may obtain legal advice if they encounter a situation they don’t feel equipped to handle. Their legal hotline is available to insureds at no additional cost.

“Other carriers may offer a hotline to provide general guidance, but we feel it’s important to leverage Littler Mendelson’s national presence to provide actual, state-specific legal advice,” Werner said. That advice can help prevent an incident from spiraling into a claim — a benefit for both insurer and insured.

The hotline is just one of the loss control services that come standard with Nationwide’s private company package policy — Freedom 360° — which includes coverage for EPLI, directors and officers, fiduciary liability, and commercial crime.

Educational Services at Insureds’ Fingertips

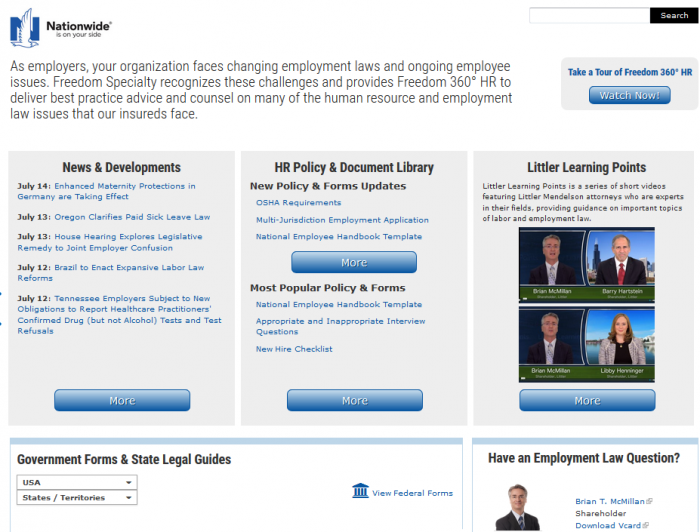

Clients also have access to Freedom 360° HR, an online portal delivering daily news updates and human resource developments, as well as educational materials around all aspects of employment practices.

“These updates touch on all employment issues — not just what our policy covers — across any state or jurisdiction,” Werner said. “There is also a library for HR policies and documentation so you can download a new hire checklist, for example, or use them as a guide to build or update an employee handbook.”

A series of short videos dubbed Littler Learning Points feature two attorneys having a Q&A-style conversation about topics ranging from EEOC filing requirements to the definition of reasonable accommodation and wage and hour compliance.

Additionally, Nationwide offers employee online training modules provided by HR Classroom. The modules are designed to satisfy an employer’s legal training requirements and provide educational programs covering workplace topics, such as ethical workplace behavior, proper anti-discrimination and anti-harassment prevention and policy, workplace diversity and wage and hour issues.

Using loss control services, especially when they are provided free of charge, should be a no-brainer. But they are often underutilized.

“That’s a trend we are trying to change,” Werner said.

Often, clients simply aren’t aware that such services are available. Nationwide remedies that by having its loss control providers send an introductory email to new insureds detailing their services.

Financial incentives don’t hurt either.

“Where we can, we will reduce the deductible or retention if an insured has made efforts to improve their risk,” Werner said.

“Every claim that comes in will be expensive. No one wants to shoulder those costs, or go through the process of a lawsuit. If companies use these loss control services, it’s a win/win. We want to reward our insureds for improving their risk.”

Building Dependability and Longevity

Recognizing and investing in efforts to reduce risk also goes a long way in building a long-term relationship within a market which can see some carrier turnover.

“We are able to achieve stability and dependability in the market through smart underwriting,” Werner said. “That means offering terms and conditions that are appropriate for a risk.”

“We’ve come across competition offering more favorable terms and conditions that we may not be willing to offer for a given risk,” Werner said. “That’s just not practical if the goal is to be profitable so that we can remain in this market for the long haul. Sacrificing sound underwriting for the sake of attracting clients makes an insurer more likely to exit the market because they aren’t profitable.”

The goal, Werner said, is for brokers and their clients to see Nationwide as a consistent presence in the market. Loss control services and incentives help to earn clients’ trust, build credibility, and maintain that presence.

And as regulatory and legislative changes continue to unfold, those services help insureds weather whatever new risk exposures might come their way.

Contact Joe Werner, director, at 212-329-6961 or [email protected] for more information

To learn about Nationwide’s EPL loss control services, visit www.freedom360hr.com and http://nationwide.hrcare.com.

1Source: National Conference of State Legislatures

About Nationwide

Nationwide is a Fortune 500 company with 16 million policies in force and an A.M. Best Rating of A+ XV. We are committed to responsive problem-solving and providing flexible and customized coverage.

Products underwritten by Nationwide Mutual Insurance Company and Affiliated Companies. Not all Nationwide affiliated companies are mutual companies, and not all Nationwide members are insured by a mutual company. Subject to underwriting guidelines, review, and approval. Products and discounts not available to all persons in all states. Certain property-casualty coverages may be provided by a surplus lines insurer. Surplus lines insurers do not generally participate in state guaranty funds, and insureds are therefore not protected by such funds. Home Office: One Nationwide Plaza, Columbus, OH. Nationwide, the Nationwide N and Eagle, and other marks displayed on this page are service marks of Nationwide Mutual Insurance Company, unless otherwise disclosed. © 2017 Nationwide Mutual Insurance Company.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Nationwide. The editorial staff of Risk & Insurance had no role in its preparation.