Risk, Reward, and Real Estate Intersect in Zillow’s Risk Management Transformation

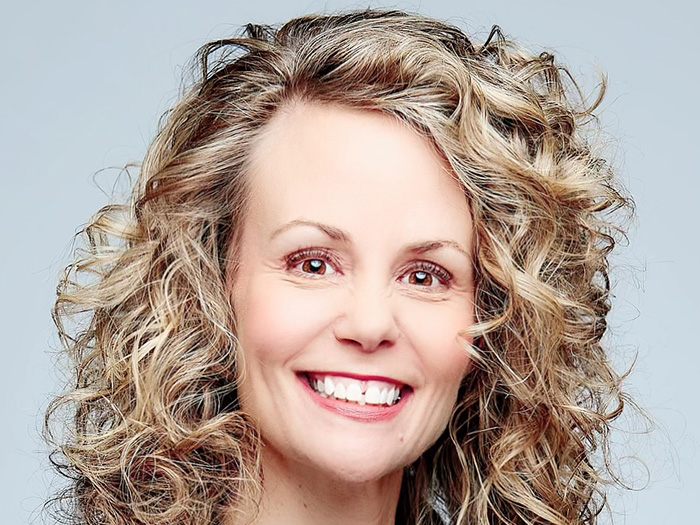

In some organizations, risk management is the department where dreams and ideas are extinguished. But not in Christy Kaufman’s wing at Zillow.

An expert at identifying pure and speculative risks, Kaufman excels at spotting untapped market potential. It’s a strength she used to identify a fresh opportunity for her team at Zillow: enhancing the rental customer experience and opening a new revenue stream.

“I feel like I was programmed to think that way,” she reflected, thinking back to her early days studying risk management at the University of Wisconsin, where she now serves as a senior lecturer.

Throughout her career, Kaufman has focused on opportunities, positioning herself as an enabler for success.

“Consider your corporate strategy,” she suggested.

“What are the risks to achieving that strategy, and how can we manage those so that we realize that opportunity?”

One challenge Kaufman faces as vice president of risk management and insurance services at Zillow is choosing from an abundance of opportunities. “There are so many problems we could solve — there are so many things in this industry that could be simplified and improved.”

“There are so many problems we could solve — there are so many things in this industry that could be simplified and improved.”— Christy Kaufman, vice president, risk management and insurance, Zillow

Guided by Zillow’s mission to smooth the home rental and purchase process, Kaufman identified embedded renters insurance as an opportunity to enrich the user experience.

“We aim to make it easy, clear and stress-free,” she said.

The product could provide a sense of security for tenants and potentially reduce liability for landlords using the platform.

As a relative newcomer to Zillow, Kaufman cast a wide net and built a robust business case for embedding renters insurance into the platform. She assembled a cross-functional team — representing Zillow’s software engineers as well as communication and compliance leaders — to conduct a thorough customer needs assessment and create a brand-aligned road map.

“[The initiative] had to deliver value for Zillow,” she emphasized. That comes in the form of a new revenue stream for Zillow.

“But more importantly, how does it help the customer?” Kaufman wanted to know. She knew firsthand the value of renters insurance. When a leak ruined the furniture in her first apartment, her renters insurance — purchased on her mother’s advice — covered the loss. That experience fueled her efforts to bring the project to fruition.

Over several months, Kaufman brokered a partnership with an insurance provider, established Zillow Insurance Services — a multi-state licensed insurance agency — and collaborated with Zillow’s rentals team for seamless integration of renters insurance into their existing offerings.

This effort helped Zillow deliver on a key part of its broader mission to “give people the power to unlock life’s next chapter” — with a bit more peace of mind.

While it is still early days for the product, according to Kaufman’s Risk All Star nomination, initial market adoption of it has been strong. &

Every year, Risk & Insurance selects deserving candidates to become Risk All Stars. These are risk managers who, through their perseverance, passion and creativity, make a big difference to the stability of their organizations.

See all the 2023 Risk All Star Winners here.