Sponsored Content by Engle Martin

In a Global Economy, Your Claims Adjuster Better Understand These 5 Nuances of an International Loss

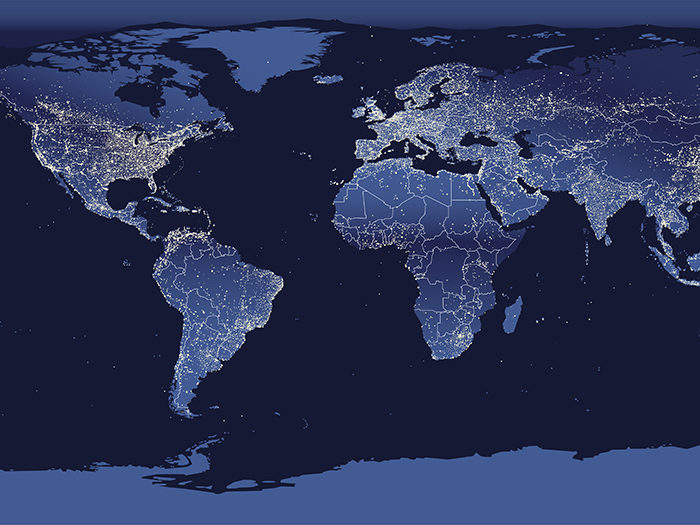

We live in a global economy. Many U.S. businesses have an international exposure of some kind, whether they source materials, run brick and mortar locations, or maintain sales relationships abroad. Likewise, many foreign firms operate U.S. subsidiaries in order to take advantage of the large U.S. market.

While global expansion does bring new business opportunities, it also complicates a company’s risk profile. When an international entity suffers a large loss, adjusting the claim becomes complex on two levels. First, the size and complexity of the loss itself introduces its own challenges, especially when it affects multiple locations in different jurisdictions. Second, the intricacies of a multinational insurance structure present unique claim management considerations.

“When a company incurs a loss on foreign soil, coverage potentially can become more complex because there will be both foreign and domestic policies involved. The way these policies interact will be subject to unique regulatory, political, cultural, and monetary considerations in both the jurisdiction of loss and the jurisdiction of the parent company’s domestic insurer,” said David Alvarez, Executive General Adjuster at Engle Martin & Associates, a national independent loss adjusting and claims management firm.

Adjusting these complex losses therefore requires specialized expertise. In addition to knowledge of the coverage structure, the adjuster must be able to see the loss in a global context. According to Alvarez, these are the key things an expert adjuster will consider in complex international claims:

1. The policy issued on local paper will set the parameters for loss adjustment.

David Alvarez, Executive General Adjuster at Engle Martin & Associates

Companies generally insure international assets via a controlled global master policy that sits above individually placed local policies, which are often required to be compliant with local insurance regulations.

The local policy will be the one that sets the parameters for how a claim is adjusted. “A domestic loss can’t be insured on foreign paper. The local policy will be the contract the insured is bound to and will establish the limits and conditions the adjuster uses to adjust the loss,” Alvarez said.

Adjusting a loss according to the parameters set by a foreign policy could cause the insured to fall out of compliance with the laws and regulations of the country where the loss occurred, potentially resulting in fines or other punitive actions. For this reason, it’s imperative that an adjuster understand every policy in play and the legal framework that governs them.

2. Contingent business interruption losses may pull in the master policy.

“On a large loss, sometimes the actual property damage isn’t as severe as the business income loss,” Alvarez said. If a factory suffers a fire, repairing the physical damage will be costly, but the stalled production could have even larger downstream effects when order cannot be met, threatening business relationships, and potentially leading to the loss of customers.

“The insured has to consider quickly what steps they can take to mitigate that loss, and what the associated expenses will be,” Alvarez said. Could the factory, for example, quickly rent backup equipment or a production facility to keep their output close to normal levels?

The loss adjuster must understand the insured’s business in order to assess the extent of the business interruption loss and know where to find coverage for it, as well as the expenses incurred to mitigate that loss.

“Any losses subsequent to the initial loss that falls outside the scope of the local policy may trigger the global master policy,” Alvarez said. “The adjuster should be able to advise the claim examiner what damage could fall under which policy. Is it solely the local policy or should there be consideration under the master policy?”

3. Cultural difference may impact the way a policy is interpreted.

In many controlled master programs, the local policies, though admitted in the local market, may not exactly mimic the structure and language of the master policy. For example, if a foreign firm owns a subsidiary in the U.S., they will procure insurance for that subsidiary through a foreign insurer (the issuer of their master policy), but on U.S. paper provided by a local underwriter.

“Though the local policy is issued on domestic paper, there may be some differences in the language or interpretation of that policy that effects overall recovery,” Alvarez said. The same applies for U.S. businesses operating on foreign soil.

“It’s important to understand that, even if the insured is a U.S. company, it’s only U.S. by name when the location of loss is in another nation. In reality, you’re working with individuals from a different country that have different understandings and expectations of what’s going to come out of this claims experience,” he said.

Culture, language, law, physical, and political environments will all factor into the investigation and adjustment of an international loss.

4. There may be additional taxes associated with a claim payment to a foreign subsidiary.

If a non-admitted insurer issues a claim payment into a foreign country, that country may view it as income for the insured rather than a policy payout — meaning it’s subject to income tax. In some cases, claim settlements are also considered taxable income. The adjuster must be aware of the tax implications associated with payouts from each policy, as determined by the regulatory framework of where the loss occurred.

“It’s important to understand the political environment and the laws that apply in the jurisdiction of the loss in order to determine what additional cost may need to be factored into the measurement of the loss,” Alvarez said.

5. Partnering with local experts is the best way to achieve an optimal outcome.

Local expertise is absolutely critical to navigate the nuances of adjusting an international loss. Speaking the local language, understanding the local business environment, and appreciating the cultural differences all lend themselves to clearer communication between all parties and reduced likelihood of claim disputes.

“Adjusters must work together with available resources, which means reaching out to adjusters familiar with the foreign landscape and, conversely, helping foreign insureds and carriers through the specific nuances of U.S. state insurance law and customs,” Alvarez said.

Forming partnerships with global networks of adjusters will be crucial to delivering a smooth claims experience.

Engle Martin’s Global Expertise

Engle Martin & Associates united with vrs Adjusters in November of 2018, becoming the U.S. arm of this global organization of independent loss adjusters and claim managers. vrs Adjusters provides global insurance market programs and adjustment services around the world, operating out of roughly 300 offices in 140 countries.

“If a U.S. business has a loss on foreign soil, we can work with vrs Adjusters in that region to handle that claim locally. Likewise, we serve as resources for vrs when a foreign company has a loss in the U.S.,” Alvarez said.

In a global economy, companies are bound to experience an international loss at some point, and partnerships like these ensure they are handled efficiently and in compliance with local law. Engle Martin also ensures that its more experienced adjusters are the ones tackling these complex cases.

“We apply a ‘task-to-talent’ mentality, meaning we match the complexity of the loss to an appropriate level of adjuster based on expertise,” Alvarez said. As an Executive General Adjuster, Alvarez has experience handling all aspects of large, complex losses, from initial investigation through the adjustment, inspection and re-inspection, as well as managing communications with all stakeholders.

“Between our team and our partners at vrs Adjusters, we have the expertise to handle complex losses almost anywhere in the world,” he said.

To learn more, visit: www.englemartin.com.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Engle Martin. The editorial staff of Risk & Insurance had no role in its preparation.