The Profession

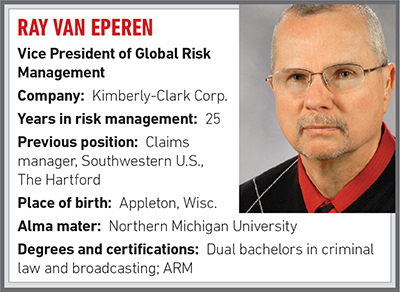

Ray Van Eperen

R&I: What was your first job?

I delivered newspapers for the “Appleton Post-Crescent” for three years. I am an early morning person and my lifelong start in getting up early started with my newspaper delivery job. You will see me in the office many times at 4 – 4:30 a.m.

R&I: How did you come to work in risk management?

I was in Houston (with The Hartford) and my father came down for Thanksgiving and told me that Kimberly-Clark had an opening in risk management. I thought, “Why not try that?” and sure enough it turned out great. I thought it was a good transition to go from the claims arena to the world of risk.

R&I: What are some of the keys to doing risk management well?

I tell people that you need certain skills. I call it blocking and tackling. Meaning you need to know how to manage claims and you need to know how to place coverage. No matter where we grow from a corporate perspective or a continuous improvement perspective, you still need those blocking and tackling skills. We’re doing a good job of that so I am real proud of seeing that continue on.

R&I: Where does risk management need to sharpen its game?

I think one area that we need to improve is quantifying risk appetite. Most companies are looking to determine what impact a risk could have on the business.

It is no longer just a property and casualty risk it’s an enterprise risk. It is difficult to quantify risk appetite. It’s very easy to work in ranges, we’re good at that.

We’re getting better at quantifying risk appetite, but I think it’s an opportunity for the whole industry.

R&I: How can people do a better job of quantifying risk appetite?

You need to understand your business. If you can do that, you will have a better picture over all. Bring in other people, legal, the business team, the HR team. Have that group sit and discuss risk appetite and try to move forward on quantifying it.

R&I: What resources are you using to expand your capabilities in enterprise risk management?

A great example is our partnering with academic institutions. At Kimberly-Clark, we partner with the University of Wisconsin, Madison.

R&I: How do you partner with the university?

I give educational presentations at least two times per year to the school of business there. Members of the university, professors and students, visit our annual risk management conference. We also bring in risk management students to spend a couple of days with the risk management department.

We’re getting better at quantifying risk appetite, but I think it’s an opportunity for the whole industry.

R&I: What’s the value of the RIMS conference for you?

I look at the risk management conferences as a great learning opportunity. At the most recent RIMS conference in New Orleans, for example, I had eight separate meetings with the CEO or president of a carrier. They allowed me to probe them on emerging risks. I love the fact that I had access to them and they’re all right there.

R&I: What emerging risks do you see?

We discussed emerging technology risks like driverless cars and drones, but as the risk manager for a manufacturer with operations around the world I think water shortages are also going to play a big part.

Another risk is social media. It just takes one person to post a video, or some other complaint about your company and it can cause you substantial reputational damage.

R&I: The reputational risks with social media are worrisome, are they not?

They really are and I need to see some strong insurance products. I am meeting next month with a carrier to look at some reputational coverage and see how that might apply.

R&I: Is there an emerging commercial risk that you think is most concerning?

I don’t think it is emerging as much as it is problematic and I’m talking about political risk. Turn back the clock just a few years. All of a sudden Venezuela is in the news. Last year it was Russia. This year it’s Argentina. The world changes so frequently. That’s not an emerging risk but we have to determine how to manage that proactively. We have manufacturing operations in 37 countries and sell our products in more than 150.

R&I: Are there risk management tools that are very valuable to you?

I tell people the perfect tool is face-to-face collaboration. We get into the world of emails and texts, and the problem is if you don’t have the face-to-face tools, you can’t build your negotiation skill-set. You can’t read people, you don’t know how to respond to people.

As a result of the technology dependence, you see many new members of organizations not having that negotiation skill-set.

R&I: How happy are you with your carrier relationships?

I look at our carriers and our brokers and I can say we have a good rapport with them. My team members know all of our brokers, that’s obvious, and we know all of our underwriters.

I require the team to make sure that no matter if it’s a multi-year program, or a single year program, every year, at least once, you need to see that underwriter. Spend some time, tell them about where we are going, how the risks are being managed, sell the corporation.

And learn more about them. We have seen in the past, business results or senior management can change and it can have an impact on the company over all.

R&I: Is pricing the thing that’s most affected by those changes; terms or conditions?

The biggest changes and concerns are what lines they’re going to write. They might say they’re not that active in something and if they’re saying that, what they mean is they’re really not that competitive.

They really don’t want to negotiate much in the area of coverages. So you see more of a limited product. Then you go across the street and you see carrier “X” and they say I want to be in that business.

In order to leverage those differences you need to meet with the companies and understand them.

R&I: Are you optimistic about the U.S. economy or pessimistic?

Optimistic. Kimberly-Clark’s stock price is at an all-time high. So that shows you what’s going on from a consumer perspective. But I mentioned it before. Political instability globally could impact us any day.

R&I: Do you or did you have a risk management or insurance mentor?

Every interaction is a chance to learn something. I have learned things from my executive assistant and my CEO and from everyone in between.

R&I: What in your career are you most proud of?

No question about it. The global risk management team drove a cultural change at Kimberly -Clark. We aggressively trained Kimberly-Clark employees to take smart risks. In the past four years we have educated more than 6,000 Kimberly-Clark employees live worldwide.

R&I: Your favorite movie?

“Taken” because Liam Neeson’s character and I have very similar skill-sets (laughs).

R&I: Do you have a favorite drink?

Stella Artois (the famous Belgian beer). My parents always told me work hard, play hard so when I get a break, I’ll grab a beer and relax.

R&I: You work for a global company. What’s the most interesting country you’ve visited?

The most interesting was Thailand. I was visiting a zoo there and was shocked at the number of risks. You’re standing in front of elephants and the only thing between you and the elephant is a two by four.

When I was there something grabbed my arm; it was a monkey. That’s a part of the world that has some opportunities for risk improvement.

R&I: Does the world have a modern hero and who is it?

It’s the men and women of this country who defend us. But we have a lot of heroes in this world and there is never just one.

R&I: What about your work do you find rewarding?

Our global risk management team maintains the freedom and the authority to make decisions and drive results. With that authority, you can find incredible value and satisfaction.

R&I: What do your friends and family think you do?

If you tell somebody you work in insurance they’re going to say, “Oh my God he’s trying to sell me a life insurance policy.” But if you tell somebody about a lawsuit or some other risk that you are working on they will say that is a world that is pretty interesting.

How can you not enjoy tackling different challenges throughout your day?