Sponsored: Liberty Mutual Insurance

The Impact of Equal Workplace Claims on Public Entities

Tight budgets are nothing new for public entities, but now several economic and litigation trends make managing finances—and risk—even harder.

Revenue streams are stressed by minimal gains from property and sales taxes and constraints of conservative state and local fiscal policies. Decreased budgets mean schools and municipalities have to decide where to spend their dollars, leading to potential gaps and vulnerabilities. Buy new textbooks, provide more training, or purchase additional insurance coverage?

In this environment of budget limitations, trends in employment practices liability claims are adding to the challenges.

Rising Tide of EPL Claims

Regulations like the American with Disabilities Act (ADA) and Family and Medical Leave Act (FMLA) provide important protections for employees and help create fairness and equality in the workplace. If an employer is not compliant with these and other discrimination regulations, an employee can file a charge with the Equal Employment Opportunity Commission (EEOC). For the second year in a row, the number of charges have increased—in 2016, the EEOC brought 91,503 workplace discrimination charges against private, state and local government and federal workplaces, fining them a total of $482 million.

“Age discrimination, harassment, wrongful termination, and failure to promote are all sources of employment practices liability (EPL) claims,” said Susan Kostro, Chief Underwriting Officer, Public Entities Practice, Liberty Mutual Insurance. “These regulations help to protect employees and maintain a safe workplace, but addressing the claims can have a substantial financial impact on an organization.”

Even if a school or municipality has processes to help ensure it maintains compliance, situations with employees alleging discrimination will likely arise, some of which may turn into employment practice liability lawsuits and costly claims.

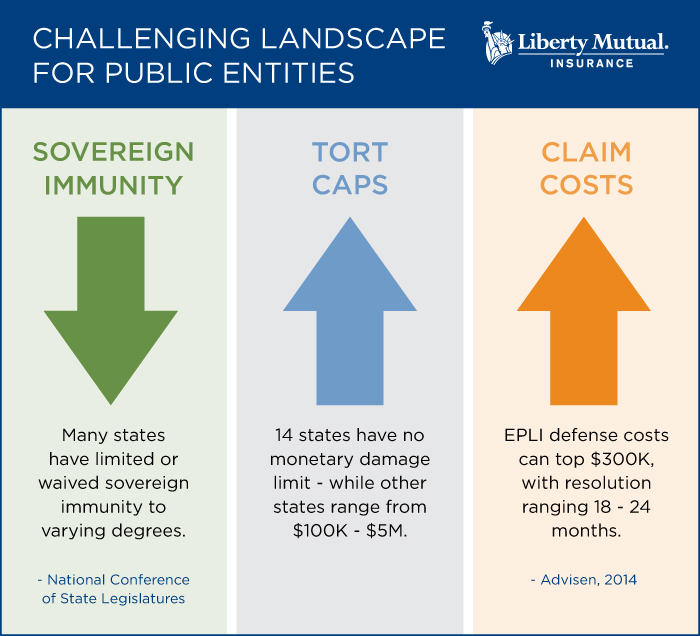

Schools and municipalities have some protection from these claims through sovereign immunity, which traditionally limits the situations and circumstances under which a public entity can be held liable. However, the circumstances in which immunity may apply appear to be narrowing in some states, increasing potential exposure for public entities.

The cost of defending a claim is also increasing.

Tort caps limiting the amount of damages that can be awarded to claimants have risen. According to an 2014 Advisen report, defense costs alone for EPL claims can reach as high as $300,000.

For a school or municipality, whose main focus is to serve its community, claims of harassment or discrimination can do much more reputational harm if those allegations become public.

“A local government needs to fight hard to get back in constituents’ good graces and regain trust,” Kostro said.

These factors can add to liability and make it more difficult to mitigate risks within existing financial constraints. It’s imperative for public entities to identify and resolve problems early before they evolve into claims.

Taking a Proactive Approach

Many schools and municipalities are self-insured, sometimes participating in risk pools. But these entities may miss out on the risk control services that come with coverage from an insurer with specialized expertise in the industry. For example, Liberty Mutual offers customers a variety of training and resources in areas such as school violence, emergency planning, and school bus and classroom safety.

The company’s HR Risk Management Service program, offered through a third-party partner, includes a toll-free helpline and website to help public entity risk managers be proactive and resolve potential employment issues before they turn into claims.

“Risk managers can learn, for example, how to put together a thorough employee handbook, which can help to clarify hiring and employment practices and establish a reference should claims arise,” Kostro said.

For a more consultative, one-on-one experience, clients can use the 24/7 helpline to speak to legal professionals and get help in navigating through some of the issues they may face.

“Through the helpline, risk managers have free and unlimited access to legal professionals each with expertise in this field, in his or her particular state,” Kostro said. “This is critical, because standards can vary state by state.”

The helpline is anonymous and private, which encourages a candid exchange of information.

“It’s like having an attorney on retainer without having to pay the retention,” Kostro said

This new service can help extend available resources, especially in those schools and governments where risk management and human resources are shared responsibilities.

A risk manager may call the helpline if, for example, a teacher reports feeling harassed. Or if a government employee threatens to sue for wrongful termination after being laid off.

“Before that complaint snowballs into a claim, the risk professional can seek advice to determine how best to work with the employee to resolve the issue, and better evaluate liability and next steps,” Kostro said.

“Access to this advice means that public entity risk managers don’t have to make the choice between hiring a lawyer and buying new school supplies.”

Backing up Prevention with Coverage

Offering the new HR Risk Management Service website and helpline is just one example of how Liberty Mutual works with clients to address their key exposures.

“We’re not just providing coverage; we’re here to help our clients manage their most challenging issues and lower the total cost of risk,” Kostro said.

Buying an EPL policy provides access to the preventive resources and expert guidance so risk managers can mitigate their exposures without any added cost.

“Insurance protection is just one piece of the risk management puzzle that ultimately helps public entities maintain professional and safe work environments so that they can continue to serve their communities,” Kostro said.

Choosing the right insurer that provides a holistic risk management solution can ultimately enable schools and governments to better manage their resources and avoid potentially unnecessary claim costs.

To learn more about Liberty Mutual’s coverage and services for public entities, visit https://business.libertymutualgroup.com/business-insurance/industries/public-entity-insurance-coverage.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Liberty Mutual Insurance. The editorial staff of Risk & Insurance had no role in its preparation.