Sponsored: Pinnacle Actuarial Resources

The Many Ways COVID-19 Has Impacted the Auto Insurance Industry — And How Insurers Are Striving for the Best Solutions

The automotive insurance industry, much like every industry across the nation, is working hard to both anticipate and manage the after-effects of COVID-19. But, as insurers in the space know, there is a very specific set of consumer needs auto must address.

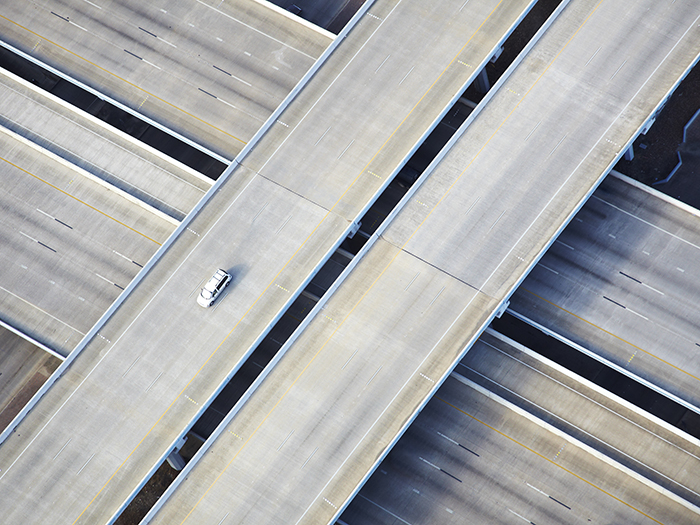

For instance, as more workers were asked to work from home during shelter-in-place mandates, the number of cars on the road decreased. Fewer vehicles crowding the streets meant fewer claims. To meet the new standard, several automotive insurers offered refunds or credits to their insureds, because they recognized driving was down. Some companies even went as far as to look into rate decreases.

“These companies were trying to reflect what’s happening right now, because the costs that the insurers are incurring are significantly different than what they expected,” said Greg Frankowiak, senior consulting actuary at Pinnacle Actuarial Resources, Inc.

This kind of action no doubt enhances good faith among consumers, but it also plays a bigger role on the side of the insurer.

Auto insurance is prospective by nature. Rates are generally estimated one to two years in advance of the time they are in effect, said Frankowiak, by reviewing numerous factors including location, cost of repairs, frequency of accidents and other related expenses.

2020 rates could not have anticipated an event with COVID-19’s magnitude, and while many are issuing such refunds, they are also preparing for what the long-term effects will look like.

Here are some of the other prominent ways the auto industry is being impacted by the pandemic.

Shifting Views for Personal and Commercial Lines Alike

Greg Frankowiak, Senior Consulting Actuary, Pinnacle Actuarial Resources, Inc.

Now that there are less people on the road, a new trend is breaking through: excess speeding.

“We’ve seen reports of drivers traveling at extremely high speeds — well over 100 miles per hour in some cases,” Frankowiak said. “It’s an interesting phenomenon to see fewer cars on the road but more reckless speeds.”

This puts both commercial and personal drivers at risk of danger: Behavior like this behind the wheel can lead to higher fatality rates in the event of an accident.

But while personal lines are seeing fewer drivers on the road, that isn’t always the case for commercial vehicles. Amazon, GrubHub, delivery services and more are supplying people stuck at home with their essentials, like groceries.

This means the increased use of personal cars for work. More and more restaurants are turning to home delivery services since they cannot allow patrons to enter their facilities.

“Is the employee delivering the food using their own car? What happens if they get into an accident?” Frankowiak asked.

“Owners would want that covered under commercial lines coverage,” he continued, “because it typically isn’t covered under personal lines coverage.”

Because of this uptick in employees on the road, Frankowiak said he has seen a number of insurance companies expanding what is typically a commercial lines coverage to personal vehicles.

What’s in Store for Future Ratemaking?

Actuaries consider a number of factors when projecting future rates for auto insurance, including expected frequency of accidents, amount of miles driven, inflation related to repair costs, inflation related to medical care, age of the insured/driver, type and cost of vehicle being insured and more.

As Frankowiak explained, these data sets are often analyzed well in advance of the time period that the rates will be in effect.

“Auto insurance’s prospective view is because the cost of the product must be determined before the transfer of risk occurs. It also takes time to finalize rate projections once data is obtained, including assembling and getting approval for and implementing rate filings,” he explained.

Knowing rates ahead of schedule gives both insurer and insured the opportunity to prepare and plan expenses. A global pandemic like COVID-19, however, was not on the radar 12 months ago.

Luckily, auto insurers are doing what they can to face the sudden shift like issuing refunds, dividends, or crediting their insureds during stay-at-home orders.

The question that remains, however, is how the current situation will impact rates in the next few years.

“That might be one of our biggest unknowns,” said Frankowiak. “We still don’t yet know the full magnitude of this or how long it will continue.”

With rates, he added, auto insurers want to project or estimate what costs will look like in the future. In a year or two from now, the coronavirus may be handled more like the annual flu virus. People hopefully will be back on the road, and driving will be up again.

“In a way, we may have to look at it like we would for catastrophe adjustments,” he said.

“I anticipate that insurers will go in and apply some type of normalization to the data to predict future rates.”

A Chance to Revisit Operations and Claims Handling

Another area COVID-19 has had an impact on is operations. Auto insurers have been forced to rethink how they’ve traditionally conducted business and what’s been needed to adjust to the current times.

“The majority of us are working from home, which changes a large aspect of auto insurance’s operations right there,” said Frankowiak.

What is needed to function outside an office space? As claims come in, how does a claim team work together without being in each other’s presence? If there’s an accident, how can a physical inspection take place?

“Auto insurers have had to think about how they can still effectively adjust claims and process them,” said Frankowiak.

As mentioned, there is a silver lining: Fewer drivers headed to an office each day has lowered the frequency of accidents, therefore reducing the number of claims coming in.

Still, accidents happen.

“One thing driving costs on the other end of claims is the interruption to the supply chain,” Frankowiak explained. “Being able to obtain repair parts for cars or even have repair shops open can prove challenging and can push some of those costs up.”

Staying Up-to-Date During the Pandemic

COVID-19 certainly impacted how business is run for many industries. For those looking to remain ever vigilant when it comes to their auto policies, the number one thing to do is to work with their insurer. Especially now as some companies begin to open up, and more drivers are getting back on the road.

“At Pinnacle, we’ve kept open lines of communication with our industry partners to stay knowledgeable in how auto insurance is being impacted,” said Frankowiak.

Pinnacle has built long-lasting relationships with industry partners in order to provide customers with reliable information, not just during crisis, but in all times.

The company’s deep-rooted predictive modeling and actuarial prowess also offer customers a better understanding of the data being collected during this time and what that will mean for auto lines moving forward.

“We want to get our clients to the right solution during this time, both for themselves and for their customers as well,” Frankowiak said.

To learn more, visit: www.pinnacleactuaries.com.

![]()

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Pinnacle Actuarial Resources, Inc. The editorial staff of Risk & Insurance had no role in its preparation.